Can Veritone (VERI) Turn Real-World Sensor Data Into a Durable, Monetizable Digital Asset Strategy?

- On 4 December 2025, Veritone and Armada announced a partnership to deliver a fully integrated edge-to-enterprise data fabric that ingests, analyzes, and monetizes high-volume audio, video, drone, and sensor streams in real time for public agencies and commercial content owners.

- A distinctive element of this deal is its focus on turning real-world media and sensor feeds into AI-ready digital tokens, reinforcing Veritone’s push to treat data as a renewable, monetizable asset class.

- We’ll now examine how this edge-to-enterprise data fabric partnership and data-token focus may reshape Veritone’s broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Veritone Investment Narrative Recap

To own Veritone, you need to believe that aiWARE and Veritone Data Refinery can become core infrastructure for turning messy media and sensor streams into sellable data products, fast enough to outrun persistent losses and dilution risk. The Armada partnership looks additive to that thesis by extending Veritone’s reach to the edge, but it does not immediately change the most important near term catalyst, which is converting the existing VDR pipeline into recurring, higher margin revenue.

The most directly connected recent announcement is Veritone’s October update that its VDR pipeline with hyperscalers had reached about US$40 million in qualified opportunities, roughly doubling since August 2025. The Armada deal plugs into this same theme by broadening the supply of “AI ready” audio, video and sensor data that could ultimately feed those refinery and licensing relationships, making actual execution on these contracts even more central to the story.

Yet against this promise, investors should also keep in mind the ongoing net losses and recent shareholder dilution...

Read the full narrative on Veritone (it's free!)

Veritone's narrative projects $158.0 million revenue and $20.7 million earnings by 2028.

Uncover how Veritone's forecasts yield a $11.20 fair value, a 104% upside to its current price.

Exploring Other Perspectives

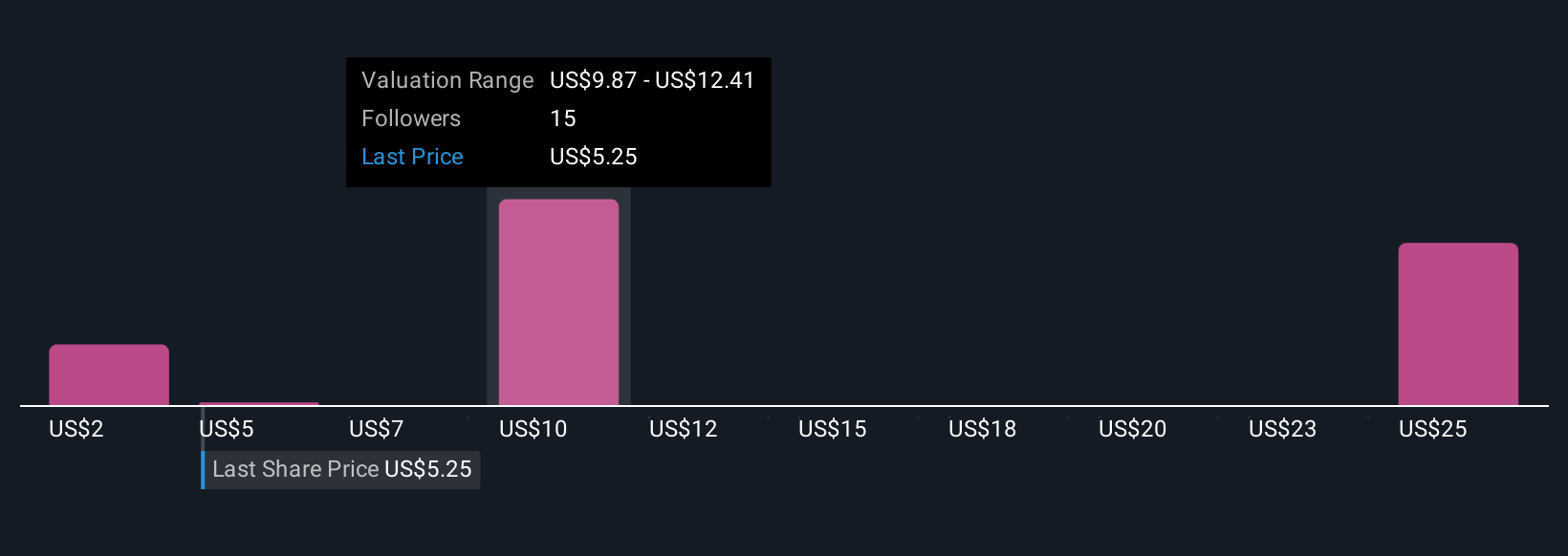

Eight fair value estimates from the Simply Wall St Community span roughly US$2 to US$26 per share, so opinion is clearly split. When you set that against Veritone’s heavy ongoing losses and reliance on fresh capital, it becomes even more important to compare several viewpoints before deciding how this fits in your portfolio.

Explore 8 other fair value estimates on Veritone - why the stock might be worth less than half the current price!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Veritone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veritone's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal