Will ASCENIV Momentum and FDA-Cleared Yield Gains Change ADMA Biologics' (ADMA) Narrative?

- ADMA Biologics recently reported third-quarter 2025 results with adjusted earnings per share matching expectations and revenue surpassing forecasts, driven by strong demand for its lead plasma-derived therapy ASCENIV.

- The company also secured FDA lot release authorization for its first yield-enhanced commercial batches, a development that could materially influence manufacturing efficiency and future gross margins.

- Next, we’ll explore how the FDA-cleared yield-enhanced batches and upgraded 2025 revenue guidance may influence ADMA Biologics’ broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ADMA Biologics Investment Narrative Recap

To own ADMA Biologics, you need to believe its plasma‑derived portfolio, led by ASCENIV, can keep scaling profitably while manufacturing upgrades hold. The latest quarter reinforces that near term, the key catalyst is whether yield‑enhanced production meaningfully improves margins, while the biggest risk remains the company’s dependence on a narrow set of products in a competitive plasma market.

The most relevant development here is the FDA lot release for ADMA’s first yield‑enhanced commercial batches, which the company expects to start benefiting gross margins from the fourth quarter of 2025. If this process scales reliably, it directly supports the margin improvement narrative behind the upgraded 2025 revenue guidance and could influence how investors weigh the trade off between growth potential and execution risk around the Boca Raton facility.

But investors should also be aware that concentration in just a few therapies leaves ADMA exposed if...

Read the full narrative on ADMA Biologics (it's free!)

ADMA Biologics' narrative projects $904.6 million revenue and $350.9 million earnings by 2028. This requires 24.0% yearly revenue growth and about a $142 million earnings increase from $208.9 million today.

Uncover how ADMA Biologics' forecasts yield a $27.25 fair value, a 37% upside to its current price.

Exploring Other Perspectives

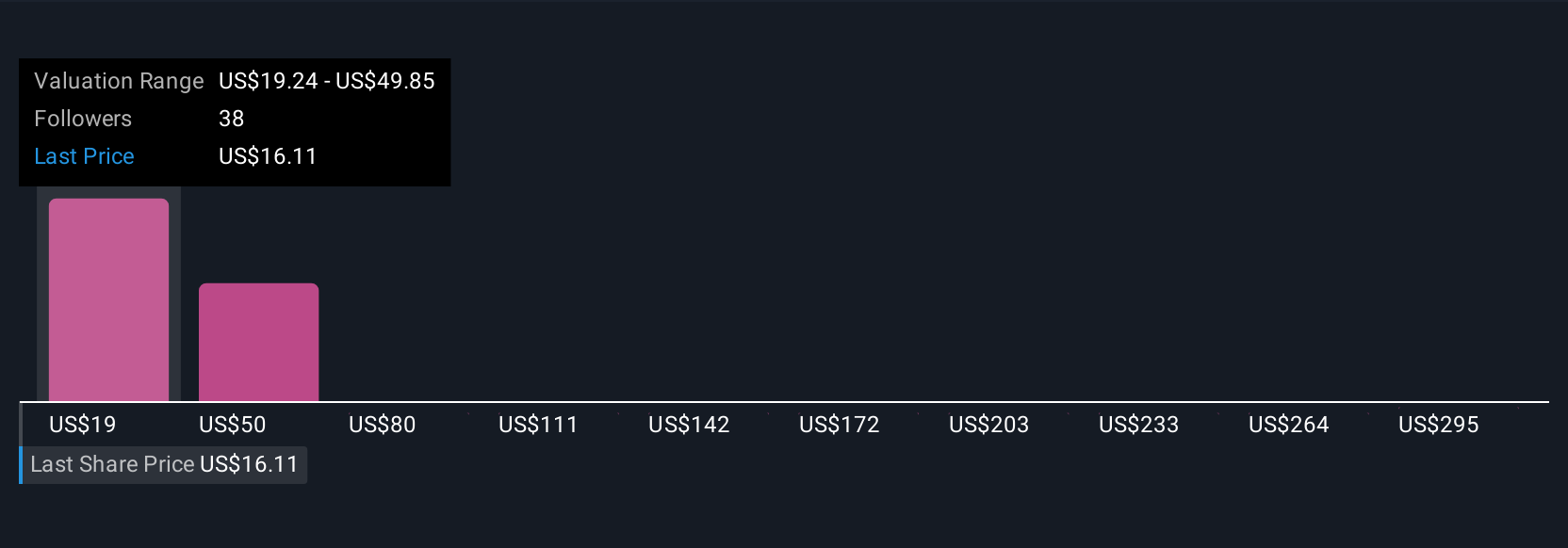

Ten fair value estimates from the Simply Wall St Community span roughly US$19 to US$56 per share, highlighting sharply different views on upside potential. You are seeing this diversity just as ADMA’s yield‑enhanced manufacturing becomes a central test of its ability to expand margins and support higher revenue targets over time.

Explore 10 other fair value estimates on ADMA Biologics - why the stock might be worth over 2x more than the current price!

Build Your Own ADMA Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADMA Biologics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADMA Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADMA Biologics' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal