GoGold Resources (TSX:GGD): Valuation Check After CAD 125 Million Composite Units Offering Reshapes Capital Structure

GoGold Resources (TSX:GGD) just closed a CAD 125 million composite units offering at CAD 2.65 per unit, issuing over 47 million new securities, a move that directly reshapes its capital structure.

See our latest analysis for GoGold Resources.

The deal lands after a powerful run, with the share price now at $2.66 and a year to date share price return above 120 percent. A one year total shareholder return above 120 percent suggests momentum is still very much intact.

If this kind of capital raise has you thinking about what else is breaking out, it could be a good moment to explore screener containing None undiscovered stocks with strong fundamentals.

But after such a sharp rally and a hefty new equity raise, is GoGold’s surge still grounded in attractive value relative to its growth prospects, or are investors now paying up for future gains that are already priced in?

Most Popular Narrative Narrative: 96.7% Undervalued

Compared to the last close at CA$2.66, the most followed narrative suggests GoGold’s long term fair value sits dramatically higher, built on aggressive production and metal price assumptions.

Under silver = US$100, fair value might be US$16-33/share depending on multiple. Under silver = US$150, values rise to US$25-52/share.

Want to see how a single district scale project, ultra low costs, and turbocharged silver prices combine into that valuation ladder? The narrative walks through the production ramp, margins, and free cash flow math step by step, without holding back the upside scenarios.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish roadmap still leans heavily on smooth permitting at Los Ricos South and continued access to low cost project financing.

Find out about the key risks to this GoGold Resources narrative.

Another Lens on Valuation

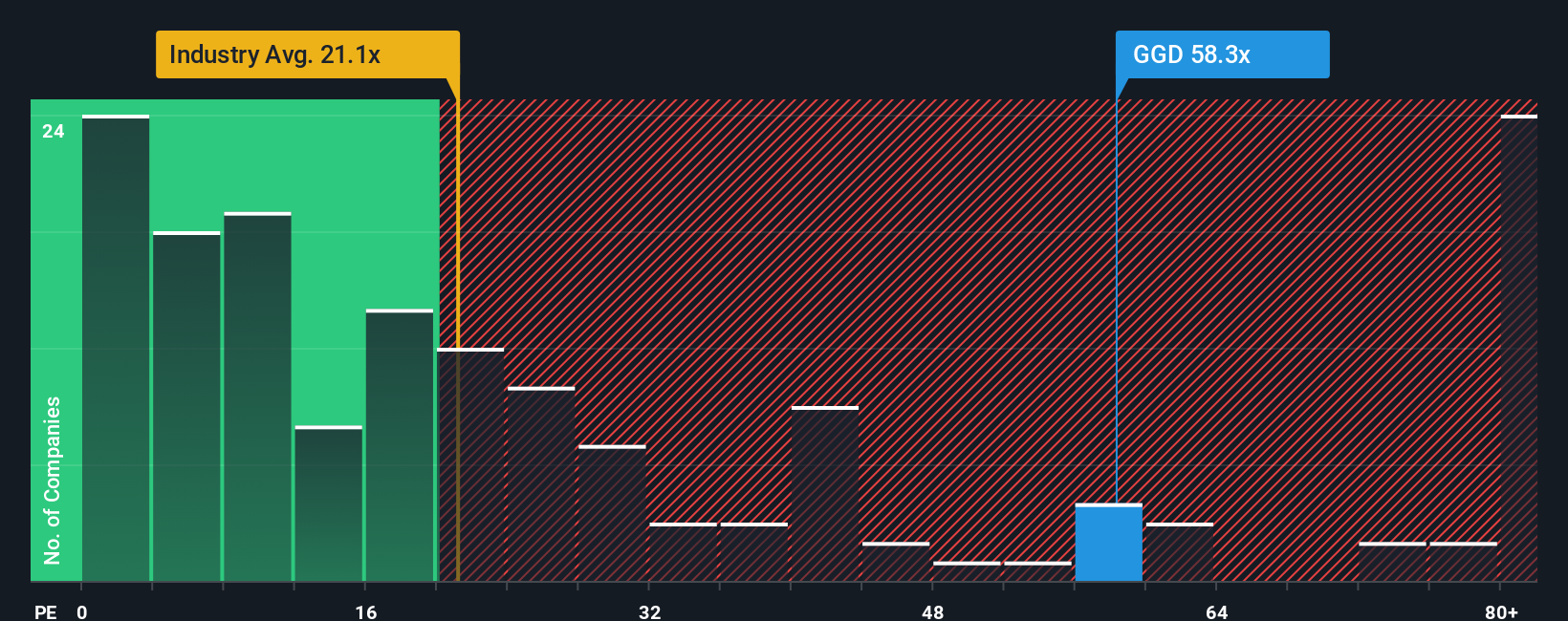

Those narrative targets sit far above where traditional valuation work lands. On simple earnings metrics, GoGold trades at about 68.5 times earnings versus roughly 21 times for the wider Canadian metals and mining group, and a fair ratio closer to 19.6 times, which together point to rich expectations already embedded in today’s price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GoGold Resources Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily build a custom view in minutes with Do it your way.

A great starting point for your GoGold Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall St’s powerful Screener so you never miss your next standout idea.

- Capture potential value rebounds by targeting companies trading below their intrinsic worth through these 907 undervalued stocks based on cash flows tailored to cash flow strength.

- Ride structural shifts in medicine by focusing on innovation at the intersection of diagnostics, treatment, and automation with these 30 healthcare AI stocks.

- Tap into high yield opportunities and steady income streams from established businesses screened via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal