Cencora (COR): Assessing Valuation After Mixed Analyst Calls and New 3PL Expansion Investments

Cencora stock has been caught between mixed analyst calls and fresh expansion news, with recent 3PL investments in the US and Europe arriving just as earnings expectations trend higher while some views turn more cautious.

See our latest analysis for Cencora.

Despite the recent pullback, including a 7 day share price return of negative 7.93 percent after a strong run, Cencora’s 51.13 percent year to date share price return and 5 year total shareholder return of 266.09 percent show momentum has been building rather than fading as investors weigh growth from logistics expansion against shifting risk perceptions.

If Cencora’s run has you thinking about what else could be quietly compounding in healthcare, it might be worth exploring healthcare stocks as your next research stop.

With earnings estimates climbing, a double digit gap to consensus price targets and heavy investment in specialty logistics, is Cencora quietly undervalued here, or is the market already pricing in every leg of future growth?

Most Popular Narrative Narrative: 11.7% Undervalued

Compared with the last close at $339.66, the most closely followed fair value estimate of $384.79 points to meaningful upside if its growth thesis holds.

The expanding demand for specialty drugs, driven by innovation in treatments for chronic diseases and new approvals in complex categories such as retina, supports robust volume growth in Cencora's high-margin specialty distribution and value-added services, directly benefiting future revenue and operating income.

Want to see what kind of revenue runway and margin lift are embedded in that view, and how that translates into richer future earnings power? The full narrative lays out the specific growth path, profit mix shift, and valuation multiple that need to line up perfectly to justify this higher price tag.

Result: Fair Value of $384.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on specialty margins holding up, as both biosimilar pricing pressure and softer international logistics demand are capable of derailing that upbeat earnings path.

Find out about the key risks to this Cencora narrative.

Another Angle on Valuation

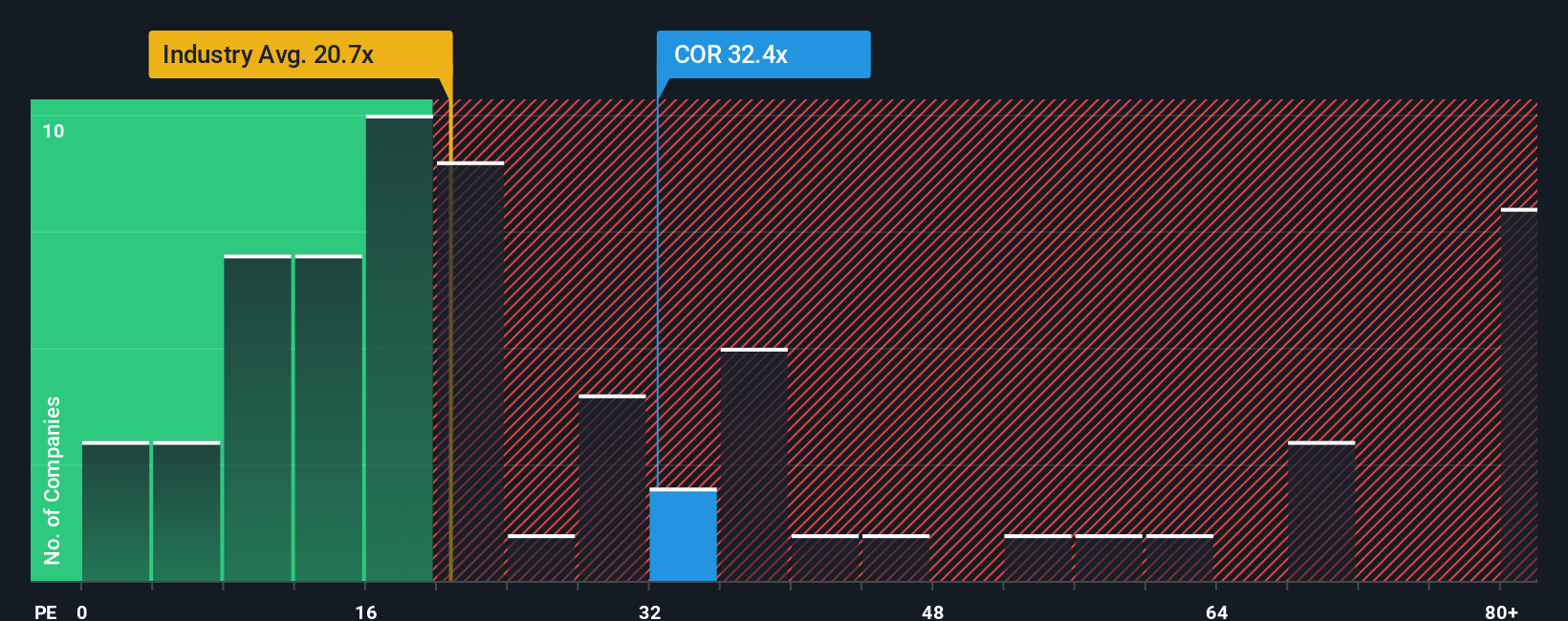

That 11.7 percent upside to fair value sits awkwardly beside a much richer price to earnings picture. Cencora trades on about 42.4 times earnings, almost double both the US Healthcare sector at 22.2 times and peer average at 22 times, and well above its 33.7 times fair ratio. This leaves little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cencora Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes, Do it your way.

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall Street Screener to uncover fresh opportunities that most investors are still overlooking.

- Capture income potential by using these 15 dividend stocks with yields > 3% to target companies offering yields that can contribute to a growing stream of cash returns.

- Position yourself early in transformative innovation with these 28 quantum computing stocks, where future focused businesses are shaping new computing frontiers.

- Strengthen your long term returns by focusing on value led opportunities through these 907 undervalued stocks based on cash flows, highlighting stocks priced below their cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal