Is Lloyds (LSE:LLOY) Still Undervalued After Its Strong Recent Share Price Performance?

Lloyds Banking Group (LSE:LLOY) has quietly outperformed the broader UK market over the past year. That strength now has investors asking whether the recent share price climb still leaves meaningful upside.

See our latest analysis for Lloyds Banking Group.

That climb has cooled slightly in the past week, but a roughly 74 percent year to date share price return and an almost 90 percent one year total shareholder return signal that momentum is still very much on Lloyds side.

If Lloyds recent run has you rethinking your UK exposure, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

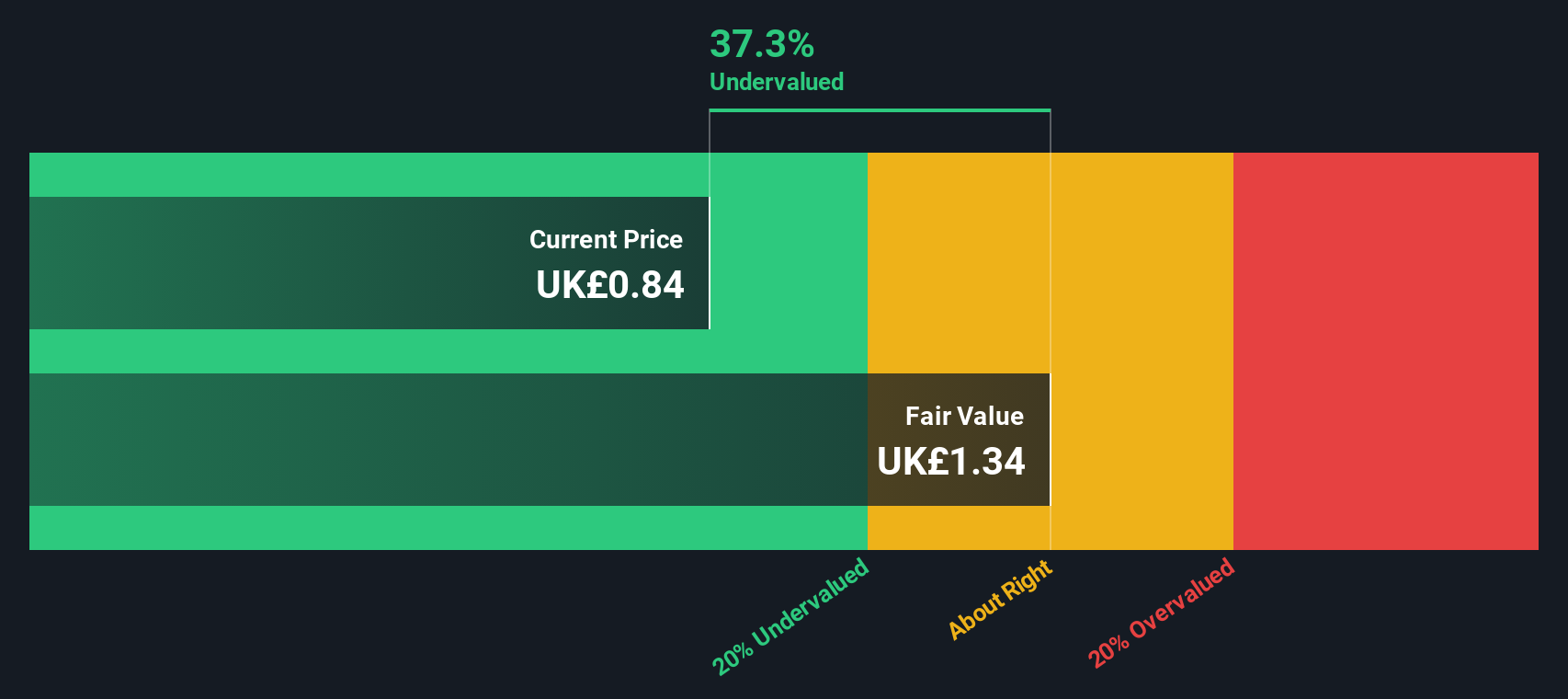

Yet with the shares now hovering near analyst targets but still trading at a hefty discount to some intrinsic value estimates, the key question is simple: is Lloyds still attractive, or is future growth already priced in?

Most Popular Narrative: 20% Overvalued

Based on the most widely followed narrative, Lloyds latest close of £0.96 sits just above an implied fair value of roughly £0.96, suggesting only modest downside.

Analysts have raised their price target for Lloyds Banking Group, reflecting modest improvements in fair value estimates and slightly stronger expectations for revenue growth and profitability.

Fair Value Estimate has risen slightly, with the modelled fair value increasing from 0.94 to 0.96, reflecting a modest uplift in long term fundamentals.

Want to see what is driving this richer valuation? The narrative leans on faster profit growth, firmer margins and a higher future earnings multiple than many investors might expect.

Result: Fair Value of $0.96 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside risks remain. These range from UK economic stagnation squeezing loan growth and credit quality to digital competitors eroding Lloyds margins and customer loyalty.

Find out about the key risks to this Lloyds Banking Group narrative.

Another Angle on Value

While the consensus narrative points to modest overvaluation, our SWS DCF model tells a very different story, suggesting Lloyds is trading about 33 percent below an estimated fair value of roughly £1.44. If that gap persists, are markets underestimating the bank or the risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lloyds Banking Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lloyds Banking Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a customised view in just minutes: Do it your way.

A great starting point for your Lloyds Banking Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Lloyds; use the Simply Wall St Screener today to uncover fresh opportunities that match your strategy before other investors get there first.

- Capture potential multi-bagger opportunities early by scanning these 3574 penny stocks with strong financials that combine small size with surprisingly solid fundamentals and growth momentum.

- Position your portfolio for the next wave of innovation by targeting these 26 AI penny stocks harnessing artificial intelligence to transform everyday industries.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that offer attractive yields without sacrificing balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal