Why On Holding (ONON) Is Up 7.7% After Earnings Beat And Upgraded Analyst Estimates – And What's Next

- In recent weeks, On Holding reported quarterly results that topped revenue and earnings expectations, with sales climbing 35.1% year over year and earnings per share more than doubling compared with the same period last year.

- This strong fundamental performance has been followed by upward revisions to earnings estimates and a top-tier Zacks Rank rating, signaling a marked shift in analyst expectations around the company’s earnings power.

- We’ll now examine how this earnings beat and improving analyst sentiment may reshape On Holding’s investment narrative and risk‑reward profile.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

On Holding Investment Narrative Recap

To own On Holding, you need to believe the brand can keep converting strong consumer demand into profitable growth while justifying a premium valuation. The recent earnings beat and upward estimate revisions support that view in the near term, but they do not eliminate key risks around heavy investment needs and sensitivity to macro and currency swings.

The company’s raised 2025 sales guidance, now calling for at least 34% constant currency growth, is particularly relevant here. It reinforces the current growth catalyst of expanding direct to consumer and international sales, while also underlining how much execution and continued demand are baked into expectations.

Yet, beneath the strong momentum, one risk investors should be aware of is how reliant On has become on premium pricing and rapid expansion...

Read the full narrative on On Holding (it's free!)

On Holding's narrative projects CHF5.0 billion revenue and CHF561.2 million earnings by 2028. This requires 22.9% yearly revenue growth and an earnings increase of about CHF425 million from CHF135.9 million today.

Uncover how On Holding's forecasts yield a $61.40 fair value, a 32% upside to its current price.

Exploring Other Perspectives

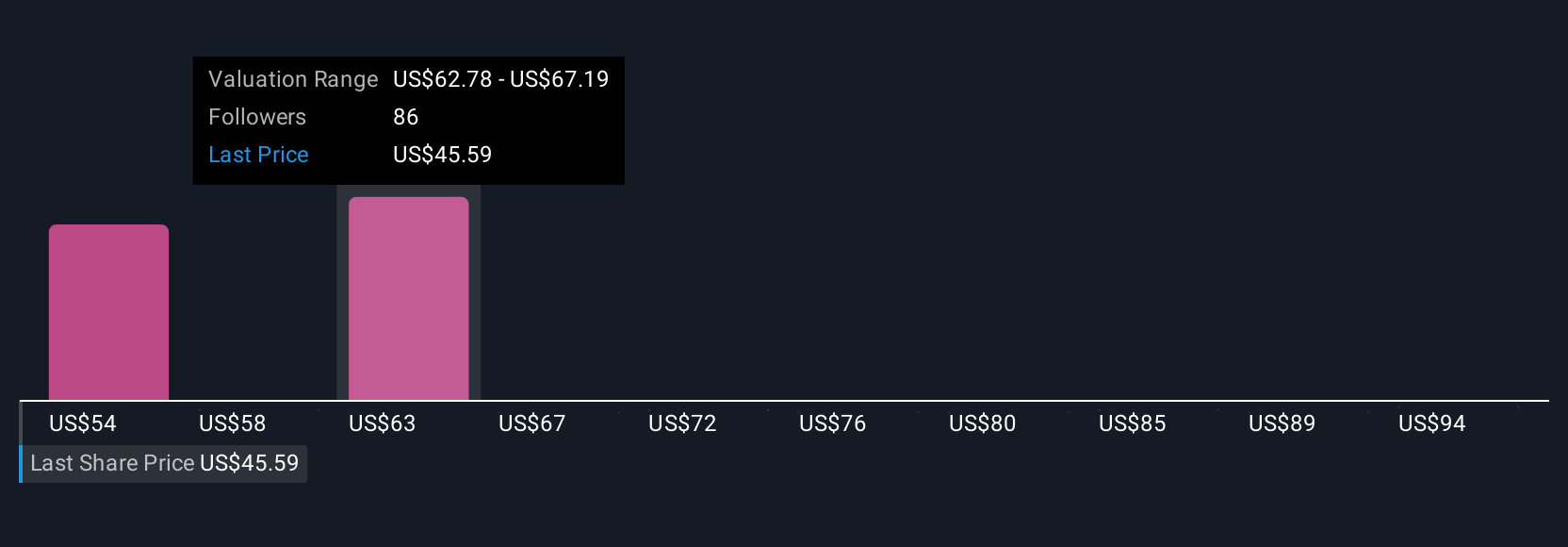

Sixteen members of the Simply Wall St Community value On Holding between US$52.65 and US$91.11, reflecting a wide spread in expectations. As you weigh these views, consider how much of the recent earnings surprise and raised sales guidance may already be reflected in such optimistic growth assumptions.

Explore 16 other fair value estimates on On Holding - why the stock might be worth as much as 96% more than the current price!

Build Your Own On Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your On Holding research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free On Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate On Holding's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal