Kinder Morgan (KMI): Revisiting the Pipeline Giant’s Valuation After Recent Share Price Gains

Market context for Kinder Morgan

Kinder Morgan (KMI) has quietly put together steady gains over the past month, with the stock up about 5% as investors revisit large pipeline operators for income and long term stability.

See our latest analysis for Kinder Morgan.

That recent 30 day share price return of 4.6% has helped KMI claw back some earlier softness. When you set that against a three year total shareholder return of 87.6%, it looks more like steady momentum than a short term blip at the current share price of $27.77.

If Kinder Morgan has you thinking about durable income and infrastructure plays, it could also be worth exploring fast growing stocks with high insider ownership for other potential long term compounders that management teams are backing with their own capital.

With Kinder Morgan trading below analyst targets yet boasting robust multi year returns, investors face a key question: is the stock still undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 10.6% Undervalued

With Kinder Morgan last closing at $27.77 versus a narrative fair value a little above $31, the story hinges on long run cash flow durability.

Robust U.S. natural gas demand growth for power generation, bolstered by the proliferation of data centers and utilities' preference for natural gas as a cleaner baseload power source, supports continued expansion of Kinder Morgan's pipeline network, driving incremental project backlog and contributing to future revenue and EBITDA growth.

Want to see why modest revenue growth and slightly rising margins still point to a higher valuation multiple than the industry norm? The full narrative maps out how steady contract backed earnings, long dated infrastructure and a specific discount rate combine to justify today’s fair value target. Curious which assumptions really move the dial on that outcome? Read on to unpack the projections behind the headline number.

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher leverage and accelerating energy transition policies could constrain Kinder Morgan's expansion options and weaken the long term cash flow story that underpins this valuation.

Find out about the key risks to this Kinder Morgan narrative.

Another View: Market Ratios Flash a Caution Sign

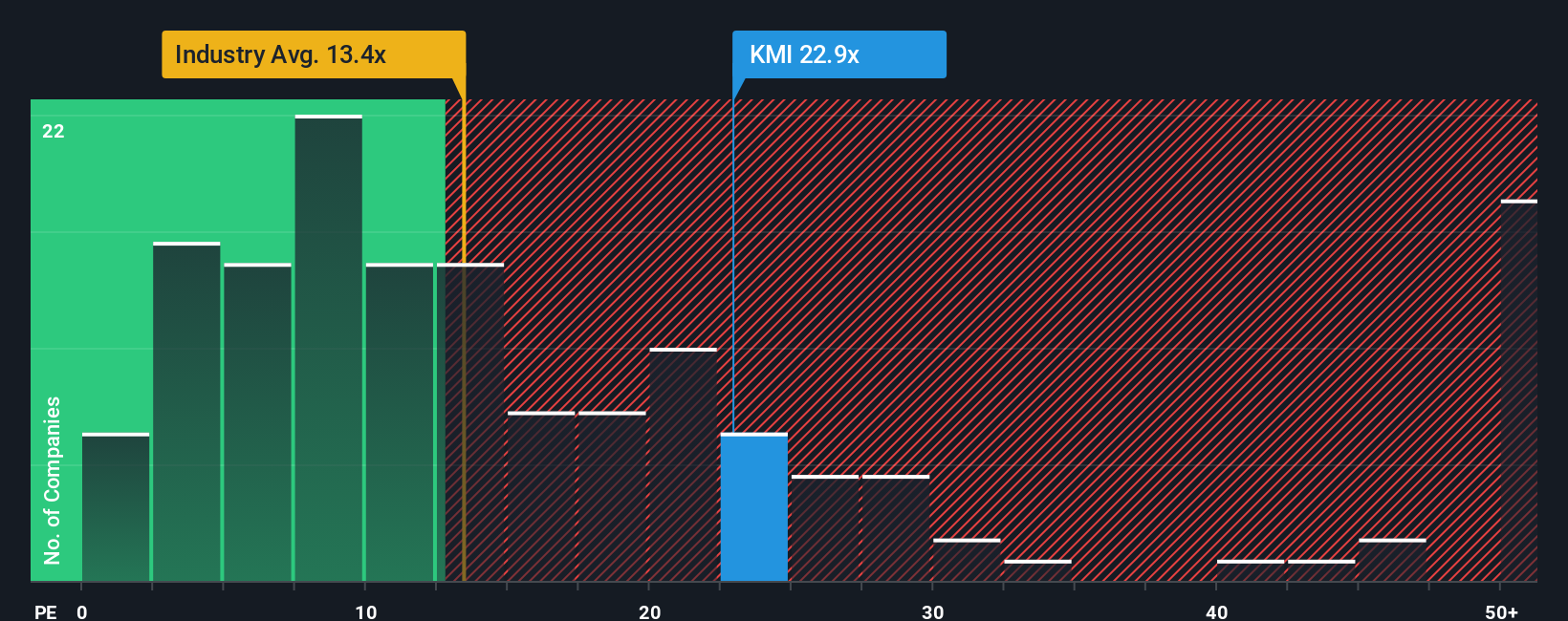

While the narrative and fair value work suggest Kinder Morgan is undervalued, its current 22.8x price to earnings ratio tells a tougher story. It is trading richer than the US Oil and Gas industry at 13.5x, peers at 17.5x, and even its own 21x fair ratio. Is the market already paying up for this stability?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If you see things differently or prefer to dig into the numbers yourself, you can build a personalized Kinder Morgan narrative in just a few minutes, Do it your way.

A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next move by using the Simply Wall St screener to explore opportunities you may find interesting.

- Look for potential multi baggers by targeting fast growing companies with solid finances using these 3573 penny stocks with strong financials.

- Explore the next wave of innovation by focusing on businesses involved in intelligent automation and algorithms with these 26 AI penny stocks.

- Review companies trading below their estimated intrinsic value using these 907 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal