Is Sana Biotechnology's (SANA) SC451 Pivot Quietly Redefining Its Long-Term Platform Strategy?

- Sana Biotechnology, Inc. recently reported a quarterly loss that was narrower than expected and outlined a renewed focus on SC451 therapies and its in vivo CAR T platform, supported by tighter operational cost controls.

- Alongside these updates, the company’s participation in high-profile healthcare conferences hosted by Citi and Evercore signals an effort to highlight its refined pipeline priorities to the broader investment community.

- With these shifts in focus and communication, we’ll now examine how the renewed emphasis on SC451 and in vivo CAR T shapes Sana’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Sana Biotechnology's Investment Narrative?

To own Sana today, you have to believe that its SC451 programs and in vivo CAR T platform can eventually justify a business that currently has US$0 revenue, ongoing losses and less than a year of cash runway. The latest quarter’s narrower loss and tighter cost controls help at the margin, but the key near term catalysts remain clinical progress and any visibility on partnering or fresh funding. The recent stock surge and upcoming Citi and Evercore conference appearances mainly sharpen the story rather than change it, giving management a chance to explain why a high price to book multiple and continued dilution risk are acceptable trade offs. If anything, the renewed focus concentrates execution risk in a smaller set of high impact assets.

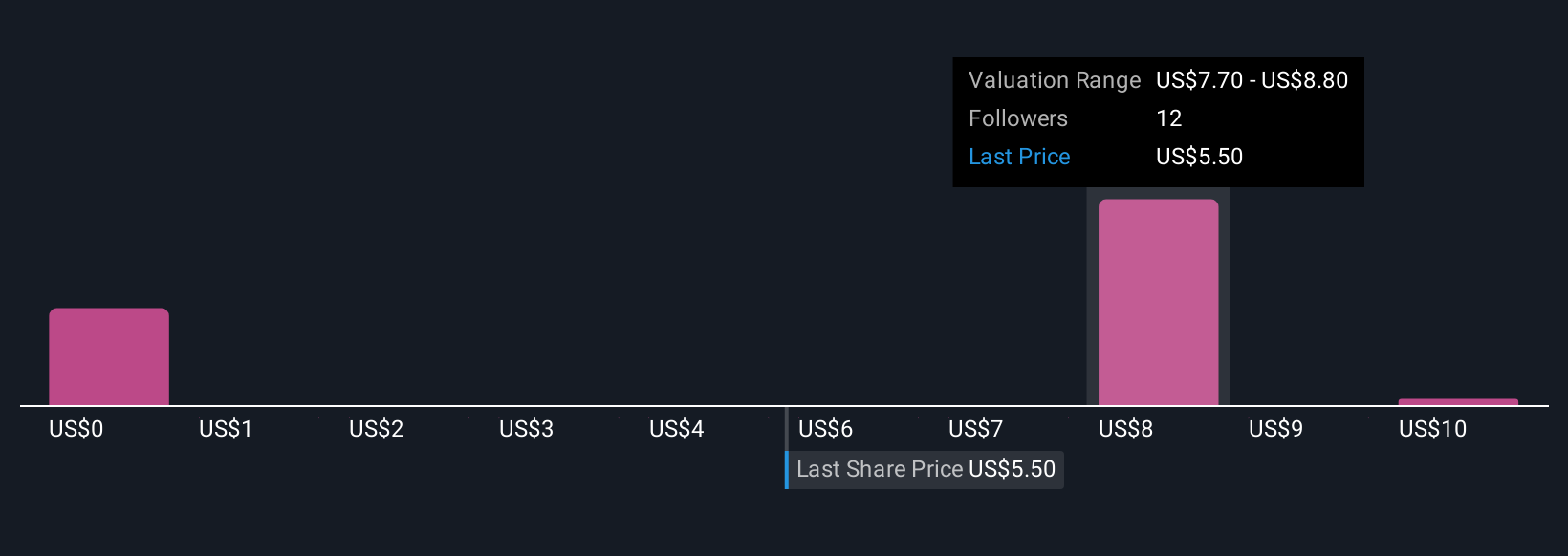

However, that sharper focus also raises the stakes if funding or trial timelines slip, which investors should understand. The analysis detailed in our Sana Biotechnology valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 8 other fair value estimates on Sana Biotechnology - why the stock might be worth less than half the current price!

Build Your Own Sana Biotechnology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sana Biotechnology research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

- Our free Sana Biotechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sana Biotechnology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal