Is BASF (XTRA:BAS) Using Battery Metals Conferences to Recast Its Transition Materials Strategy?

- On 2 December 2025, BASF SE took part in the Resourcing Tomorrow and Mines and Money conferences in London, with Battery Metals Management representative Matthew Burford presenting on the company’s role in the evolving raw materials landscape.

- By engaging directly with mining and battery metals stakeholders, BASF highlighted how its upstream materials expertise connects to broader themes of the energy transition and resource security.

- We’ll now examine how BASF’s high-profile battery metals conference presence fits into its existing investment narrative around portfolio focus and transition materials.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BASF Investment Narrative Recap

To own BASF, you need to believe its portfolio reshaping and cost savings can offset structurally weaker base chemicals and European demand. The battery metals conference appearances do not materially change the near term picture, where execution on portfolio optimization remains a key catalyst and prolonged low margins in core chemicals are still a central risk.

The recent decision to discontinue PolyTHF production at Ulsan, consolidating capacity into other global sites, is more directly relevant for shareholders than the conference spotlight. It underlines BASF’s ongoing push to sharpen competitiveness and simplify its asset base, which sits at the heart of its earnings recovery and cash flow improvement efforts.

Yet while BASF is working to streamline its portfolio, investors should be aware that prolonged weakness in European demand and potential asset closures could...

Read the full narrative on BASF (it's free!)

BASF's narrative projects €70.9 billion revenue and €3.3 billion earnings by 2028. This requires 3.0% yearly revenue growth and about a €2.9 billion earnings increase from €388.0 million today.

Uncover how BASF's forecasts yield a €48.02 fair value, a 10% upside to its current price.

Exploring Other Perspectives

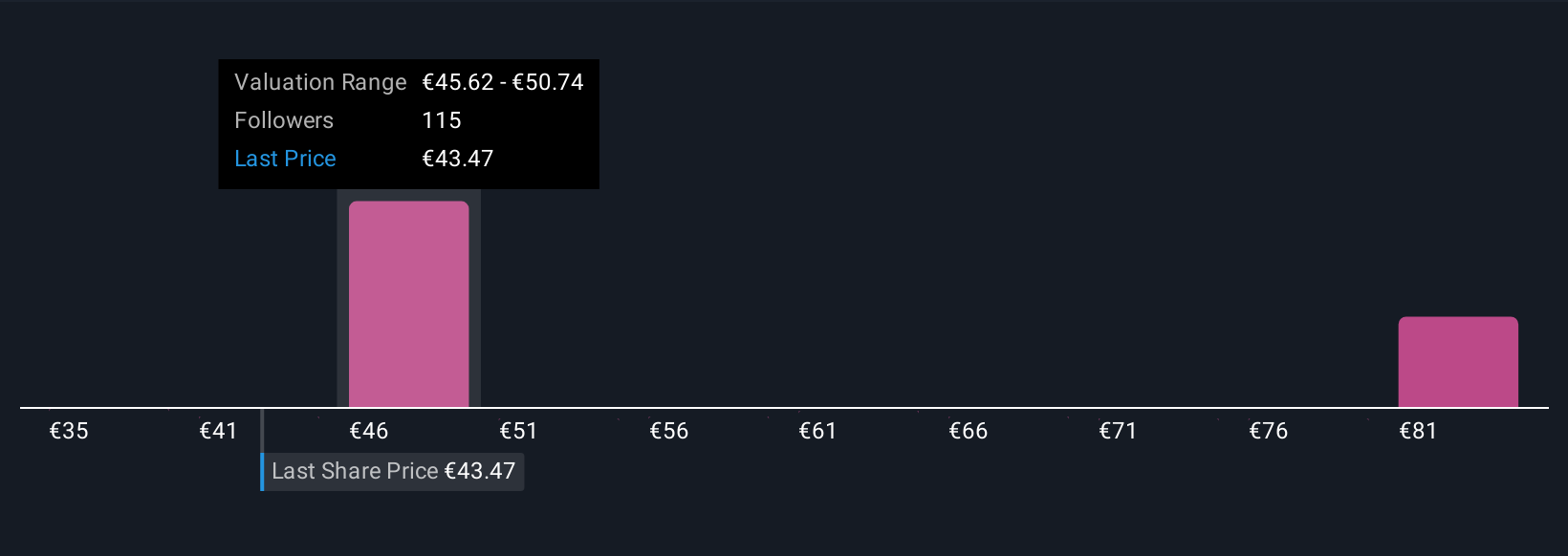

Eleven fair value estimates from the Simply Wall St Community span roughly €35 to €87 per share, showing how far apart individual views can be. Against this wide spread, the risk that prolonged low margins and overcapacity in base chemicals could weigh on profitability for years is a central issue you may want to explore from several angles.

Explore 11 other fair value estimates on BASF - why the stock might be worth as much as 98% more than the current price!

Build Your Own BASF Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BASF research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free BASF research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BASF's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal