Assessing Atmos Energy (ATO) Valuation After Earnings Beat, 2026 Guidance Upgrade and Dividend Increase

Atmos Energy (ATO) just cleared a major hurdle with an earnings beat, upbeat 2026 guidance, and a higher dividend, giving investors fresh reasons to revisit this steady regulated gas utility.

See our latest analysis for Atmos Energy.

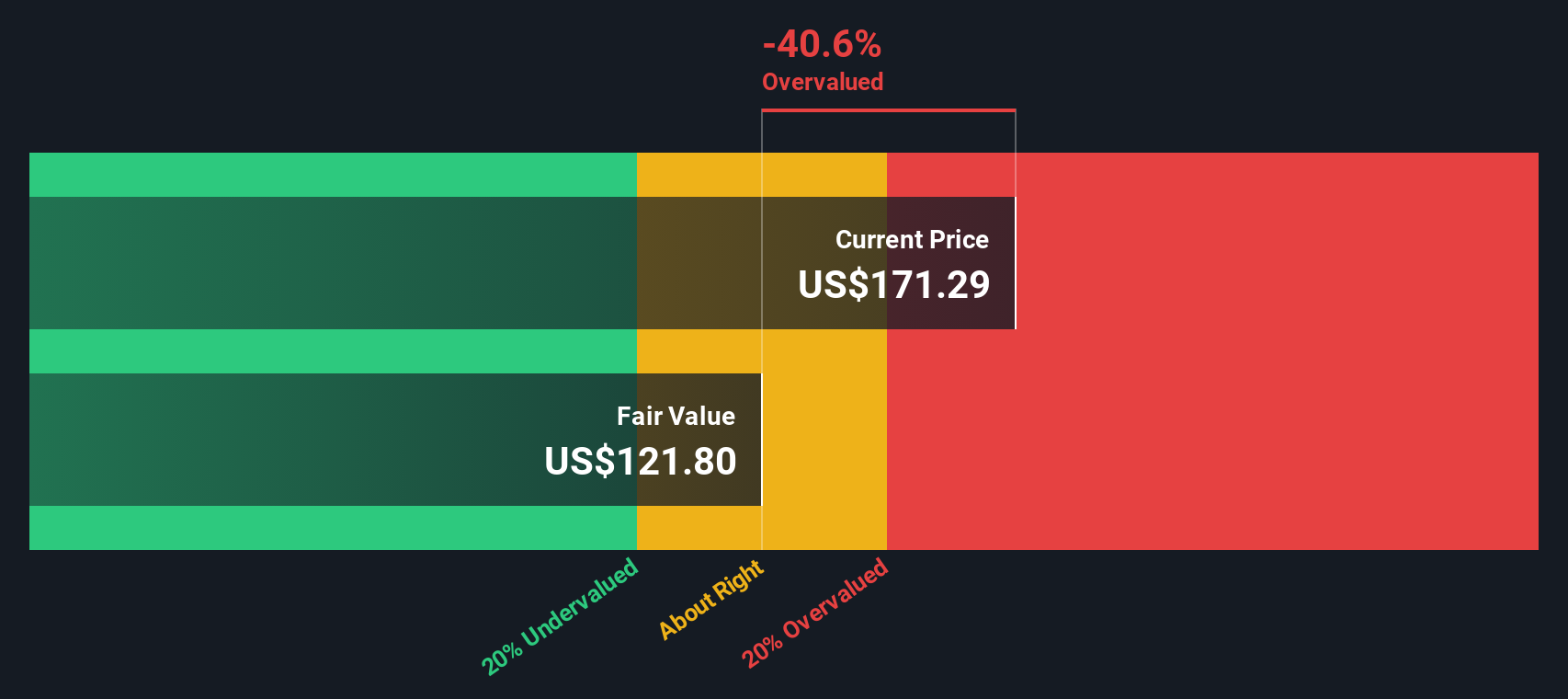

Despite a small pullback in the past month, Atmos Energy’s share price has climbed to $171.29 and delivered a robust year to date share price return, supported by upbeat guidance and a nearly doubling five year total shareholder return.

If this steady utility has you rethinking where reliable growth might come from next, it could be worth exploring fast growing stocks with high insider ownership for other potentially compelling ideas.

With the stock hovering just below analyst targets after a strong run and rich valuation multiples, the key question now is simple: is Atmos still suitable for long-term growth investors, or is potential future upside already reflected in the current price?

Most Popular Narrative Narrative: 2.3% Undervalued

With Atmos Energy last closing at $171.29 against a narrative fair value of about $175.27, the story leans toward modest upside grounded in projected earnings power.

The analysts have a consensus price target of $162.7 for Atmos Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $182.0, and the most bearish reporting a price target of just $141.0.

Want to see why steady double digit growth assumptions and a premium future earnings multiple still add up to upside for a regulated gas utility? The full narrative unpacks how revenue, margins, and valuation are all expected to evolve from here.

Result: Fair Value of $175.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated capital spending needs and potential shifts in regulatory support could pressure free cash flow and weaken the case for a continued premium valuation.

Find out about the key risks to this Atmos Energy narrative.

Another View: Richer Valuation Signals Caution

While the narrative fair value suggests Atmos Energy is 2.3 percent undervalued, our DCF model paints a very different picture. It implies fair value near $121.8 and flags the stock as materially overvalued at current levels.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Atmos Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Atmos Energy Narrative

If you are unsure about these conclusions or would rather dig into the numbers yourself, you can craft a personalized narrative in just minutes. Do it your way

A great starting point for your Atmos Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high potential opportunities?

Do not stop with just one stock. Put Simply Wall Street’s powerful screener to work now so you can look for tomorrow’s standout opportunities before everyone else.

- Explore smaller names by reviewing these 3572 penny stocks with strong financials that combine low share prices with financial strength.

- Focus on the automation theme by scanning these 26 AI penny stocks related to developments in artificial intelligence.

- Search for potential bargains by reviewing these 907 undervalued stocks based on cash flows that may be mispriced based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal