Texas Instruments (TXN) Is Up 8.5% After Big US Fab Spend and Cautious Outlook - Has The Bull Case Changed?

- In Q3 2025, Texas Instruments reported strong revenue growth but issued cautious Q4 guidance and confirmed plans to invest over US$60.00 billion in expanding its U.S. semiconductor manufacturing capacity, pressuring near-term earnings and margins.

- This combination of slower dividend growth, heavy capital spending, and softer guidance highlights a tension between funding future capacity and maintaining the company’s long-standing income appeal for shareholders.

- Now we’ll examine how Texas Instruments’ cautious guidance and large-scale U.S. fab investments may reshape its previously optimistic investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Texas Instruments Investment Narrative Recap

To own Texas Instruments today, you need to believe that its core analog and embedded chip business in industrial and automotive end markets can justify heavy, long-duration investment in U.S. manufacturing. The recent Q3 2025 beat but softer Q4 guidance, together with more than US$60.00 billion of planned fab spending, directly affects the key near term catalyst of a cyclical industrial and auto recovery, while amplifying the biggest risk of underutilized capacity and margin pressure if demand disappoints.

The most relevant recent announcement to this story is TI’s 4% dividend increase to US$1.42 per share in September 2025, marking its 22nd consecutive annual raise. Against slowing dividend growth and cautious guidance, this move underscores management’s continued commitment to income returns even as capex soars, and it ties directly into the central trade off investors are weighing between funding new U.S. fabs and preserving TI’s long standing appeal as a dependable dividend payer.

But despite this consistency in dividend hikes, investors should be aware of the growing risk that...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments’ narrative projects $22.3 billion revenue and $7.9 billion earnings by 2028. This implies 10.1% yearly revenue growth and an earnings increase of about $2.9 billion from $5.0 billion today.

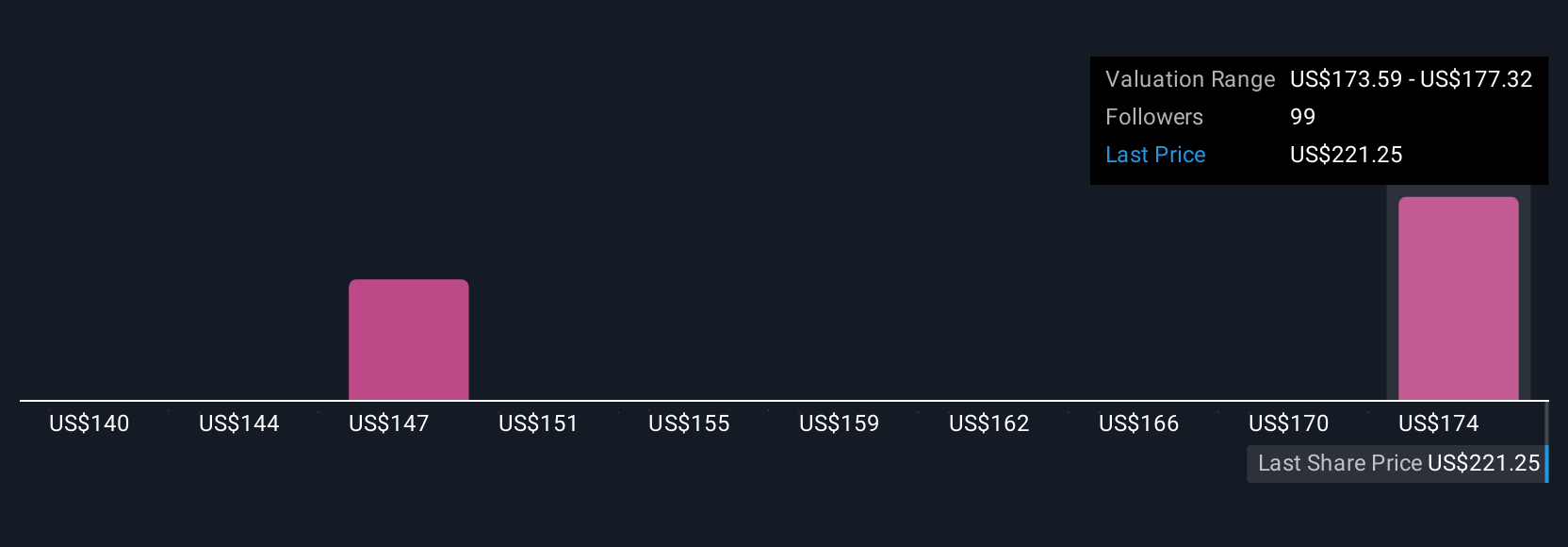

Uncover how Texas Instruments' forecasts yield a $189.56 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were assuming TI could lift annual revenue to about US$27.9 billion with earnings of US$11.7 billion, yet this new guidance and capacity risk remind you that views can differ widely and may need updating as conditions evolve.

Explore 9 other fair value estimates on Texas Instruments - why the stock might be worth 31% less than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal