Sanmina (SANM): Rethinking Valuation After Strong Q4 Beat and Confident Cloud and AI Infrastructure Guidance

Sanmina (SANM) just delivered an upside surprise in its fourth quarter, beating consensus on both revenue and earnings while leaning heavily on communications networks, cloud, and AI infrastructure strength to set up confident guidance for early 2026.

See our latest analysis for Sanmina.

Even after a soft 1 day share price return of 1.66 percent and a 1 month share price return of 7.18 percent, Sanmina’s 90 day share price return of 32.94 percent and year to date share price return of 109.47 percent point to strong momentum backed by improving sentiment around its cloud and AI infrastructure exposure. A 5 year total shareholder return of 392.03 percent shows the longer term payoff for investors who have been willing to ride out the volatility.

If Sanmina’s run has you rethinking where the next big hardware and infrastructure winners could emerge, this is a good moment to explore high growth tech and AI stocks as potential additions to your watchlist.

With the stock up more than 100 percent year to date and still trading below the average analyst price target, investors now face a tougher call: is Sanmina still mispriced or already discounting years of AI driven growth?

Most Popular Narrative: 16.8% Undervalued

The prevailing narrative pegs Sanmina’s fair value well above the last close of $158.09, framing the recent rally as only a partial re rating.

The imminent acquisition of ZT Systems is expected to add $5 to $6 billion of annual run rate revenue, positioning Sanmina to double its net revenue within three years and potentially benefit from strong growth in data center and AI infrastructure investment. This is expected to provide a multi year boost to overall revenue and EPS accretion from synergies and integration.

Curious how this potential revenue surge, rising margins, and a leaner share count combine into one valuation story, and why the implied earnings multiple stays surprisingly restrained? Dive in to see which specific growth and profitability assumptions power that $190 fair value and what it suggests about Sanmina’s long term AI infrastructure exposure.

Result: Fair Value of $190 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat case still hinges on a smooth ZT Systems integration and on avoiding major demand shocks from concentrated top customers.

Find out about the key risks to this Sanmina narrative.

Another View: DCF Flips the Script

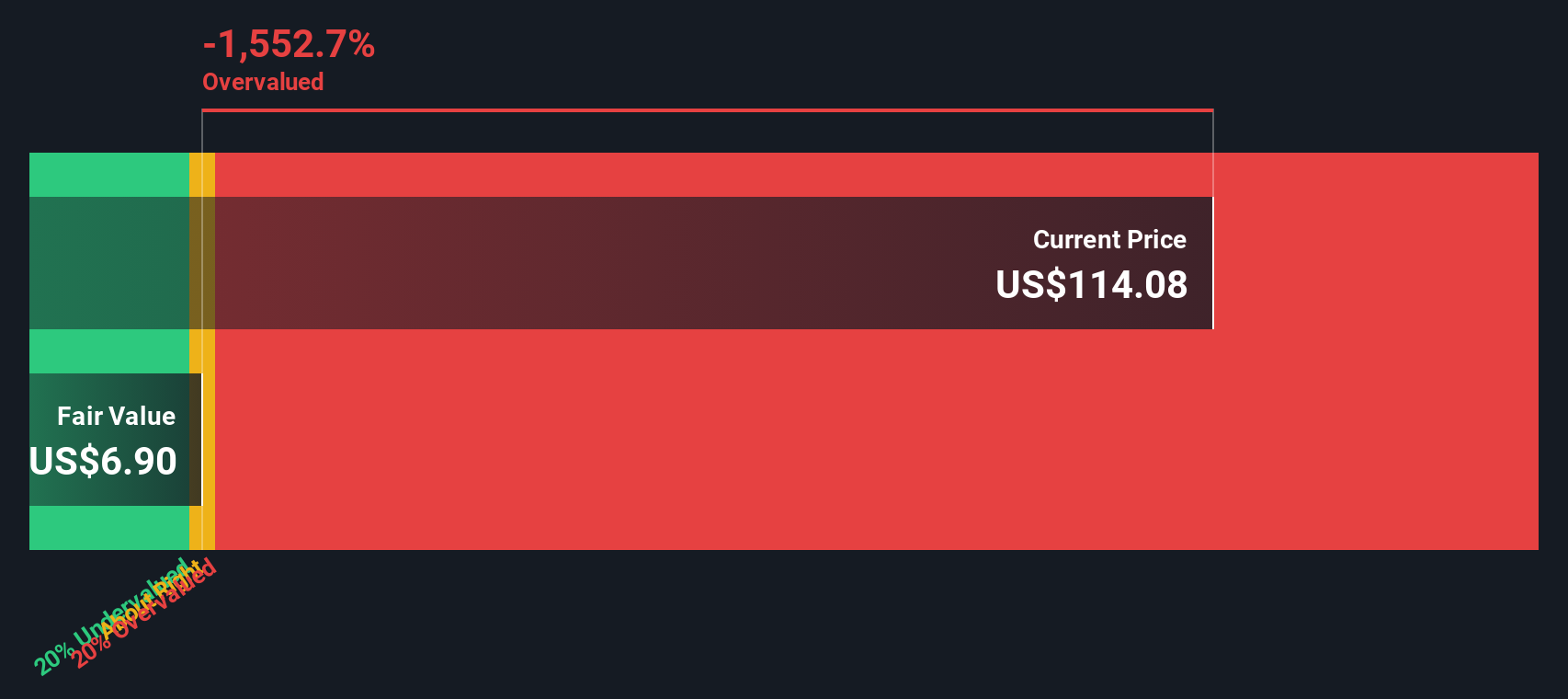

While the narrative driven fair value sits around $190 per share, our DCF model paints a starkly different picture. It suggests intrinsic value closer to $31.71, implying Sanmina is trading well above fair value. Is the market correctly pricing a new AI era, or just getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sanmina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sanmina Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sanmina.

Ready for your next investing move?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy and keep you ahead of the crowd.

- Capture potential bargains early by reviewing these 907 undervalued stocks based on cash flows, which strong cash flow analysis suggests may still be trading below what they are truly worth.

- Tap into powerful innovation trends by scanning these 26 AI penny stocks, which could benefit from surging demand for machine learning, automation, and data driven solutions.

- Boost your portfolio income by targeting these 15 dividend stocks with yields > 3%, which can help support more stable long term returns through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal