Sea (NYSE:SE) Valuation Check After Recent Share Price Pullback

Sea (NYSE:SE) has quietly slipped about 11% over the past month and nearly 30% in the past 3 months, even as revenue and net income keep growing at a healthy double-digit clip.

See our latest analysis for Sea.

Zooming out, that recent 3 month share price slide of roughly 30% comes after a strong year to date share price return and a solid 3 year total shareholder return, which suggests momentum has cooled even as Sea’s long term compounding story stays intact.

If Sea’s pullback has you thinking about what else might be setting up for the next leg higher, now is a good time to explore fast growing stocks with high insider ownership.

With shares now trading at a hefty discount to analyst targets and solid double digit revenue and profit growth still coming through, is Sea quietly becoming an undervalued compounder, or is the market simply pricing in all the future upside?

Most Popular Narrative Narrative: 30.3% Undervalued

With Sea’s fair value in the narrative sitting well above the recent 133.99 last close, the story leans firmly toward upside driven by compounding fundamentals.

Investments in logistics technology, AI driven ad tech, and content ecosystem improvements are enhancing customer experience, boosting take rates, and lowering per order costs, positively impacting Shopee's unit economics and supporting EBITDA margin expansion over time.

Want to see the full math behind this bullish setup? The crux is how fast revenue, margins, and earnings are projected to scale together. Curious which profit profile and future earnings multiple are doing the heavy lifting in this valuation story, and how those assumptions stack up over the next few years?

Result: Fair Value of $192.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in key e-commerce markets, and any stumble in Garena’s gaming pipeline, could quickly challenge the upbeat growth and valuation assumptions.

Find out about the key risks to this Sea narrative.

Another Lens On Valuation

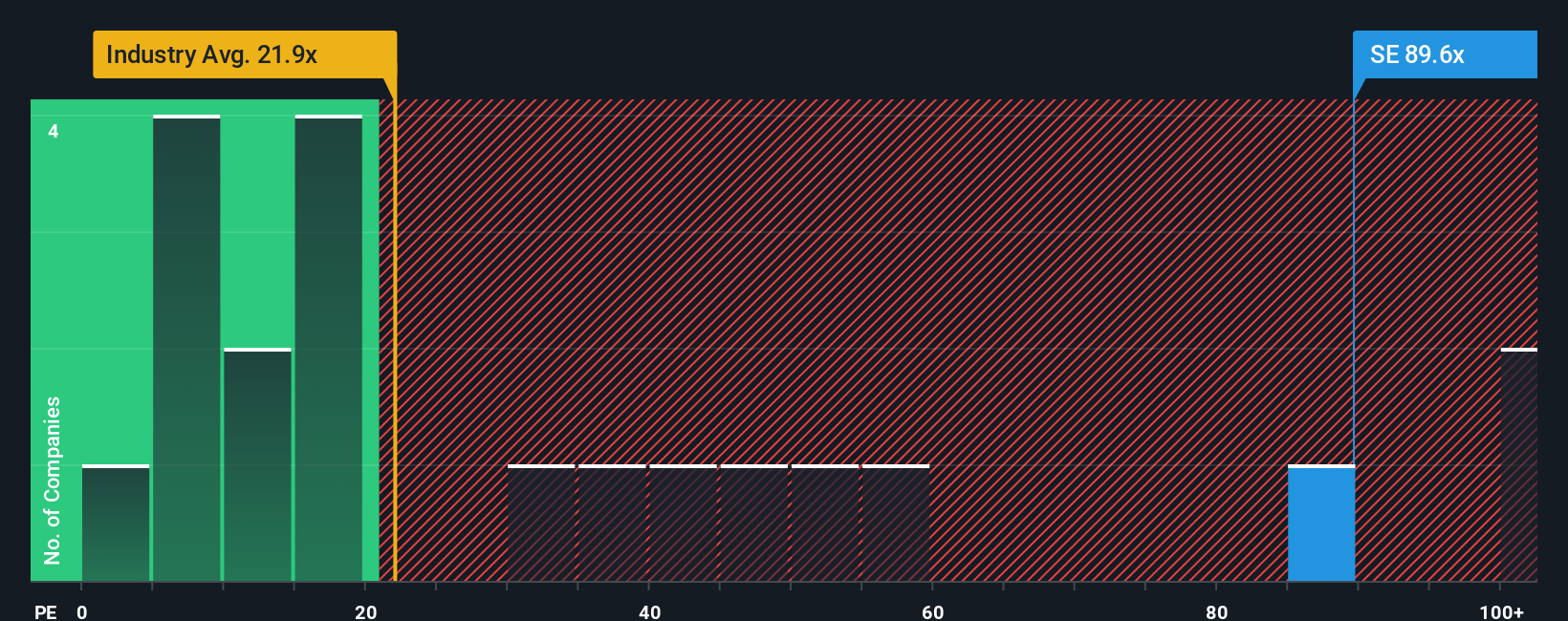

On earnings, the picture looks very different. Sea trades at about 55.9 times earnings, well above the Global Multiline Retail average of 19.8 times, the peer average of 51 times, and our fair ratio of 37.1 times. That gap points to meaningful valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If this take does not quite match your view, or you prefer to dig through the numbers yourself, you can spin up a custom narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Ready for more high conviction ideas?

Before the next move catches you off guard, put Simply Wall Street’s screener to work and line up your next wave of potential winners today.

- Capture asymmetrical upside by targeting these 3574 penny stocks with strong financials that already back their tiny market caps with real balance sheet strength and improving fundamentals.

- Position ahead of structural change by focusing on these 30 healthcare AI stocks powering diagnostics, treatment pathways, and hospital efficiency with scalable, defensible technology.

- Lock in growing cash payouts with these 15 dividend stocks with yields > 3% that combine sustainable yields above 3% with earnings support and room for future increases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal