Applied Materials (AMAT) Is Up 7.8% After Strong AI-Driven Quarter and Upbeat Guidance - What's Changed

- In recent days, Applied Materials reported strong quarterly results and upbeat guidance, supported by firm demand for AI-enabled advanced memory and logic chips and wafer fab equipment.

- This combination of solid operational execution and increasingly positive analyst views highlights how central AI-related chipmaking tools have become to the company’s story.

- We’ll now examine how growing confidence in AI-driven equipment demand might influence Applied Materials’ existing investment narrative and risk profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Applied Materials Investment Narrative Recap

To own Applied Materials today, you need to believe that AI-led demand for advanced memory, logic, and wafer fab equipment can outweigh cyclicality, export risks, and high customer concentration. The latest earnings beat and upbeat guidance reinforce AI tools as the core near term catalyst, while export license uncertainty and order swings in China remain largely unchanged as the key risk to watch, despite the recent share price strength.

The Q4 2025 results, with revenue of US$6,800 million and continued earnings outperformance versus consensus, are particularly relevant here because they underpin the market’s confidence in Applied’s AI-driven equipment positioning. At the same time, the stronger outlook and analyst upgrades come as the stock already trades at a premium to some community fair value estimates, which can sharpen the impact of any future slowdown or license setback on sentiment.

Yet investors should still be aware that if export license delays deepen or broaden, especially in China, then...

Read the full narrative on Applied Materials (it's free!)

Applied Materials' narrative projects $32.5 billion revenue and $9.2 billion earnings by 2028. This requires 4.3% yearly revenue growth and roughly a $2.4 billion earnings increase from $6.8 billion today.

Uncover how Applied Materials' forecasts yield a $241.69 fair value, a 10% downside to its current price.

Exploring Other Perspectives

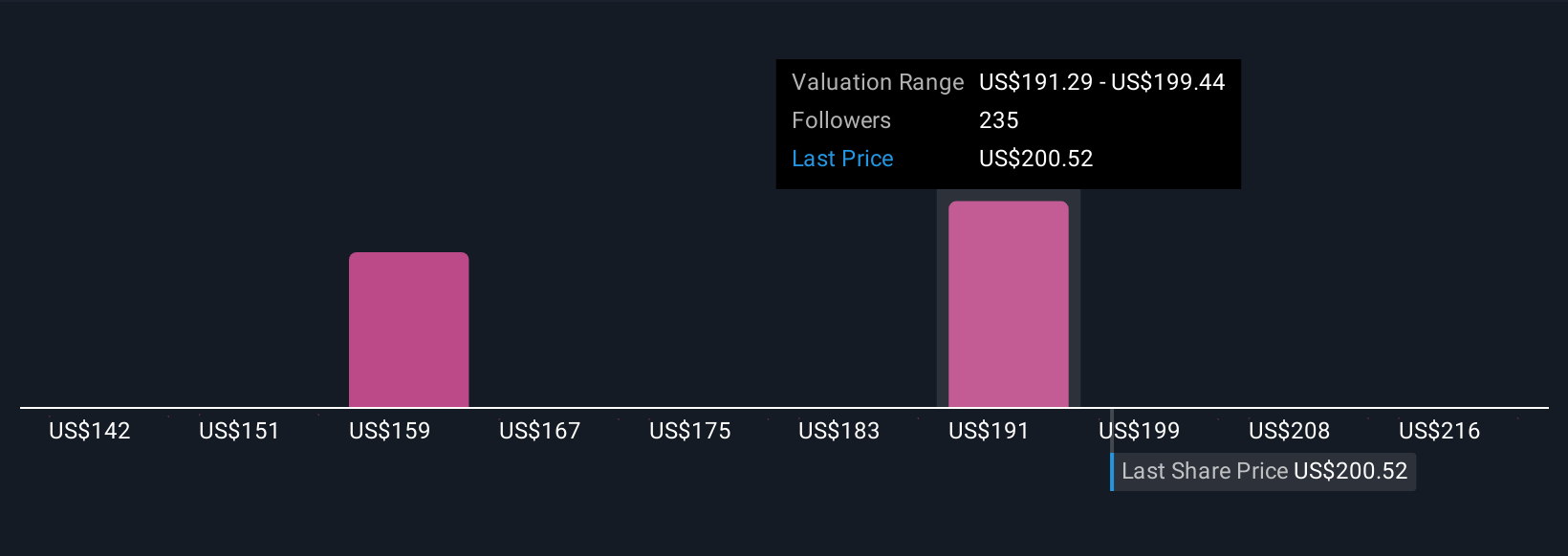

Nineteen members of the Simply Wall St Community value Applied Materials between US$146 and about US$247 per share, showing a wide spread of expectations. When you set those views against the strong AI related equipment momentum that underpins the recent earnings beat and guidance, it underlines why examining several different risk and return assumptions can be so important before investing.

Explore 19 other fair value estimates on Applied Materials - why the stock might be worth 46% less than the current price!

Build Your Own Applied Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Applied Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Materials' overall financial health at a glance.

No Opportunity In Applied Materials?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal