Texas Pacific Land (TPL) Is Up 7.0% After Approving a Three-for-One Stock Split and Share Expansion

- Texas Pacific Land Corporation recently amended its certificate of incorporation to support a three-for-one forward stock split, increasing authorized common shares from 46,536,936 to 139,610,808, with the split effective December 22, 2025 and trading on a split-adjusted basis beginning December 23, 2025.

- This move to expand the share count and execute a stock split is intended to make TPL’s high-priced shares more accessible, while fresh analyst coverage highlights how its extensive Permian Basin land and royalty interests are drawing renewed attention from both energy and infrastructure investors.

- We’ll now examine how TPL’s three-for-one stock split, aimed at boosting liquidity and accessibility, could influence the company’s longer-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Texas Pacific Land Investment Narrative Recap

To own Texas Pacific Land, you need to believe its Permian Basin land, royalty and water assets can keep converting operator activity into high-margin, relatively capital-light cash flows. The three-for-one stock split itself does not alter that thesis, and it is unlikely to materially change the key near term driver, which remains the pace of drilling and infrastructure build out on TPL’s acreage, or the main risk, which is paying a high multiple for earnings still tied to commodity-sensitive activity.

The most relevant recent development alongside the split is KeyBanc’s initiation of coverage with an Overweight rating and a US$1,050 price target, which has helped refocus attention on TPL’s 882,000 acre footprint and fee based model. That external spotlight ties directly into the current catalyst around monetizing land through royalties, easements and water services, but it also sits against a backdrop of modest recent earnings growth and a valuation that is already rich versus peers.

However, investors should also be aware that paying a premium price for a business whose cash flows are still exposed to...

Read the full narrative on Texas Pacific Land (it's free!)

Texas Pacific Land's narrative projects $895.3 million revenue and $610.3 million earnings by 2028. This requires 7.2% yearly revenue growth and about a $150 million earnings increase from $460.2 million today.

Uncover how Texas Pacific Land's forecasts yield a $842.50 fair value, a 9% downside to its current price.

Exploring Other Perspectives

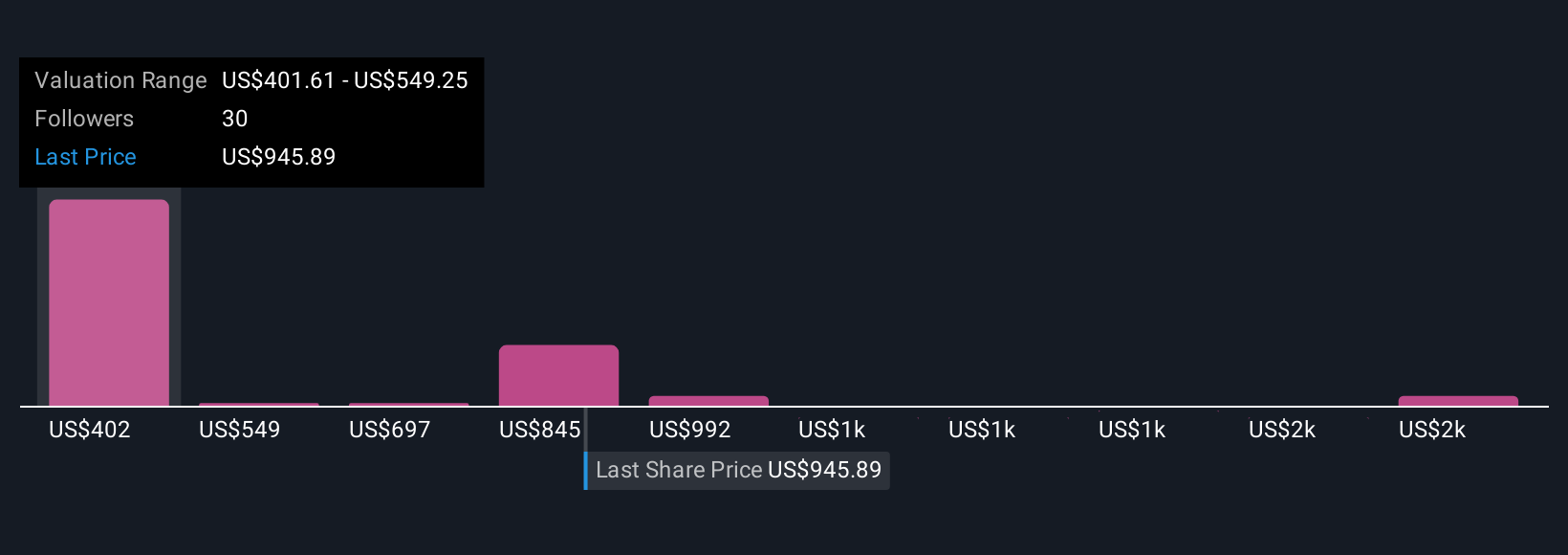

Thirteen members of the Simply Wall St Community currently see TPL’s fair value anywhere between about US$402 and US$1,791, underscoring how far opinions can diverge. Against that backdrop, the stock split and focus on monetizing royalties and water services could matter a lot if you are weighing how sensitive those high margin cash flows remain to changes in Permian activity and commodity prices.

Explore 13 other fair value estimates on Texas Pacific Land - why the stock might be worth as much as 94% more than the current price!

Build Your Own Texas Pacific Land Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Pacific Land research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Texas Pacific Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Pacific Land's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal