Jacobs (J): Assessing Valuation After New Queensland Rail and El Paso Water Infrastructure Wins

Jacobs Solutions (J) just landed two meaningful infrastructure wins, including a key certifier role on Queensland's Logan and Gold Coast Faster Rail Project, which may give investors fresh reasons to revisit the stock's long term growth story.

See our latest analysis for Jacobs Solutions.

Those contract wins land at an interesting moment, with the share price at $140.22 after a choppy few months that include a negative 1 month share price return but a positive year to date share price return. A solid 3 year total shareholder return of more than 40 percent suggests the longer term growth story is still intact and gaining institutional confidence.

If projects like Queensland rail and El Paso water have you thinking about where infrastructure demand could flow next, it is worth exploring aerospace and defense stocks as another pocket of long term contract driven opportunities.

Yet with the stock trading below analyst targets but up strongly over three and five years, the real question is whether Jacobs is still mispriced or if the market is already discounting years of infrastructure-led growth.

Most Popular Narrative: 12.2% Undervalued

With the narrative fair value sitting above Jacobs Solutions recent close of $140.22, the story leans toward patient upside rather than a quick rerating.

Record-high backlog growth (up 14% year over year) in Water, Advanced Facilities, and Critical Infrastructure driven by global infrastructure modernization, water scarcity, and data center expansion provides strong visibility into multi-year revenue growth and supports confidence in accelerating top-line results into FY '26 and beyond.

Curious how that backlog, rising margins, and a higher future earnings multiple all fit together? The valuation hinges on a surprisingly ambitious earnings path. Want to see the exact assumptions behind that upside narrative?

Result: Fair Value of $159.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on steady public sector funding and flawless execution. Project delays or cost overruns could quickly erode those optimistic assumptions.

Find out about the key risks to this Jacobs Solutions narrative.

Another Angle on Valuation

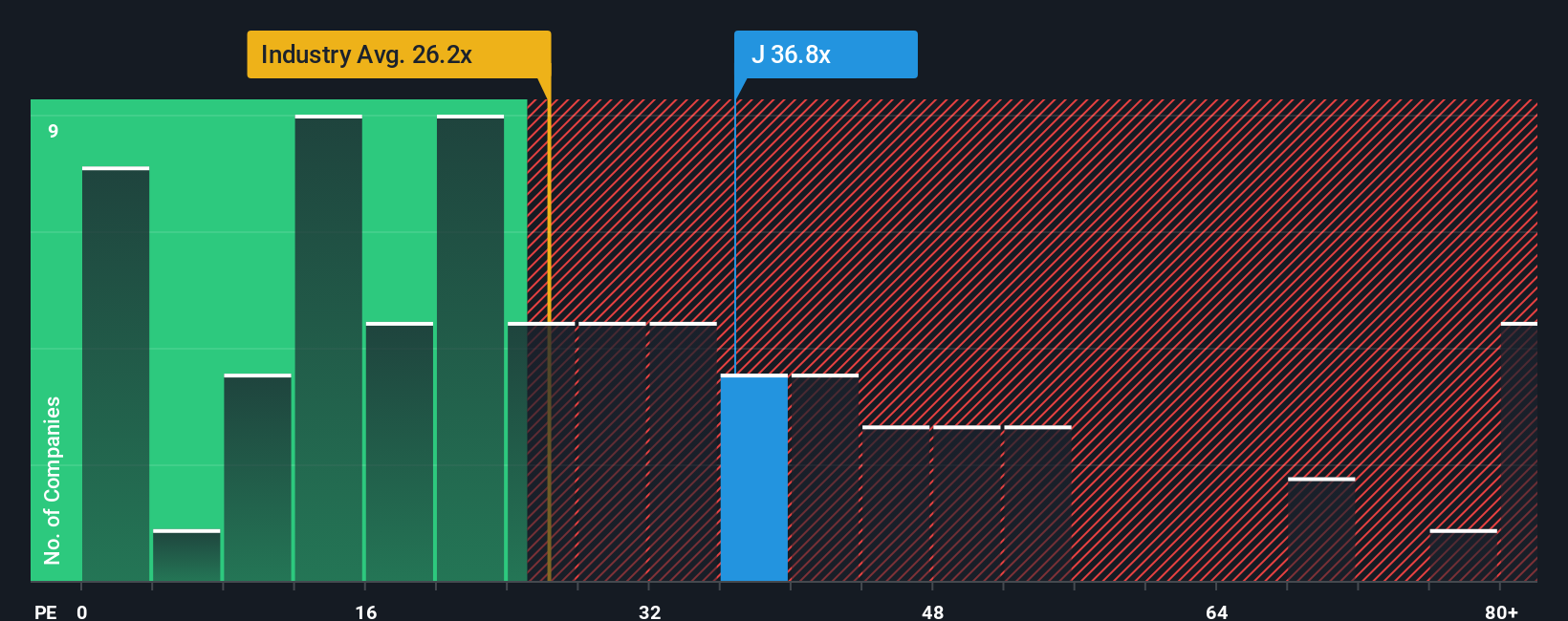

Looking beyond the upbeat narrative, Jacobs appears stretched on earnings. The shares trade at 53 times earnings, compared with 25 times for the US Professional Services industry and 31.9 times for peers. This is also above a fair ratio of 31.6 times that the market could move toward over time. Is today’s price assuming more growth than the business can realistically deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jacobs Solutions Narrative

If you see the story differently, or simply want to test your own assumptions, you can build a full narrative from scratch in just a few minutes, Do it your way.

A great starting point for your Jacobs Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Jacobs, you could miss out on other powerful opportunities. Put the Simply Wall St Screener to work and keep your edge sharp.

- Capture potential multi-baggers early by scanning these 3574 penny stocks with strong financials built on strengthening balance sheets and improving fundamentals before the wider market catches on.

- Ride structural tailwinds in automation and machine learning by targeting these 26 AI penny stocks that pair rapid growth with scalable business models.

- Lock in value focused opportunities by systematically reviewing these 907 undervalued stocks based on cash flows that trade below their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal