Sally Beauty (SBH) Beats Earnings as Insider Sells Shares Is Management Signaling Confidence or Caution?

- Sally Beauty Holdings recently reported past fourth-quarter 2025 results that exceeded forecasts for both adjusted diluted earnings per share and revenue, while Senior Vice President Scott C. Sherman sold 15,000 shares of common stock worth about US$244,000 on 1 December 2025.

- The combination of an earnings beat and insider selling has drawn attention to how investors are weighing operational progress against leadership share disposals and mixed institutional positioning.

- We’ll now examine how Sally Beauty’s stronger-than-expected quarterly earnings could influence its existing investment narrative and forward-looking assumptions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sally Beauty Holdings Investment Narrative Recap

To own Sally Beauty, you generally need to believe it can translate its value-focused, professional assortment and ongoing cost savings into steady earnings despite slow top-line growth and intense competition. The latest fourth-quarter earnings beat supports that case in the near term, while the most immediate risk still looks tied to price-sensitive customers trading down in care and ancillary categories rather than to this single instance of insider selling, which does not materially alter the core thesis.

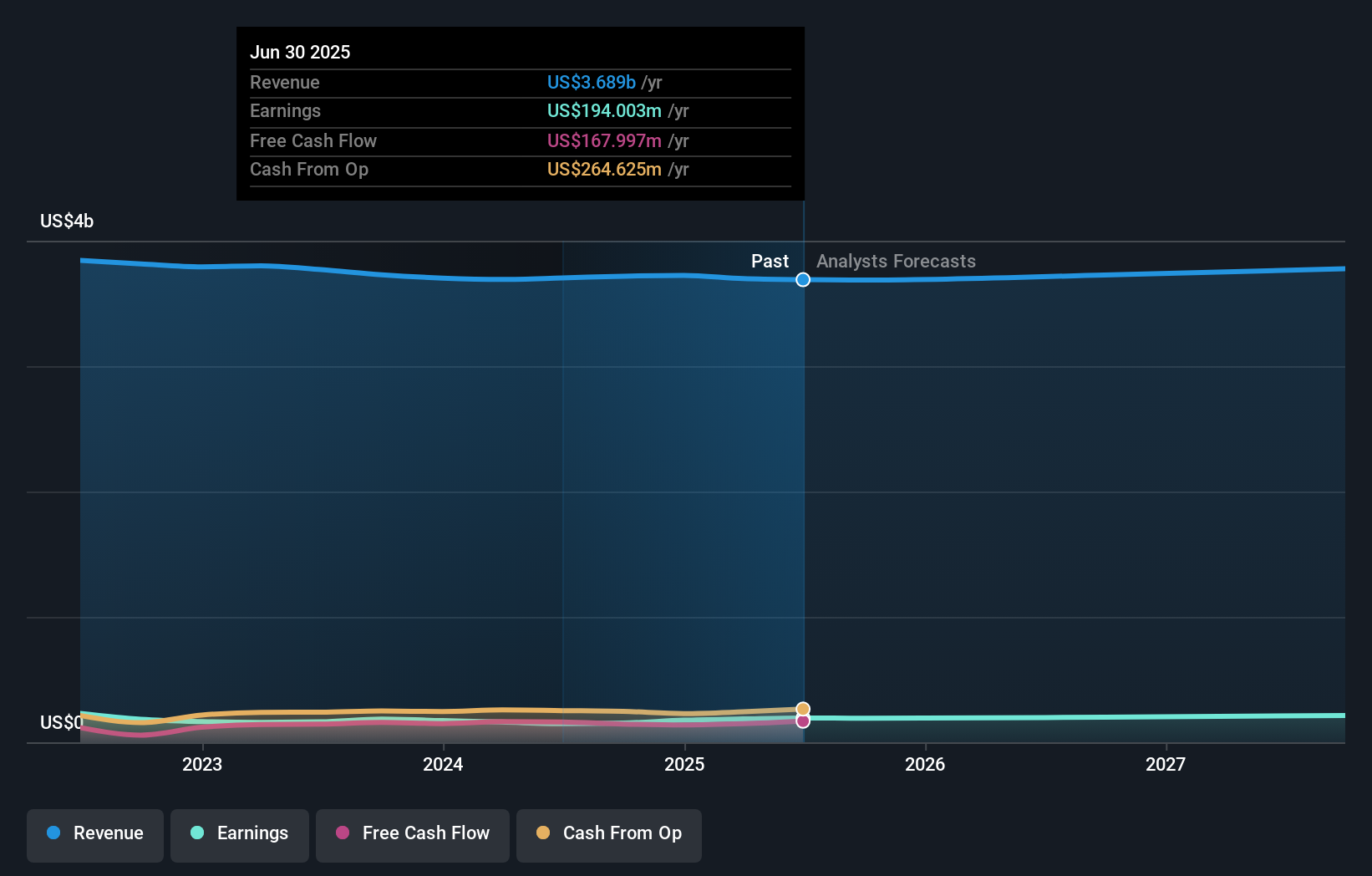

The company’s recent full year 2025 results, with net income rising to US$195.9 million and diluted EPS at US$1.89 on US$3.7 billion in sales, are especially relevant alongside the quarterly beat, as they frame how much operating progress is already embedded in expectations. Together with guidance for flat to slightly positive sales in 2026, these results interact directly with key catalysts such as expanding higher margin proprietary brands and digital initiatives to support modest earnings growth.

Yet, against this progress, the pressure from consumers trading down in key categories remains an issue investors should be aware of as...

Read the full narrative on Sally Beauty Holdings (it's free!)

Sally Beauty Holdings' narrative projects $3.8 billion revenue and $211.5 million earnings by 2028. This requires 1.3% yearly revenue growth and about a $17.5 million earnings increase from $194.0 million today.

Uncover how Sally Beauty Holdings' forecasts yield a $16.25 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$16 to US$26.19, showing how differently individual investors view Sally Beauty’s potential. Against that spread, the recent earnings beat sits alongside persistent risks from value-focused trade down behavior, which could influence how each of those views plays out over time.

Explore 3 other fair value estimates on Sally Beauty Holdings - why the stock might be worth just $16.00!

Build Your Own Sally Beauty Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sally Beauty Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sally Beauty Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sally Beauty Holdings' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal