Reassessing Steelcase (SCS) Valuation After Its Quiet Multi‑Year Shareholder Return Recovery

Steelcase (SCS) has quietly outperformed many office-furniture peers this year. That kind of move usually signals that investors are rethinking the company’s earnings power, cash generation, and longer term workplace demand.

See our latest analysis for Steelcase.

That strength has not disappeared, but the pace has cooled recently. The share price is still up strongly year to date, while the three year total shareholder return remains the real standout. This suggests investors are steadily repricing Steelcase’s recovery story.

If Steelcase’s comeback has you thinking about what else might be quietly rerating, this could be a good moment to explore fast growing stocks with high insider ownership.

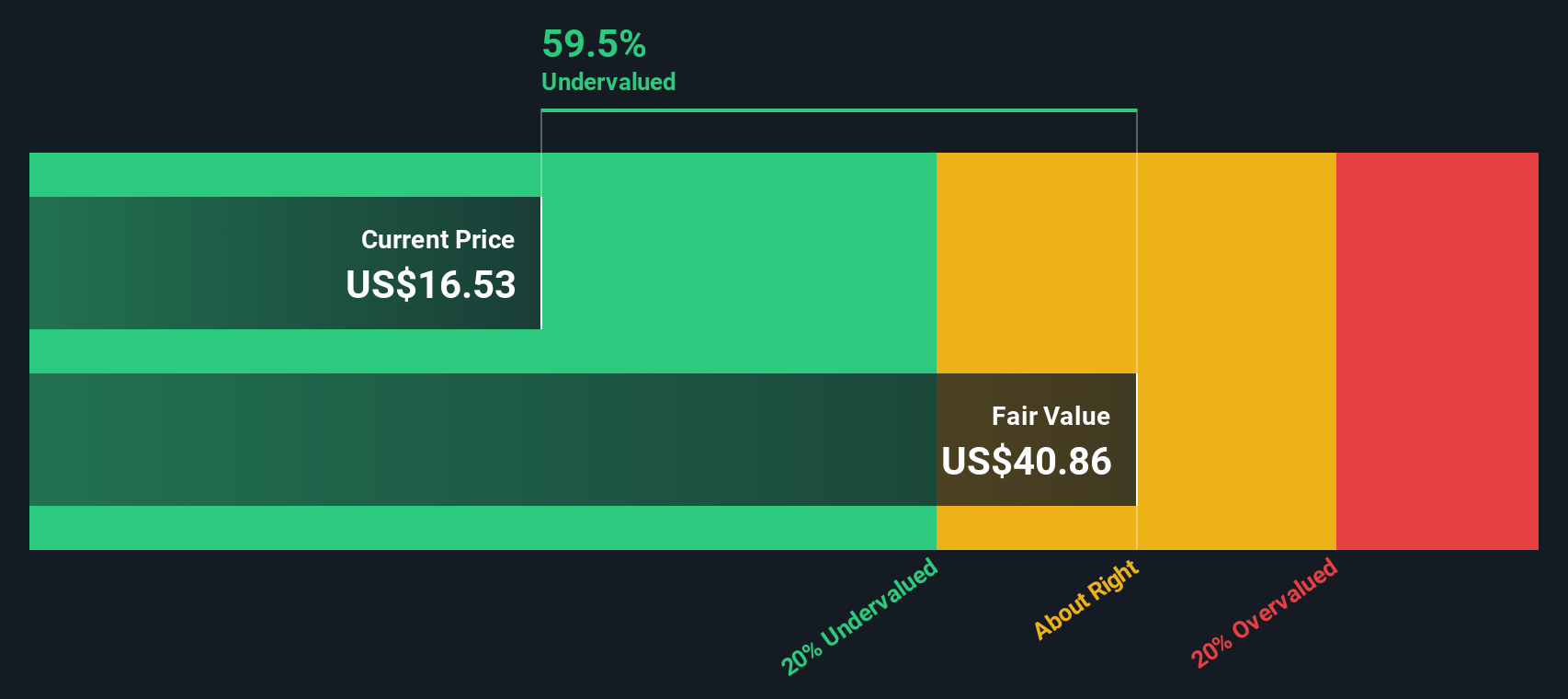

With earnings rebounding, a solid value score, and shares still trading at a steep discount to intrinsic value, is Steelcase an underappreciated cash generator, or has the market already priced in its next leg of growth?

Most Popular Narrative: 3.5% Overvalued

According to codabat, the narrative pins Steelcase’s fair value just below the last close of $16.14, implying only a modest premium in today’s price.

Investment Thesis: While SCS trades at a discount to intrinsic value (~30% upside), the investment quality remains questionable due to low revenue growth (2.6% TTM), volatile earnings, and secular headwinds from hybrid work trends. This appears to be a value trap rather than a value opportunity, and the low multiple reflects justified skepticism about business quality.

Want to know why a stock with slow growth and choppy profits still earns a double digit upside tag? The key is in how future margins, earnings durability, and a re-rated profit multiple all fit together. Curious which assumptions have to hold for that upside to materialise, and how sensitive the story is if they slip? Follow the narrative and see the full valuation playbook codabat is using.

Result: Fair Value of $15.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster-than-expected office demand recovery or structurally higher margins from cost cuts could force a major rethink of Steelcase’s supposed value trap status.

Find out about the key risks to this Steelcase narrative.

Another Lens on Value

Our SWS DCF model paints a far more optimistic picture, putting Steelcase’s fair value around $42.28 per share, meaning the stock looks deeply undervalued versus today’s $16.14 price. If the cash flows prove durable, is the market underestimating a long runway of recovery?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Steelcase Narrative

If you see Steelcase differently, or want to stress test the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Steelcase research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover stocks with similar characteristics and potential.

- Explore income opportunities by targeting companies in these 15 dividend stocks with yields > 3% that combine consistent dividend payments with solid fundamentals.

- Track developments in these 26 AI penny stocks that are involved in areas such as automation and predictive analytics.

- Review these 907 undervalued stocks based on cash flows that the market may not have fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal