Tokai Carbon (TSE:5301) Valuation Check After U.S. Subsidiary Reorganization and Governance Overhaul

Tokai Carbon (TSE:5301) is shaking up its U.S. footprint by folding three fine carbon subsidiaries into a single entity under its American holding company, a structural tidy up that could quietly improve efficiency and oversight.

See our latest analysis for Tokai Carbon.

Despite the recent U.S. restructuring push, market sentiment has been mixed. The latest pullback leaves the 1 year total shareholder return at 14.23%, while shorter term share price momentum has softened. This hints at fading near term enthusiasm but a still respectable longer horizon outcome.

If Tokai Carbon’s reshuffle has you rethinking your portfolio, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership

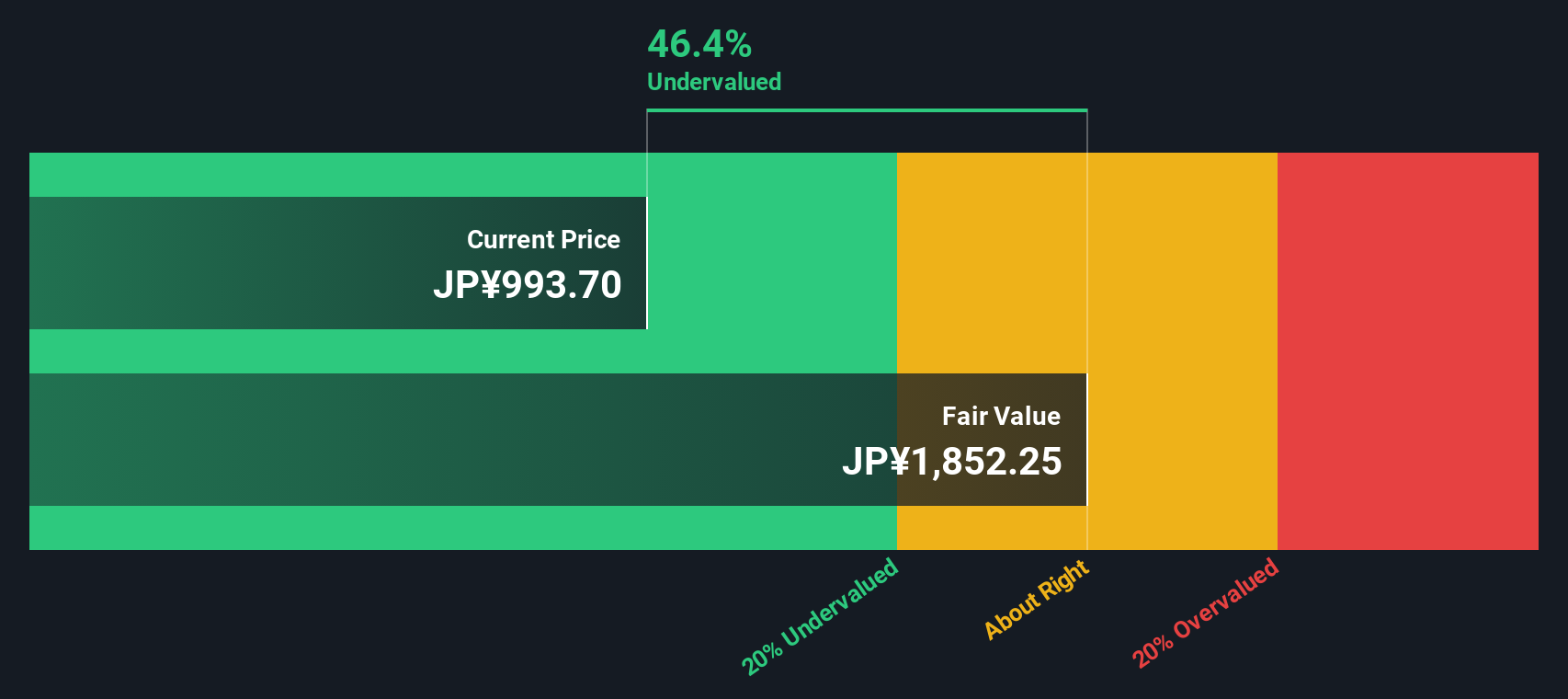

With shares trading at a hefty discount to analyst targets, but following a solid 12 month run, investors now face a key question: is Tokai Carbon still undervalued, or is the market already pricing in its recovery and future growth?

Price-to-Sales of 0.6x: Is it justified?

Tokai Carbon trades on a price to sales ratio of 0.6x, which points to a modest valuation even as the share price has recovered.

The price to sales multiple compares the company’s market value to its annual revenue, a useful lens when earnings are volatile or currently negative, as they are for Tokai Carbon.

Analysts judge 0.6x slightly expensive versus both the Japanese chemicals peer average and the wider peer set at the same level. However, regression based fair value work implies the market could still move toward a higher, more generous multiple over time.

Against the industry, however, Tokai Carbon’s 0.6x sits at parity, suggesting investors are pricing the business broadly in line with chemicals peers rather than applying either a clear premium or discount today.

Explore the SWS fair ratio for Tokai Carbon

Result: Price to sales of 0.6x (ABOUT RIGHT)

However, sustained net losses and weak multi year shareholder returns could quickly cap any rerating, especially if demand slows or restructuring benefits underwhelm.

Find out about the key risks to this Tokai Carbon narrative.

Another View: What the DCF Says

Our DCF model paints a more optimistic picture than the 0.6x sales ratio suggests, indicating Tokai Carbon could be trading about 46% below fair value at roughly ¥1,852 per share. If cash flows recover as forecast, is the market underestimating the pace of that turnaround?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokai Carbon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokai Carbon Narrative

If this perspective does not quite fit your view, or you prefer digging into the numbers yourself, you can build a custom take in minutes: Do it your way

A great starting point for your Tokai Carbon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock when the market offers so many angles. Use the Simply Wall Street Screener to explore other possibilities before others react.

- Seek potential mispricings early by targeting companies that look cheap on fundamentals with these 907 undervalued stocks based on cash flows before the market closes the gap.

- Focus on structural trends in healthcare by looking at innovators harnessing algorithms and data through these 30 healthcare AI stocks while the story is still developing.

- Explore income opportunities and potential capital growth by filtering for reliable payers using these 15 dividend stocks with yields > 3% instead of waiting for yield to come to you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal