Stronger Q3 Results And Rich Dividend Yield Might Change The Case For Investing In Peoples Bancorp (PEBO)

- In the past quarter, Peoples Bancorp Inc. reported improved Q3 results, with higher revenue, rising net income, expanding net interest margin, loan growth and steady deposits alongside healthier asset quality.

- An additional draw for investors is Peoples Bancorp’s dividend profile, as its more than 5.5% yield and consistent increases support an income-focused thesis.

- We’ll now explore how this combination of stronger quarterly performance and an appealing dividend yield affects Peoples Bancorp’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Peoples Bancorp Investment Narrative Recap

To own Peoples Bancorp, you generally need to believe in steady community banking economics supported by disciplined credit, stable funding and a reliable dividend. The latest quarter’s stronger revenue, wider net interest margin, loan growth and improved asset quality modestly support that view, but do not fully resolve concerns about pressure on margins and earnings from funding costs and any lingering credit issues in smaller ticket portfolios.

The recent decision to maintain a US$0.41 quarterly dividend, following an earlier increase from US$0.40, is particularly relevant here, because it underlines management’s continued commitment to income returns even as net income has been under pressure year to date. For investors, that dividend consistency sits alongside the Q3 improvement as a key near term support, but it also sharpens the question of how sustainable the payout is if loan growth slows or funding and credit costs rise again.

But investors should also be aware that rising noninterest expenses and a weaker efficiency ratio could...

Read the full narrative on Peoples Bancorp (it's free!)

Peoples Bancorp's narrative projects $393.5 million revenue and $134.1 million earnings by 2028. This implies a 10.8% yearly revenue decline and an earnings increase of about $30.9 million from $103.2 million today.

Uncover how Peoples Bancorp's forecasts yield a $34.17 fair value, a 13% upside to its current price.

Exploring Other Perspectives

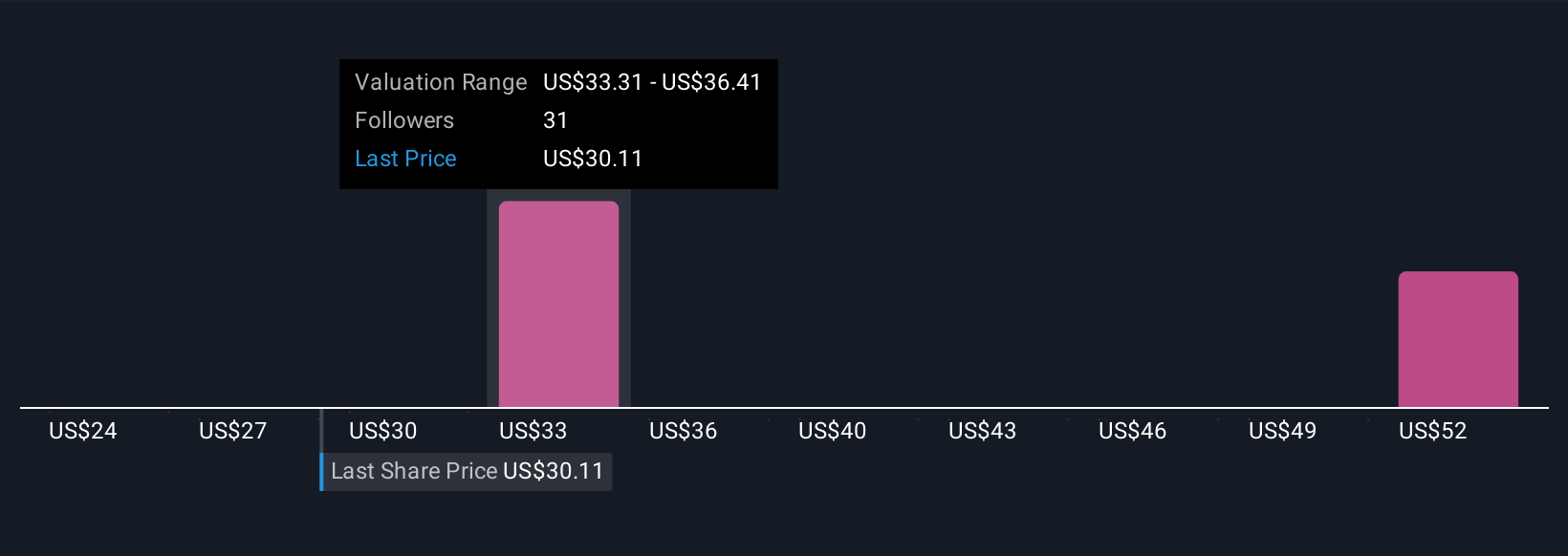

Five members of the Simply Wall St Community currently estimate fair value for Peoples Bancorp between US$24 and about US$54 per share, highlighting a very wide valuation spread. When you set those views against credit quality concerns in the small ticket leasing portfolio, it underlines why performance could diverge from expectations and why it is worth comparing several viewpoints before forming a view.

Explore 5 other fair value estimates on Peoples Bancorp - why the stock might be worth as much as 78% more than the current price!

Build Your Own Peoples Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peoples Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Peoples Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peoples Bancorp's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal