Does Polestar (PSNY) ADS Ratio Reset Quietly Reframe Its Dilution Risk and Capital-Raising Playbook?

- Polestar Automotive Holding UK PLC recently confirmed the implementation date for a previously announced change in the ratio of its Class A, B, C-1 and C-2 American Depositary Shares to the underlying ordinary shares, formalizing this adjustment in a Form 6-K filed with the SEC.

- By incorporating the ADS ratio change into its existing Form S-8 and Form F-3 registration statements, Polestar has effectively embedded the new share structure mechanics into its capital-raising framework, which can influence how investors evaluate ownership, dilution risk and liquidity across its listed instruments.

- We’ll now examine how locking in the ADS ratio change implementation date may affect Polestar’s investment narrative, especially around dilution.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Polestar Automotive Holding UK Investment Narrative Recap

To own Polestar, you need to believe it can turn fast revenue growth and an expanding model lineup into a sustainable, profitable EV business despite heavy competition and funding needs. The confirmed ADS ratio implementation date itself does not materially change that near term story, but it does intersect with the key short term catalyst of future capital raises and the main risk of further dilution while the company remains loss making and cash constrained.

The recent US$200,000,000 private placement with PSD Investment Limited is closely tied to this new ADS ratio disclosure, because both sit within the same capital raising toolkit that underpins Polestar’s cash runway. For investors, connecting this fresh equity issuance with the formalized ADS structure helps frame how any future funding events could affect ownership stakes, liquidity and the timing of catalysts such as progress toward breakeven or compliance with Nasdaq listing requirements.

Yet alongside the potential upside from continued revenue growth and new model launches, investors should also be aware of the ongoing risk that...

Read the full narrative on Polestar Automotive Holding UK (it's free!)

Polestar Automotive Holding UK's narrative projects $11.0 billion revenue and $559.6 million earnings by 2028. This requires 63.1% yearly revenue growth and about a $3.3 billion earnings increase from -$2.7 billion today.

Uncover how Polestar Automotive Holding UK's forecasts yield a $1.00 fair value, a 58% upside to its current price.

Exploring Other Perspectives

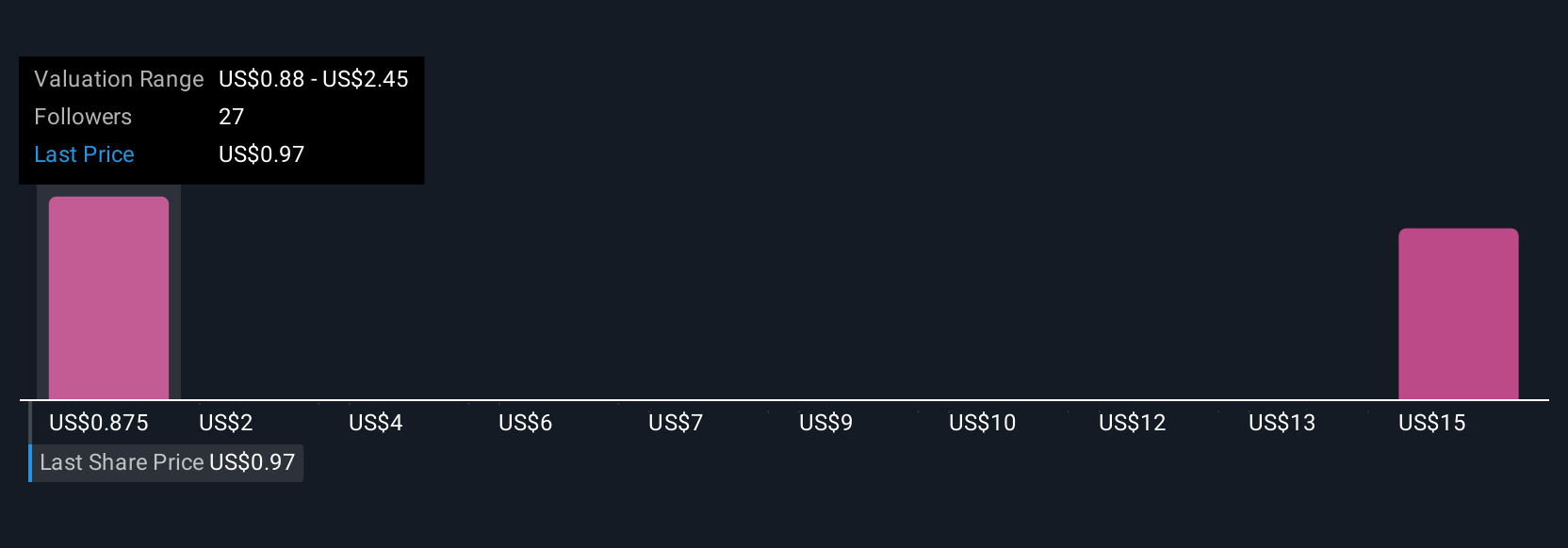

Ten fair value estimates from the Simply Wall St Community span about US$1.00 to US$4.59 per share, showing sharply different views on Polestar’s potential. When you set that against the risk of ongoing cash burn and possible future dilution, it underlines why you may want to explore several viewpoints before deciding how Polestar could fit into your portfolio.

Explore 10 other fair value estimates on Polestar Automotive Holding UK - why the stock might be worth just $1.00!

Build Your Own Polestar Automotive Holding UK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Polestar Automotive Holding UK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Polestar Automotive Holding UK's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal