Can Cleveland-Cliffs’ (CLF) Automation Drive Durable Cost Advantages In Cyclical Steel Markets?

- Cleveland-Cliffs recently reported gains in steel output efficiency, using advanced automation, real-time monitoring, and energy management systems to optimize its production workflows across key end markets.

- This push to modernize operations could reshape the company’s cost base and competitive position in supplying steel to automotive, construction, and industrial machinery customers.

- Next, we’ll examine how Cleveland-Cliffs’ new production efficiency gains might influence its cost discipline and longer-term earnings narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Cleveland-Cliffs Investment Narrative Recap

To own Cleveland-Cliffs, you need to believe it can turn a traditionally higher cost, blast furnace heavy model into a disciplined, cash generative steel supplier to core U.S. end markets. The latest efficiency gains support that earnings repair story in the near term, but they do not remove the key short term swing factor, which is still steel pricing and spreads, or the biggest ongoing risk from potential changes to U.S. trade protection.

Among recent developments, the company’s series of new long term notes, including the upsized US$850,000,000 of 7.625% 2034 debt, looks most relevant here. Efficiency improvements may help Cleveland-Cliffs service this higher cost capital structure more comfortably over time, but they also underline how dependent the equity case is on the company’s ability to steadily deleverage while competing against lower cost, scrap based EAF producers.

Yet investors should also weigh how exposed those improved margins could still be if Section 232 tariffs are weakened or removed...

Read the full narrative on Cleveland-Cliffs (it's free!)

Cleveland-Cliffs' narrative projects $22.5 billion revenue and $590.0 million earnings by 2028. This requires 6.8% yearly revenue growth and an earnings increase of about $2.3 billion from -$1.7 billion today.

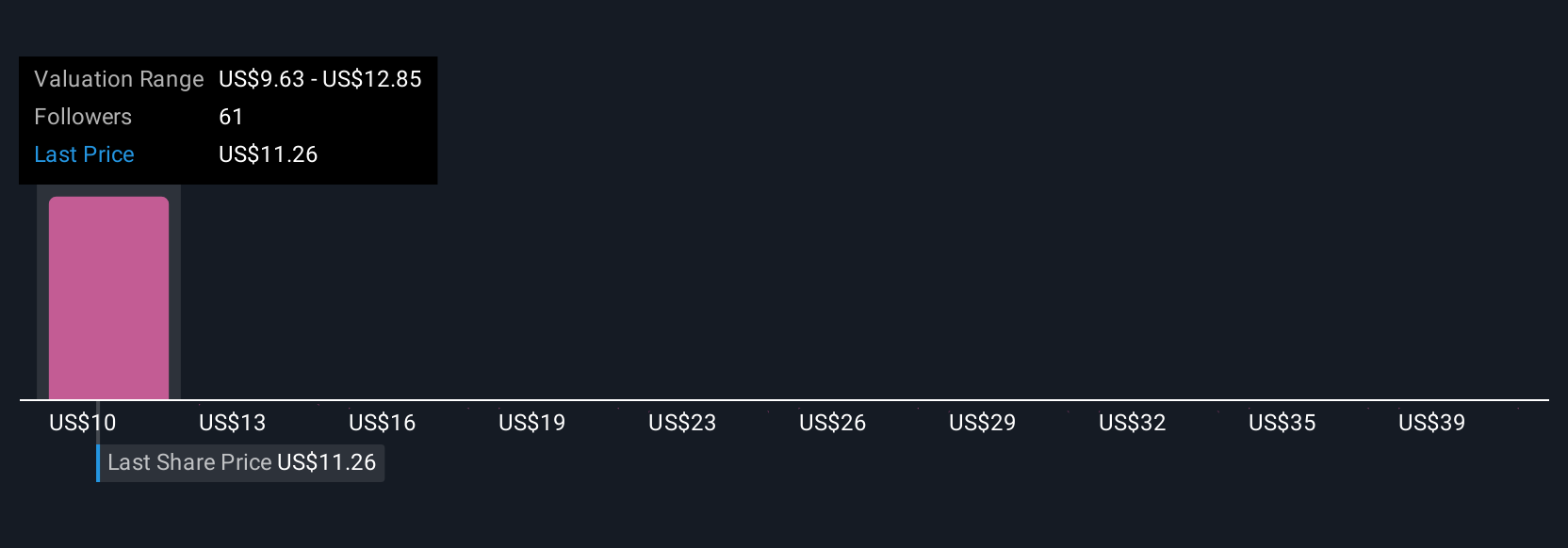

Uncover how Cleveland-Cliffs' forecasts yield a $12.45 fair value, in line with its current price.

Exploring Other Perspectives

Seven Simply Wall St Community fair value estimates for Cleveland-Cliffs span roughly US$7.54 to US$56.79, highlighting very different views on upside. Against that wide spread, the ongoing reliance on Section 232 tariffs and exposure to global overcapacity remain central to how you think about the company’s long term earnings power and are reasons to compare several viewpoints before deciding how this stock fits your portfolio.

Explore 7 other fair value estimates on Cleveland-Cliffs - why the stock might be worth over 4x more than the current price!

Build Your Own Cleveland-Cliffs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cleveland-Cliffs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cleveland-Cliffs' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal