Warrior Met Coal (HCC): Reassessing Valuation After Global Steel Demand Fuels a Sharp Share Price Rally

Warrior Met Coal (HCC) is climbing as global steel producers in Europe, South America, and Asia scramble for more metallurgical coal. That demand spike is reshaping how investors are thinking about the stock.

See our latest analysis for Warrior Met Coal.

That demand story has clearly filtered into the market, with Warrior Met Coal’s share price up 27.45 percent over the last month and a hefty 51.74 percent year to date. Its five year total shareholder return of 340.81 percent shows momentum has been building for much longer.

If this kind of cyclical upswing has your attention, it could be a good moment to explore aerospace and defense stocks for other economically sensitive plays riding global spending trends.

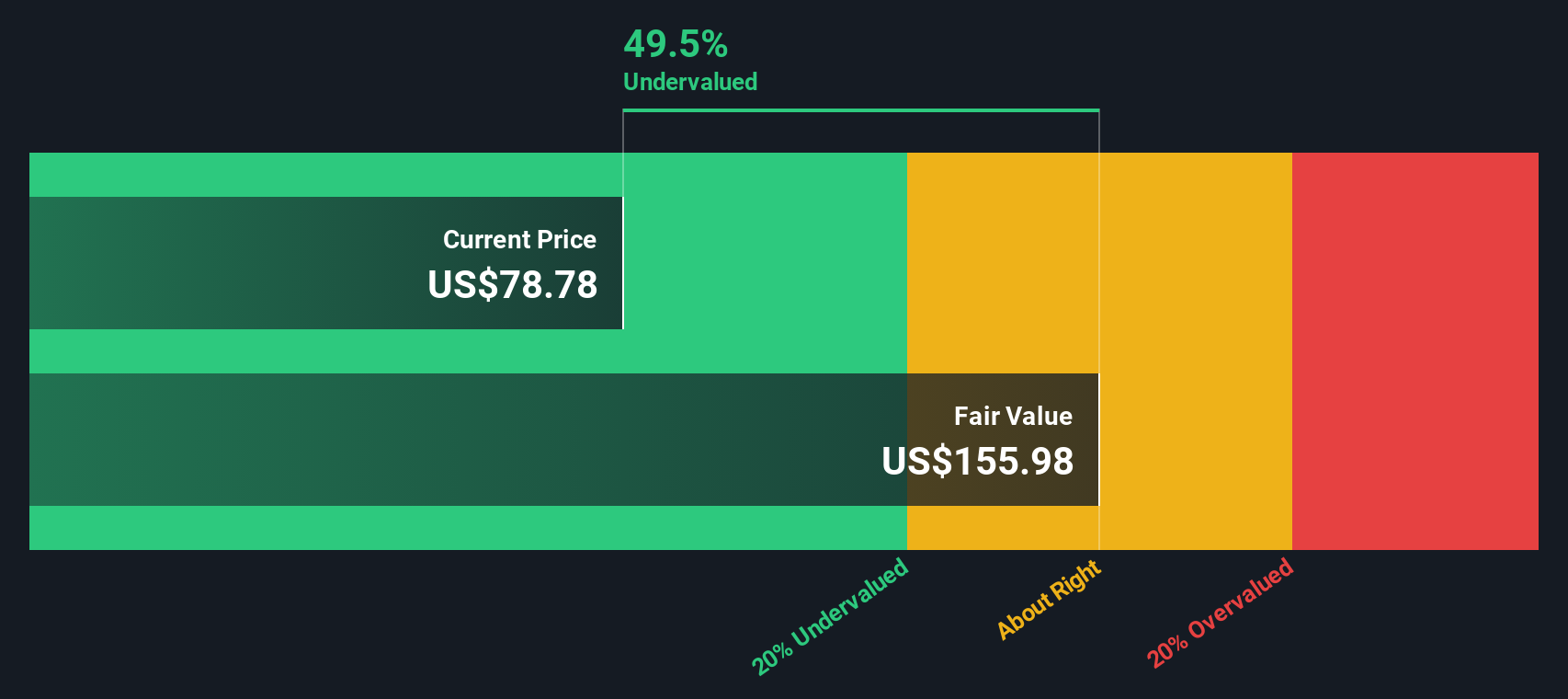

Yet with shares already near analyst targets but still trading at a steep discount to some intrinsic value estimates, investors face a key question: Is Warrior Met Coal still a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 2.2% Overvalued

With Warrior Met Coal closing at $82.61 versus a most popular narrative fair value of about $80.83, expectations and price have nearly converged, putting the focus squarely on the assumptions underneath.

The ahead of schedule and on budget launch of the Blue Creek longwall in early Q1 2026 accelerates Warrior Met Coal's transition from capital investment to higher volume revenue generation, unlocking increased production capacity and lower cost, higher quality tons. This positions the company to grow both revenues and net margins as volumes ramp and cost efficiencies are realized.

Want to see how aggressive revenue growth, a margin reset, and a much lower future earnings multiple can still line up into one tight fair value story?

Result: Fair Value of $80.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could unravel if global steel demand stays weak and Blue Creek’s ramp up brings higher costs without matching long term contract volumes.

Find out about the key risks to this Warrior Met Coal narrative.

Another View: DCF Points to Deep Value

Our DCF model offers a different angle, suggesting Warrior Met Coal could be worth about $153.52 per share, roughly 46 percent above today’s price. If the cash flow surge that analysts expect actually materializes, is the current market skepticism an opportunity or a warning?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Warrior Met Coal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Warrior Met Coal Narrative

If you see the story differently or want to test your own assumptions against the numbers, build a custom view in under three minutes: Do it your way.

A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single coal story when you can use Simply Wall Street’s powerful screener tools to uncover fresh, high conviction opportunities before others notice.

- Identify potential multibaggers early by scanning these 3577 penny stocks with strong financials that already show improving fundamentals and momentum on the numbers.

- Position your portfolio for emerging innovation trends by targeting these 26 AI penny stocks in automation, data, and intelligent software.

- Explore income opportunities by focusing on these 15 dividend stocks with yields > 3% that combine attractive yields with payout coverage and balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal