Is Tesla’s (TSLA) Robot and AI Pivot Quietly Rewriting Its Core Investment Story?

- In late November 2025, Perrone Robotics filed patent infringement lawsuits against Tesla and six other automakers, while Tesla’s operations, robotics ambitions, product updates, and regional sales trends continued to evolve through early December, including new Model 3 pricing in Europe and mixed demand signals across key markets.

- At the same time, Tesla’s growing focus on humanoid robots, in‑house AI chips, and supportive U.S. robotics policy is shifting the company’s story further away from pure electric vehicles toward broader artificial intelligence and automation.

- Next, we’ll examine how Tesla’s push into Optimus humanoid robots and AI chip design could reshape its existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Tesla Investment Narrative Recap

Tesla’s investment case hinges on the idea that it can evolve from a pure EV maker into a broader AI, autonomy and robotics platform. In the near term, the key catalyst remains scaling high margin robotaxi and FSD software, while the biggest risk is that slowing EV demand and execution challenges on new products, including Optimus, keep profitability under pressure. The Perrone Robotics lawsuit and recent demand swings do not yet appear to change this core setup in a material way.

Among recent announcements, Tesla’s push into in house AI chips stands out as most connected to its autonomy and robotics ambitions. Management has outlined plans to design a new AI processor each year, even as critics question whether Tesla has the infrastructure and resources to compete with established chipmakers. For investors focused on autonomy and Optimus as key catalysts, this raises important questions about capital intensity, execution risk and the timing of any payoff.

Yet while optimism around Optimus and AI chips is high, investors should also be aware that...

Read the full narrative on Tesla (it's free!)

Tesla's narrative projects $148.1 billion revenue and $15.4 billion earnings by 2028. This requires 16.9% yearly revenue growth and an earnings increase of about $9.5 billion from $5.9 billion today.

Uncover how Tesla's forecasts yield a $392.93 fair value, a 14% downside to its current price.

Exploring Other Perspectives

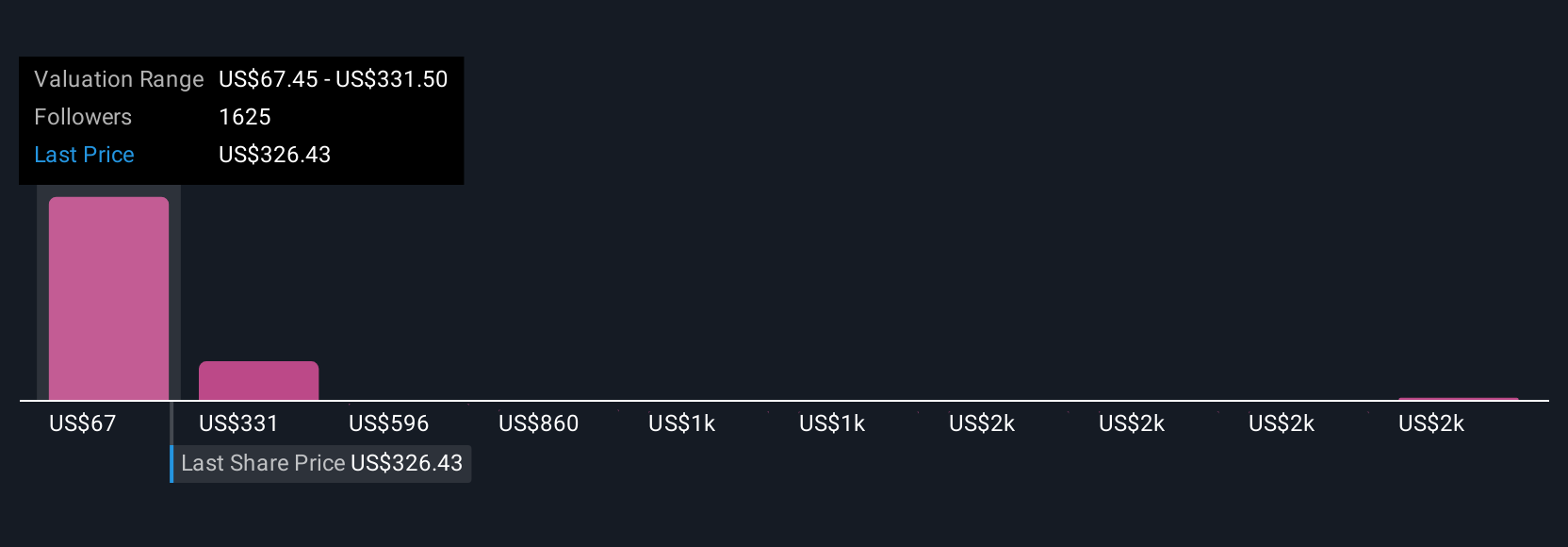

219 members of the Simply Wall St Community currently place Tesla’s fair value anywhere between US$67 and US$2,708, with many clustered well above the analyst consensus. When you compare those expectations with the execution risk around robotaxi expansion and monetizing FSD outside the US, it becomes clear why exploring several alternative viewpoints can be useful before forming your own stance.

Explore 219 other fair value estimates on Tesla - why the stock might be worth over 5x more than the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal