Descartes Systems (TSX:DSG) Mid‑Teens EPS Growth Supports Premium Valuation Narrative

Descartes Systems Group (TSX:DSG) has just posted another steady quarter, with Q2 2026 revenue coming in at about $179.8 million and basic EPS of $0.44, underscoring consistent profitability heading into the second half of fiscal 2026. The company has seen revenue move from roughly $163.4 million in Q2 2025 to $179.8 million in Q2 2026, while basic EPS edged from $0.41 to $0.44 over the same period. This sets the stage for investors to focus on how its solid margins underpin the latest results.

See our full analysis for Descartes Systems Group.With the headline numbers on the table, the next step is to see how this blend of revenue growth, steady EPS gains, and firm margins compares with the prevailing narratives investors follow around Descartes Systems Group.

See what the community is saying about Descartes Systems Group

Mid teens earnings growth backing logistics demand story

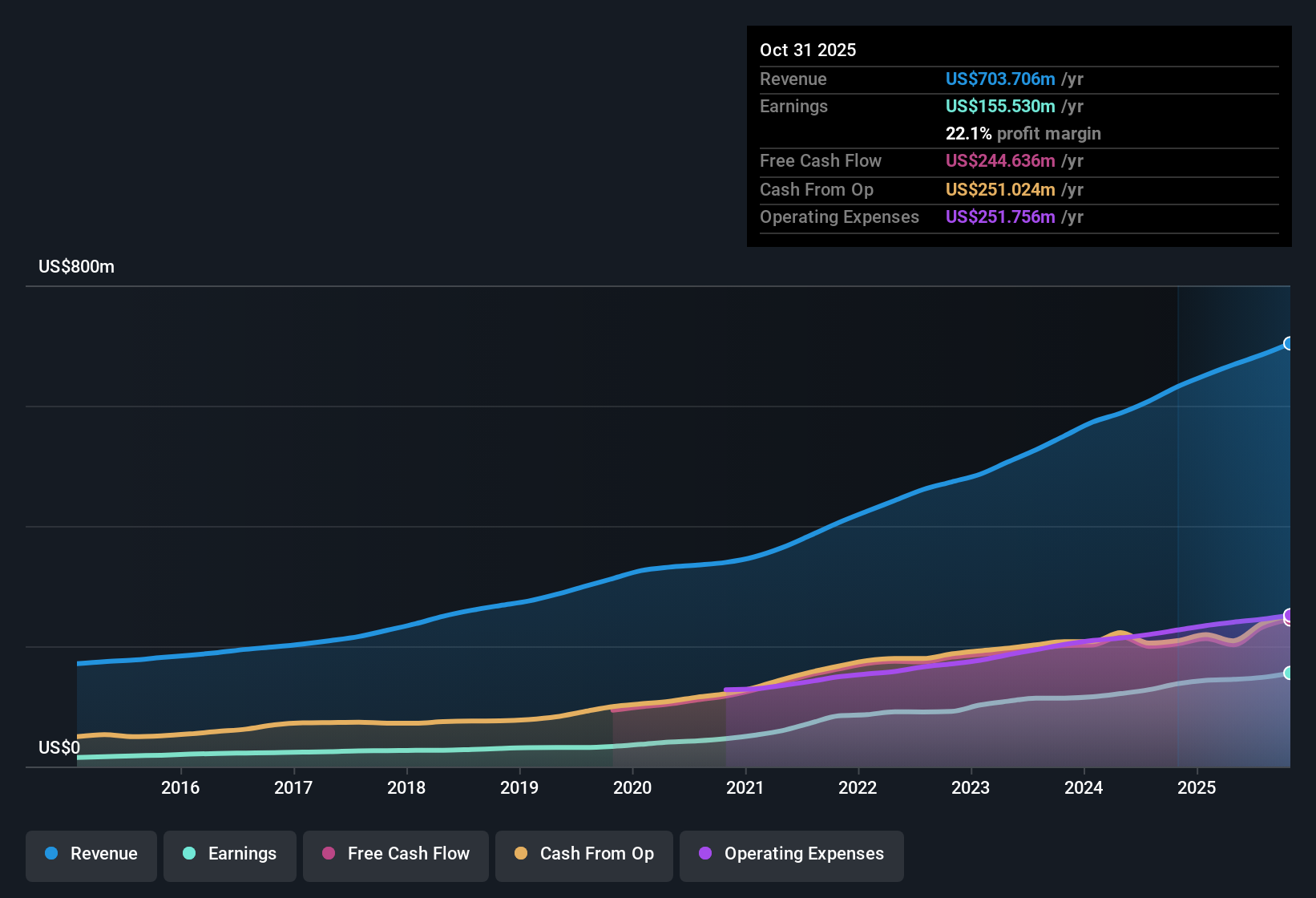

- Over the last 12 months, net income excluding extra items reached about $148.2 million on $684.8 million of revenue, equating to a 21.6% net margin that is slightly above the prior year’s 21%.

- Consensus narrative points to e commerce and global trade complexity as key growth drivers, and the 16% earnings growth over the past year alongside revenue growth forecast at about 9.5% per year supports that bullish view, even though earnings growth is now expected to run at roughly 15.85% per year, below the 19.9% five year average.

- The shift from roughly 19.9% five year average earnings growth to 16% most recent growth shows a still healthy but moderating pace, which fits a story of a more mature yet resilient platform rather than a hyper growth phase.

- Forecast revenue growth of around 9.5% per year, above the Canadian market’s 4.6%, lines up with the idea that demand for Descartes compliance and logistics tools is broad based rather than tied to a single one off catalyst.

Premium P/E with small DCF upside

- At a share price of CA$132.45, Descartes trades on a trailing P/E of 55.1 times, above the Canadian software industry average of 49.1 times, while sitting about 1.1% below a DCF fair value of roughly CA$133.92.

- Skeptics focus on the elevated multiple relative to the broader industry, and the fact that one year earnings growth of 16% is below the 19.9% five year average gives some backing to that bearish angle, even though the shares are only marginally below the stated DCF fair value and analysts still expect mid teens earnings growth ahead.

- The gap between the 55.1 times P/E and the 49.1 times industry average shows investors are paying a visible premium, which bears argue leaves less room for disappointment if growth slows further from the historic 19.9% pace.

- At the same time, trading only about 1.1% below a DCF fair value of CA$133.92 suggests the downside case relies more on valuation stretching further than on today’s numbers signalling a major breakdown.

Recurring strength visible in trailing figures

- On a trailing basis, revenue moved from about $607.7 million to $684.8 million while net income excluding extra items rose from roughly $127.8 million to $148.2 million, keeping earnings quality described as high.

- Analysts consensus view highlights high recurring revenue and cross selling potential as key supports, and the steady lift in trailing 12 month revenue and net income reinforces that stable foundation even as some of the growth depends on acquisitions rather than purely organic expansion.

- The increase of roughly $77 million in trailing 12 month revenue, alongside a near $20 million rise in net income, indicates that recent deals plus organic drivers are showing up consistently in the income statement.

- With net margins holding around 21.6%, the numbers so far align with the idea that Descartes can absorb new acquisitions without sacrificing profitability, which is central to the consensus long term growth argument.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Descartes Systems Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes you can test your own view and turn it into a shareable story: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Descartes Systems Group.

See What Else Is Out There

Descartes Systems Group’s rich valuation, moderating earnings growth, and only slight DCF upside leave little margin for error if its performance softens further.

If paying a premium for slowing momentum makes you uneasy, shift your focus to these 912 undervalued stocks based on cash flows today to hunt for stronger value and better downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal