Should Mastercard’s Strong Q3, AI Expansion and Antitrust Progress Require Action From Mastercard (MA) Investors?

- Mastercard recently reported strong Q3 2025 results with revenue up 17% year over year and widening margins, while also advancing its digital footprint through an AI-powered Agent Pay rollout in the UAE and a Digital Country Partnership memorandum with Ukraine’s government.

- At the same time, progress toward resolving long-running U.S. merchant antitrust litigation suggests clearer visibility on future fee structures, which could meaningfully influence how investors assess Mastercard’s long-term business model and risk profile.

- We’ll now examine how the strong Q3 performance and improving antitrust outlook may influence Mastercard’s existing investment narrative and risks.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mastercard Investment Narrative Recap

To own Mastercard, you generally have to believe its global card network and value added services can keep attracting payment volumes even as alternatives emerge. The strong Q3 2025 results and widening margins support that view in the near term, while the proposed U.S. merchant antitrust settlement improves visibility on fee structures, which has been one of the most important nearer term overhangs.

The Digital Country Partnership memorandum with Ukraine’s government looks most relevant here, because it underlines Mastercard’s push to embed itself in national digital infrastructures. For investors, initiatives like this can reinforce the existing catalyst that value added services and digital products may deepen customer relationships, even as regulators and local payment schemes put pressure on traditional card economics.

Yet against this constructive backdrop, the growing threat from alternative payment rails in key emerging markets is something investors should be aware of because...

Read the full narrative on Mastercard (it's free!)

Mastercard's narrative projects $42.6 billion revenue and $19.9 billion earnings by 2028. This requires 12.1% yearly revenue growth and about a $6.3 billion earnings increase from $13.6 billion today.

Uncover how Mastercard's forecasts yield a $656.51 fair value, a 21% upside to its current price.

Exploring Other Perspectives

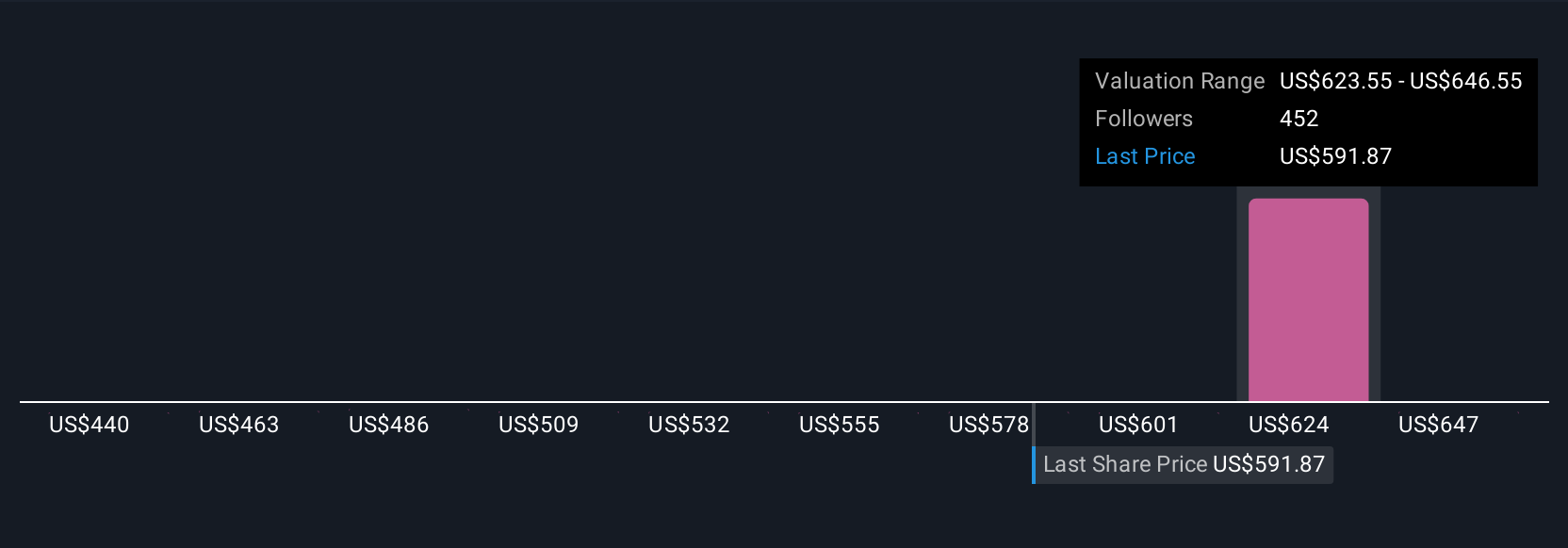

Sixteen Simply Wall St Community fair value estimates for Mastercard span roughly US$500.73 to US$656.51, showing how differently individual investors can view the same stock. You can weigh those views against the current catalyst that Mastercard’s improving antitrust outlook could reshape how its long term regulatory risk is factored into potential performance.

Explore 16 other fair value estimates on Mastercard - why the stock might be worth 8% less than the current price!

Build Your Own Mastercard Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mastercard research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mastercard research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mastercard's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal