Assessing RadNet (RDNT) Valuation After Share Resale Prospectus Spurs 3% Pullback

RadNet (RDNT) slipped about 3% after it filed a prospectus supplement tied to its shelf registration, clearing the way for certain existing holders to potentially resell roughly 73,500 shares of common stock.

See our latest analysis for RadNet.

The pullback to a share price of $78.59, with a 1 day share price return of around negative 3 percent on the resale prospectus news, comes after a solid 90 day share price return and a powerful three year total shareholder return. This suggests momentum in the story is still broadly intact, even if near term sentiment is a bit cautious.

If this kind of healthcare imaging play has caught your attention, it could be a good moment to explore other potential opportunities across healthcare stocks and compare how they stack up on growth and risk.

With shares still sitting below analyst targets despite impressive multi year returns and rapid profit growth, is RadNet quietly trading at a discount, or is the market already pricing in every bit of that future expansion?

Most Popular Narrative Narrative: 15% Undervalued

With RadNet last closing at $78.59 against a narrative fair value of $92.50, the story leans toward upside built on ambitious growth and margins.

Analysts expect earnings to reach $198.8 million (and earnings per share of $1.43) by about September 2028, up from $-14.9 million today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.8x on those 2028 earnings, up from -376.8x today.

Want to see how a loss making imaging operator is modeled to flip into meaningful profits, with a premium style earnings multiple baked in? The full narrative unpacks the revenue ramp, margin rebuild, and valuation leap that have to line up almost perfectly for that fair value to hold.

Result: Fair Value of $92.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reimbursement pressure or slower than expected imaging demand could quickly challenge those upbeat growth assumptions and compress the premium valuation case.

Find out about the key risks to this RadNet narrative.

Another Way to Look at Value

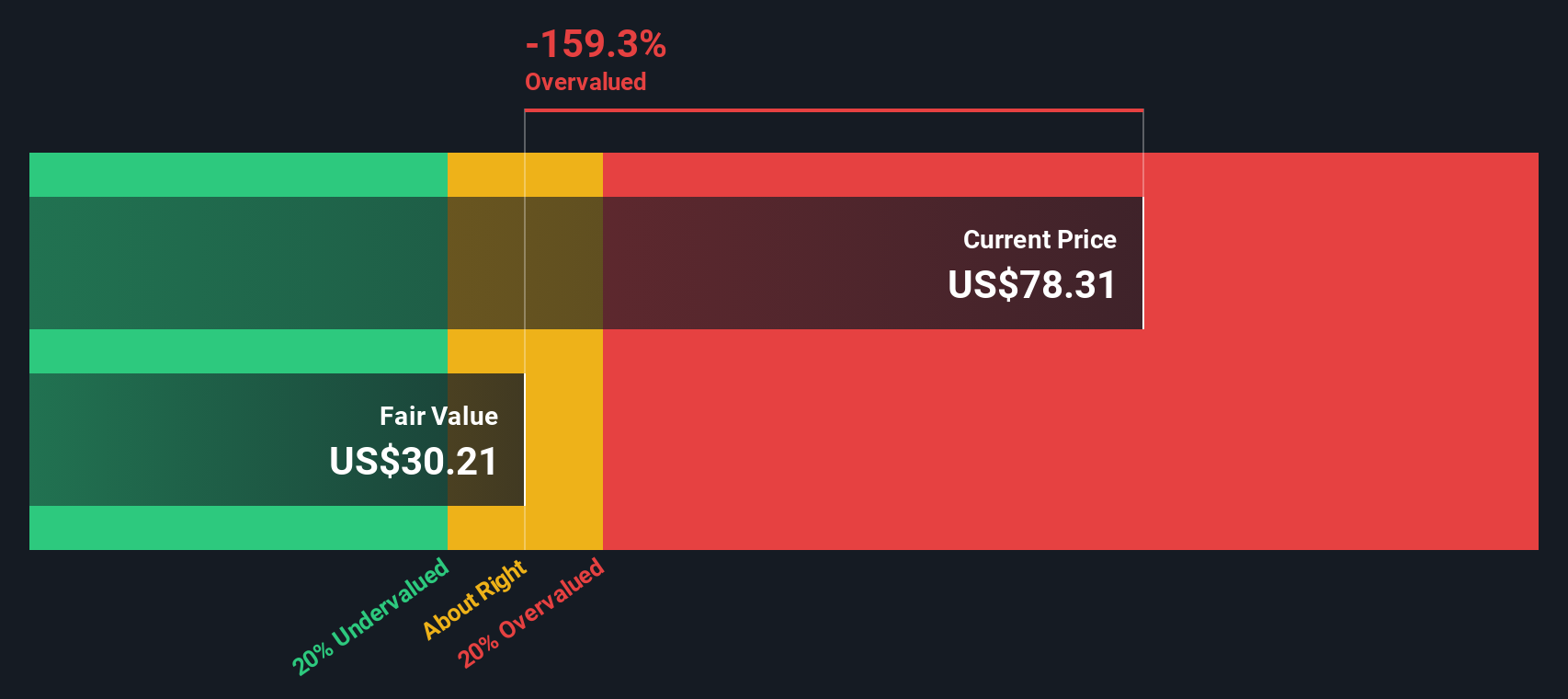

While the narrative fair value suggests upside, our DCF model points the other way. On SWS DCF numbers, RadNet’s fair value is closer to $33.10, making today’s $78.59 share price look materially overvalued. Which story do you trust more: the upbeat growth path or the cash flow math?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own RadNet Narrative

If you see the numbers differently or would rather lean on your own homework, you can shape a personalized view in just a few minutes by starting with Do it your way.

A great starting point for your RadNet research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in an edge by using the Simply Wall Street Screener to uncover focused stock ideas that match your style and risk appetite.

- Target income potential first and let these 15 dividend stocks with yields > 3% help you zero in on companies that could strengthen your portfolio’s cash flow.

- Capitalize on disruptive innovation by scanning these 26 AI penny stocks for businesses pushing the frontiers of artificial intelligence.

- Position yourself ahead of the crowd with these 81 cryptocurrency and blockchain stocks, highlighting listed plays in digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal