How Investors Are Reacting To Verizon (VZ) Leadership Shake-Up And Dividend Steadiness

- On December 4, 2025, Verizon Communications declared a quarterly dividend of US$0.69 per share, payable on February 2, 2026, and on December 5, 2025 it appointed Jennifer K. Mann to the Board’s Human Resources Committee.

- These governance and capital allocation moves follow the earlier appointment of former PayPal CEO Dan Schulman as Verizon’s CEO, sharpening attention on how leadership incentives align with long-term shareholder value.

- We’ll now examine how Schulman’s incentive-heavy leadership package could influence Verizon’s cost-efficiency narrative and long-term earnings trajectory.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Verizon Communications Investment Narrative Recap

To own Verizon today, you need to believe its 5G, fixed wireless and fiber investments can offset a maturing wireless market and high debt load. The latest dividend affirmation and board committee change do not materially alter the near term earnings catalyst or the key risks around capital intensity, competition and balance sheet flexibility.

The most relevant update is Verizon’s decision to hold its quarterly dividend at US$0.69 per share, payable on February 2, 2026. For investors focused on cost efficiency and cash generation under Dan Schulman’s incentive driven leadership, this affirmation keeps attention squarely on whether Verizon can keep funding its high yield payout while investing enough in 5G and broadband growth.

But while the dividend looks reassuring, investors should be aware that Verizon’s US$116,000,000,000 debt load and exposure to interest rates could...

Read the full narrative on Verizon Communications (it's free!)

Verizon Communications' narrative projects $144.5 billion revenue and $22.1 billion earnings by 2028. This requires 1.8% yearly revenue growth and about a $3.9 billion earnings increase from $18.2 billion.

Uncover how Verizon Communications' forecasts yield a $47.52 fair value, a 14% upside to its current price.

Exploring Other Perspectives

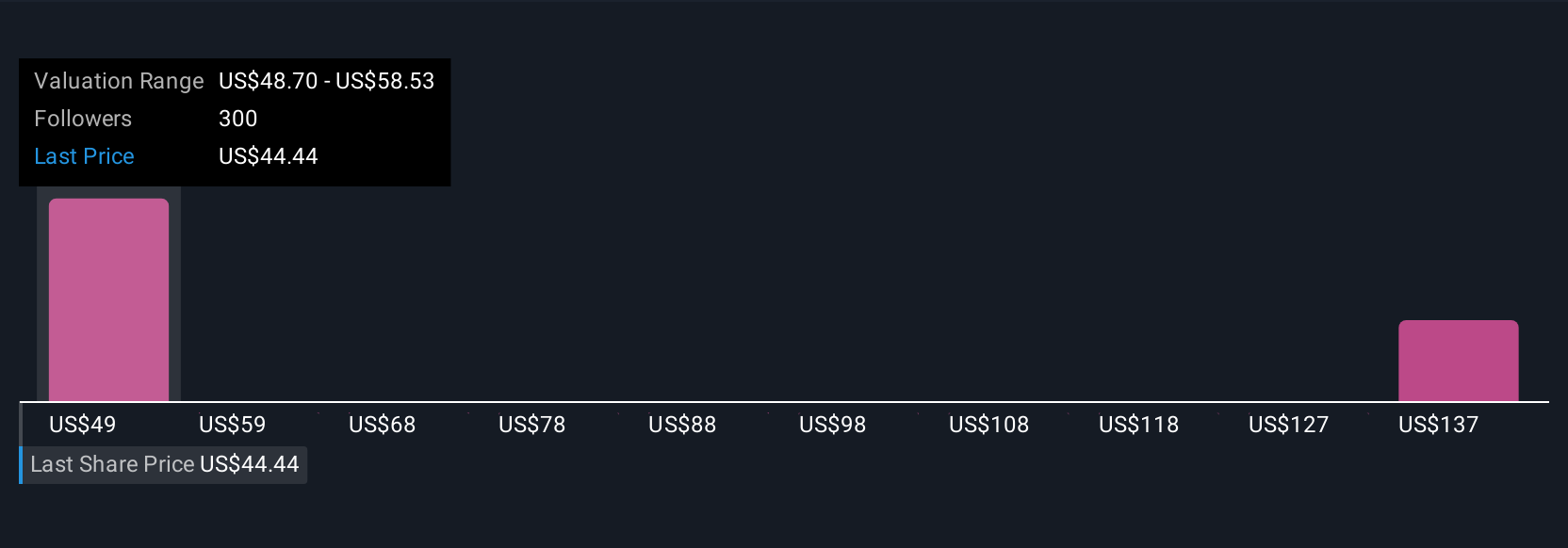

Sixteen members of the Simply Wall St Community currently see Verizon’s fair value between US$46.38 and US$102.19, underscoring how far views can diverge. When you set those opinions against Verizon’s heavy 5G and fiber capex needs, it becomes even more important to compare multiple scenarios for future cash flows and resilience.

Explore 16 other fair value estimates on Verizon Communications - why the stock might be worth just $46.38!

Build Your Own Verizon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verizon Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verizon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verizon Communications' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal