Does Allied Gold (TSX:AAUC) Kurmuk Upgrade Sharpen Its Long-Term Underground Mining Strategy?

- In late November 2025, Allied Gold Corporation reported an exploration and development update for its Kurmuk mine in western Ethiopia, with first-pass drilling at the Urchin Prospect and multiple nearby targets returning higher-than-reserve gold grades and confirming mineralization continuity across a 1,600 m by 500 m multi-lens deposit that remains open at depth and laterally.

- The company also identified modelled hydrothermal breccias with higher-than-average grades and outlined potential for underground resources and deeper pit extensions, supported by ongoing drilling into 2026 and planned deep-penetrating IP surveys to better define the system and prioritize targets along an approximately 8 km gold-in-soil trend.

- We’ll now look at how these higher-grade Kurmuk drill results and underground potential may influence Allied Gold’s existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Allied Gold Investment Narrative Recap

To own Allied Gold, you need to believe it can turn a concentrated, high cost portfolio into a more efficient, longer life producer, with Kurmuk as a key leg of that story. The latest higher grade Kurmuk results modestly support the short term catalyst of improving grades and future production, but they do not remove the key risk around elevated all in sustaining costs and the need for those costs to fall meaningfully.

The Kurmuk update sits alongside a busy 2025 funding year, including the October follow on equity offering that raised roughly C$175.0 million. For investors, that capital raise underpins Allied Gold’s ability to keep drilling Kurmuk and advancing development, which in turn ties directly into the catalyst of lifting group production and lowering unit costs over the next phase of the mine plan.

Yet against these encouraging drill results, investors still need to keep an eye on the company’s high cost base and what happens if...

Read the full narrative on Allied Gold (it's free!)

Allied Gold's narrative projects $2.1 billion revenue and $838.9 million earnings by 2028. This requires 30.2% yearly revenue growth and a $967.4 million earnings increase from -$128.5 million today.

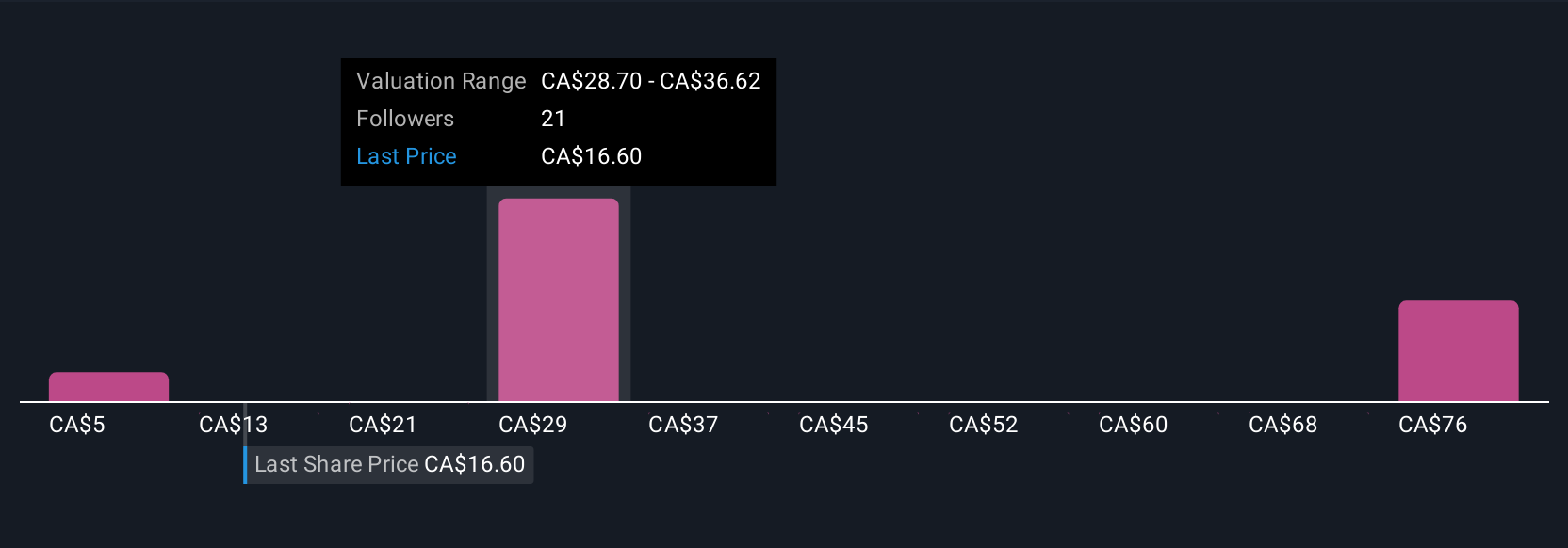

Uncover how Allied Gold's forecasts yield a CA$38.84 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly C$6.93 to C$224.03, underscoring how differently individual investors view Allied Gold’s prospects. When you set that against the central catalyst of Kurmuk potentially boosting grades and reducing group costs, it becomes clear why opinions diverge so widely and why it can be useful to compare several viewpoints before deciding how this story might affect long term performance.

Explore 9 other fair value estimates on Allied Gold - why the stock might be worth over 7x more than the current price!

Build Your Own Allied Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allied Gold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Allied Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allied Gold's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal