Beam Therapeutics (BEAM): Valuation Check After Analyst Upgrades on Sickle Cell and Manufacturing Progress

Beam Therapeutics (BEAM) jumped after analysts upgraded their outlook, pointing to progress in its sickle cell disease program and smoother manufacturing, a combination that has quickly boosted market confidence in the gene editing specialist.

See our latest analysis for Beam Therapeutics.

The upbeat call from analysts lands on top of already strong momentum, with an 8.12% 1 day share price return feeding into a 38.46% 90 day share price return, even as the 3 year total shareholder return remains deeply negative. This shows sentiment has only recently started to turn.

If this kind of rebound has your attention, it might be worth scanning other innovative drug developers through healthcare stocks to spot more potential turnaround stories in the sector.

But with shares still trading at a steep discount to analyst targets despite a sharp recent rally, are investors looking at an early stage recovery story with room to run, or has the market already priced in Beam’s next chapter of growth?

Most Popular Narrative Narrative: 69.6% Undervalued

With Beam Therapeutics last closing at $28.91 versus a narrative fair value of $95, the gap implies investors may still be heavily discounting its long term potential.

The investment thesis in Beam Therapeutics is a long-term, high-conviction bet on a fundamental technological shift in genetic medicine. While first-generation gene editors like CRISPR-Cas9 function as "molecular scissors," they are an inherently disruptive tool. By creating double-strand DNA breaks, they introduce significant risks, including unpredictable insertions, deletions, and large genomic rearrangements. Beam represents "Gene Editing 2.0." Its base editing platform is a "molecular pencil," a precision instrument that chemically rewrites a single "letter" of the genetic code without cutting the DNA backbone. This approach offers a potentially superior safety and precision profile, designed to mitigate the core risks that plague its predecessors.

According to davidlsander, this story hinges on bold revenue trajectories, fat margins, and a premium future multiple that assume Beam’s platform truly changes genetic medicine economics.

Result: Fair Value of $95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup could unravel if clinical data disappoints or regulators push back on Beam’s accelerated approval ambitions.

Find out about the key risks to this Beam Therapeutics narrative.

Another Lens on Valuation

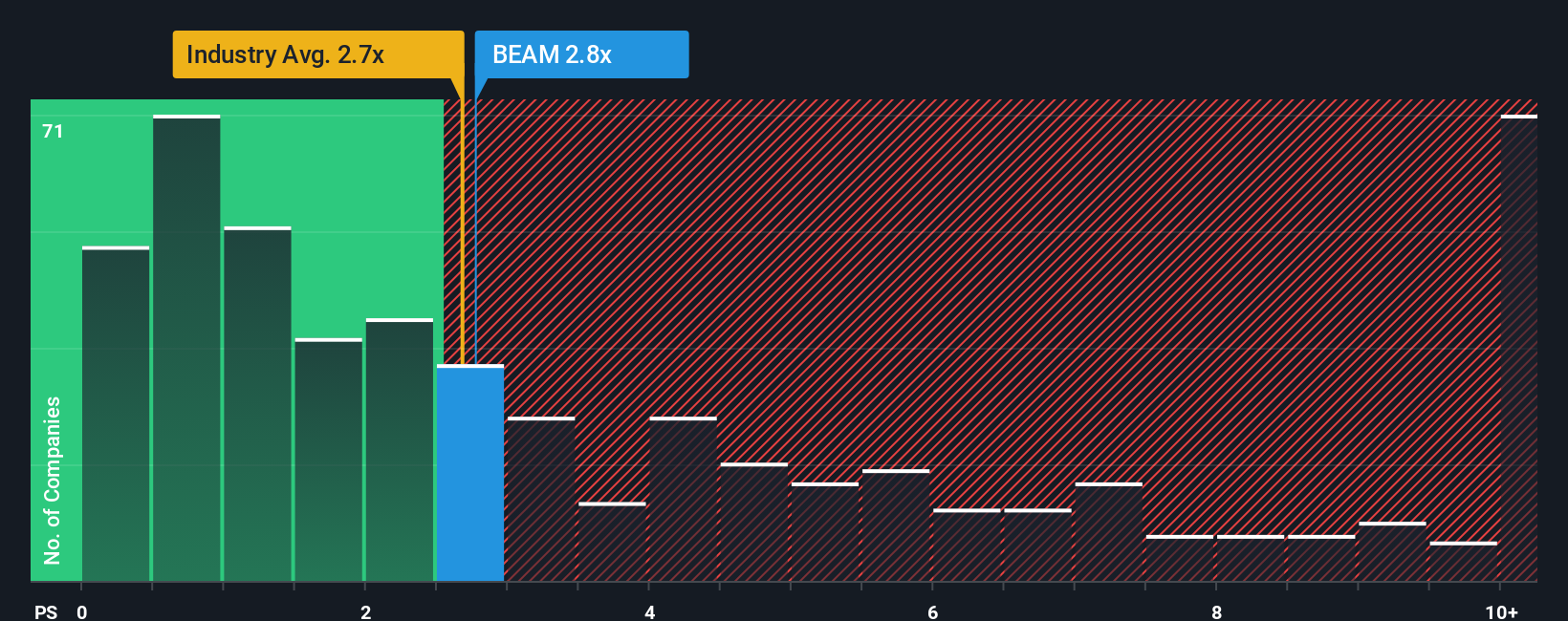

Step away from narrative models and Beam starts to look less like a bargain. Its price to book ratio sits around 3 times, slightly above the US biotech average of 2.7 times but well below peer levels near 5.9 times. This leaves investors debating whether they are paying up for quality or discounting lingering risks too heavily.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you see the numbers differently, or simply want to dive into the data yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Beam might be just the beginning. Before the next big move passes you by, put Simply Wall Street’s powerful screener to work and upgrade your watchlist.

- Capture early-stage potential by tracking these 3574 penny stocks with strong financials that already show financial strength instead of pure speculation.

- Position yourself for structural growth by focusing on these 26 AI penny stocks pushing real world AI adoption, not just hype.

- Lock in reliable income streams by targeting these 15 dividend stocks with yields > 3% that can help anchor your portfolio through volatile markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal