Ericsson (OM:ERIC B) Valuation Check After 3-Year Outperformance and Recent Earnings Dip

Telefonaktiebolaget LM Ericsson (OM:ERIC B) has quietly outperformed over the past 3 years, with total returns above 50%, even as recent revenue and net income dipped slightly. This combination creates an interesting value setup.

See our latest analysis for Telefonaktiebolaget LM Ericsson.

Over the past year the share price has drifted slightly, while the latest 90 day share price return of 20.91 percent and a three year total shareholder return above 50 percent suggest momentum is tentatively rebuilding as investors reassess Ericsson’s earnings dip against its longer term network and cloud position.

If Ericsson has you thinking about where the next wave of digital infrastructure winners might come from, this is a good moment to scout other high growth tech and AI stocks.

With earnings contracting but intrinsic value models hinting at a sizable discount, is Ericsson still flying under the radar as a mispriced 5G and cloud enabler, or has the market already baked in its next leg of growth?

Most Popular Narrative: 3.2% Overvalued

With Ericsson last closing at SEK90.22 against a narrative fair value of roughly SEK87.38, the latest storyline leans cautious despite long term tailwinds.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, up from 14.2x today. This future PE is lower than the current PE for the GB Communications industry at 49.4x.

If you are curious what earnings path and margin rebuild this narrative is banking on, and why it still assumes a richer future multiple even with flat revenues and a relatively modest risk premium baked in, click through to unpack the numbers behind that conviction.

Result: Fair Value of $87.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying geopolitical tensions and prolonged investment pauses in key emerging markets could quickly derail the cautiously optimistic narrative currently reflected in Ericsson.

Find out about the key risks to this Telefonaktiebolaget LM Ericsson narrative.

Another Take On Value

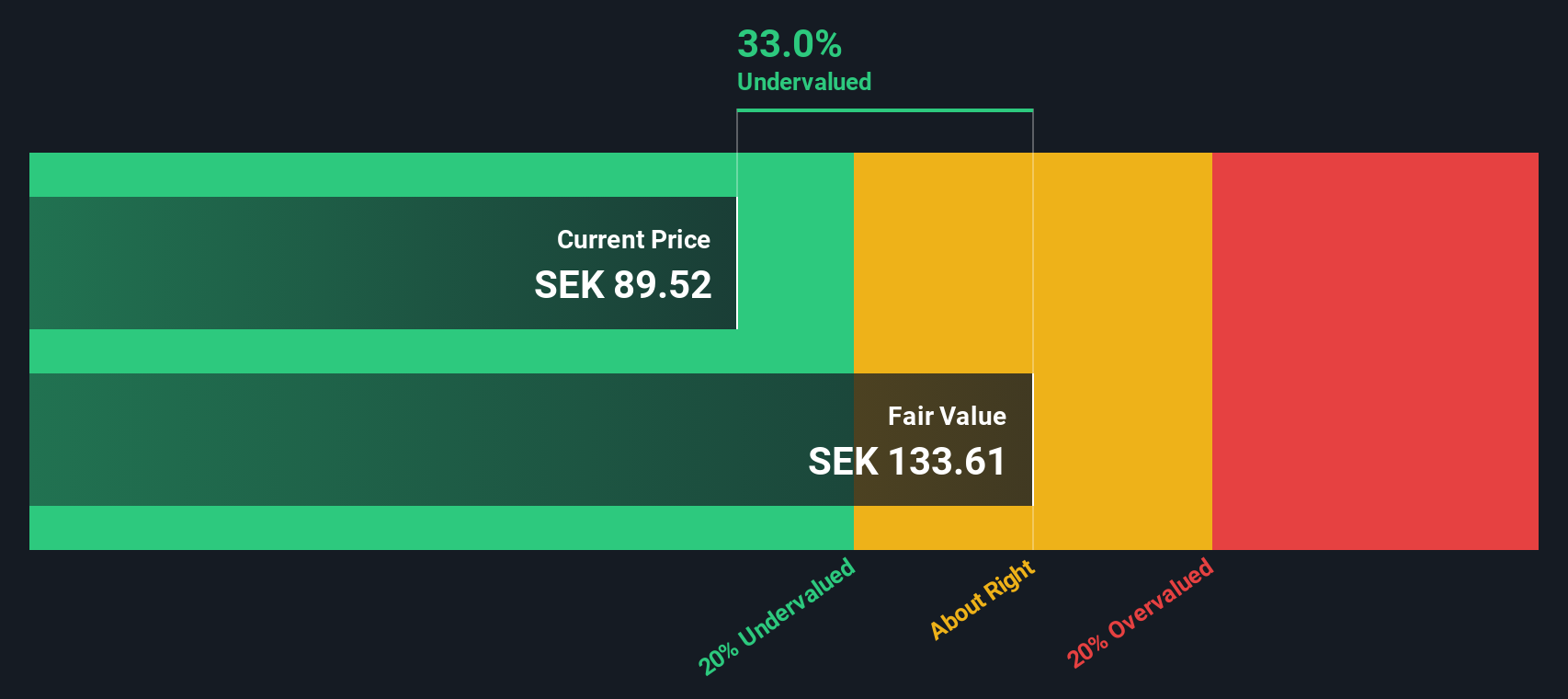

While the narrative fair value suggests Ericsson is slightly overvalued, our DCF model paints a very different picture, with shares trading about 35 percent below an estimated SEK139.15 fair value. If cash flows really track those assumptions, is the current price a value trap or a rare bargain?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Telefonaktiebolaget LM Ericsson Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers firsthand, you can shape a fresh view in minutes with Do it your way.

A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single stock. Use the Simply Wall Street Screener to identify opportunities that align with your strategy before the market fully reacts.

- Explore mispriced quality by targeting these 907 undervalued stocks based on cash flows that combine strong cash flows with meaningful upside potential.

- Consider the next wave of innovation by reviewing these 26 AI penny stocks involved in areas such as automation and personalized digital services.

- Look for reliable portfolio income by tracking these 15 dividend stocks with yields > 3% that offer attractive yields alongside sustainable payout strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal