Snap’s New Ad Tools and Record User Base Might Change The Case For Investing In Snap (SNAP)

- Earlier in Q3 2025, Snap introduced new ad products such as Sponsored Snaps and Smart Campaign Solutions, alongside reporting a record 477 million daily active users on Snapchat.

- These tools, which are already showing encouraging gains in ad conversions, hint at Snap’s efforts to strengthen the core economics of its advertising platform.

- We’ll now explore how these improving ad tools and conversion trends might influence Snap’s existing investment narrative around higher-margin growth.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Snap Investment Narrative Recap

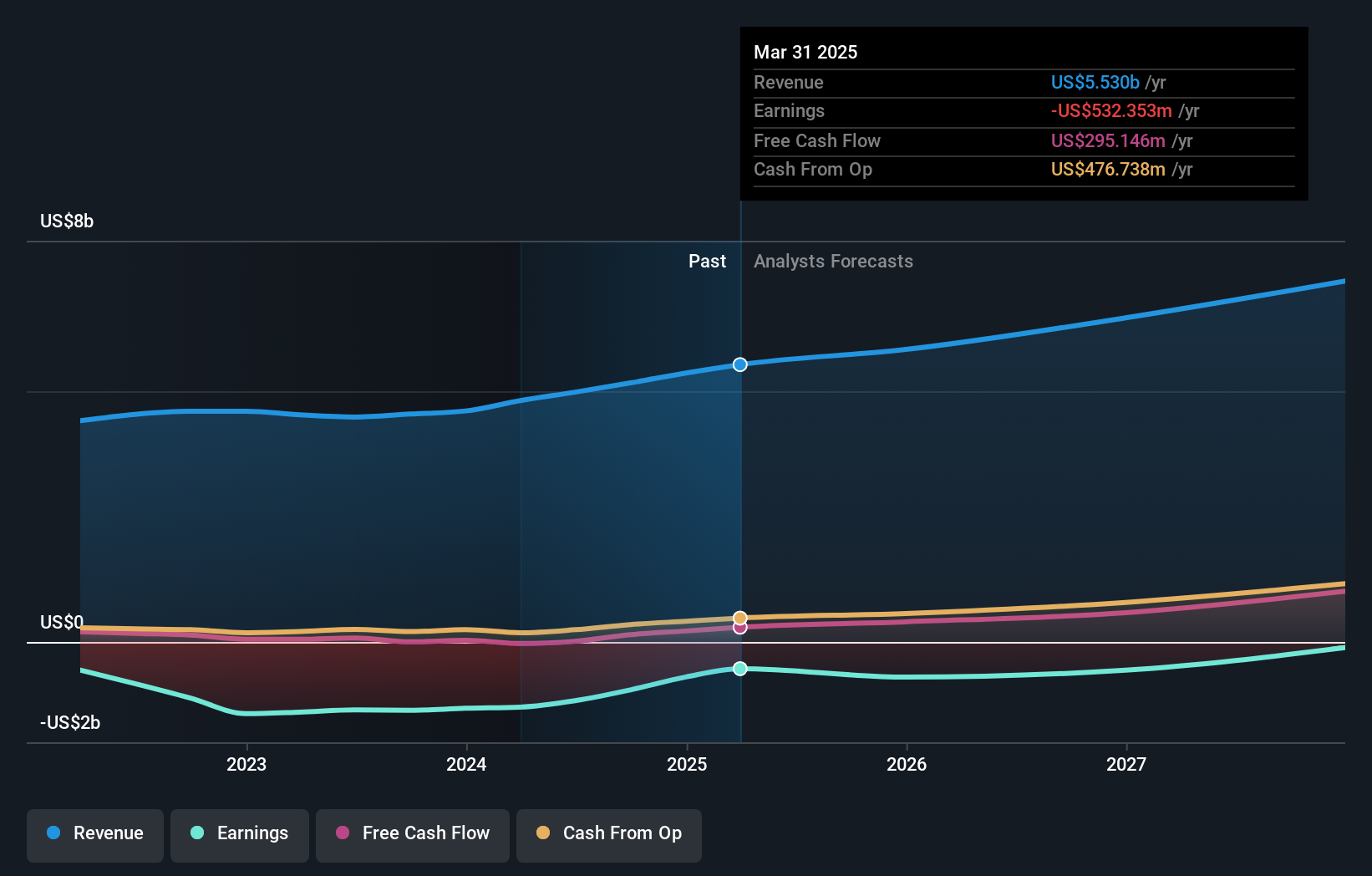

To own Snap today, you need to believe that a very large, highly engaged user base can eventually support a sustainable, higher-margin advertising and subscription business despite ongoing losses and heavy competition. The latest launch of Sponsored Snaps and Smart Campaign Solutions, together with 477 million daily active users, supports the key short term catalyst of better ad conversion and monetization, but does not remove the biggest risk that Snap remains unprofitable with significant net losses.

Among recent updates, Sponsored Snaps look most relevant here, because they sit at the heart of Snap’s push to convert rising engagement into more effective ad spend. If these formats continue to lift conversions for advertisers, they may reinforce the thesis that Snap can improve revenue per user and gradually support its margin expansion story, even as it contends with intense rivalry from Meta, Alphabet and TikTok.

Yet, despite these encouraging ad tools, investors still need to be aware of the risk that Snap’s persistent unprofitability could...

Read the full narrative on Snap (it's free!)

Snap's narrative projects $7.5 billion revenue and $827.3 million earnings by 2028.

Uncover how Snap's forecasts yield a $9.84 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community currently estimate Snap’s fair value between US$8.23 and US$16.87, reflecting a wide spread of expectations. As you weigh those views against the central catalyst of improving ad tools and conversions, it becomes clear that investor opinions can differ sharply, so it is worth exploring several perspectives before deciding how Snap’s evolving ad economics might influence its longer term performance.

Explore 13 other fair value estimates on Snap - why the stock might be worth just $8.23!

Build Your Own Snap Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Snap research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Snap research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Snap's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal