Does Pagaya’s US$1.26 Billion Shelf Plan Reframe Its Growth Versus Dilution Trade‑Off (PGY)?

- Pagaya Technologies has previously filed a shelf registration for up to US$1.26 billion in Class A ordinary shares, giving it flexibility to issue 53,055,988 new shares over time.

- This sizeable shelf registration highlights management’s emphasis on maintaining capital-raising optionality, which could influence future ownership dilution and funding plans.

- Now, we’ll examine how this sizeable shelf registration shapes Pagaya’s existing investment narrative around growth, funding flexibility, and potential dilution.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Pagaya Technologies Investment Narrative Recap

To own Pagaya today, you need to believe its AI underwriting and data network can keep attracting new bank and fintech partners while maintaining model performance and credit outcomes. The US$1.26 billion shelf registration expands Pagaya’s funding flexibility, but the potential dilution does not materially change the near term catalyst, which still sits with partner growth and ABS execution, nor the key risk of tighter regulatory and compliance scrutiny on AI driven lending.

The most relevant recent development alongside the shelf is Pagaya’s expanded US$132 million revolving credit facility, which has already bolstered liquidity and reduced funding costs ahead of any potential equity issuance. Together with ongoing ABS issuance under the PAID program, this provides a broader capital stack to support network volume growth, but also increases the importance of maintaining stable access to funding partners and credit markets as conditions evolve.

Yet while the capital story has improved, the increased flexibility to issue new shares adds another layer of dilution risk that investors should be aware of...

Read the full narrative on Pagaya Technologies (it's free!)

Pagaya Technologies' narrative projects $1.8 billion revenue and $311.7 million earnings by 2028. This requires 17.0% yearly revenue growth and about a $594 million earnings increase from -$282.4 million today.

Uncover how Pagaya Technologies' forecasts yield a $40.50 fair value, a 63% upside to its current price.

Exploring Other Perspectives

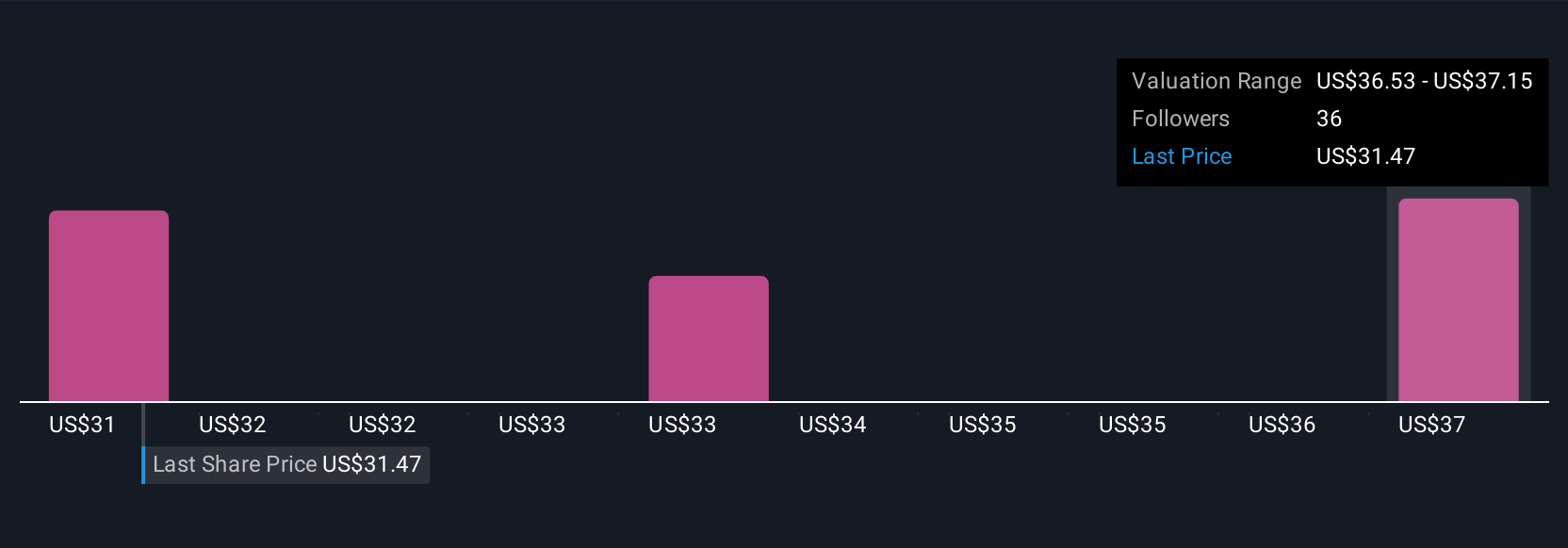

Seven fair value estimates from the Simply Wall St Community span roughly US$34 to US$323 per share, underlining how far apart individual views can be. Against that wide range, Pagaya’s enlarged shelf registration and potential dilution sit alongside funding access and regulatory scrutiny as key factors that could shape how the business actually performs over time, so it is worth exploring several of these viewpoints before deciding where you stand.

Explore 7 other fair value estimates on Pagaya Technologies - why the stock might be worth just $34.05!

Build Your Own Pagaya Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pagaya Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pagaya Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pagaya Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal