Will Clarivate’s New AI Regulatory Assistant Shift the Core Narrative for CLVT Investors?

- Clarivate recently launched the Cortellis Regulatory Intelligence AI Assistant for all Cortellis Regulatory Intelligence customers, offering instant cited answers, multilingual support, rapid document summarization, and draft-versus-final guidance comparison to help life sciences regulatory teams speed reviews and decisions.

- By embedding an agentic AI layer directly into its regulatory workflow platform, built with customer feedback, Clarivate is aiming to deepen platform stickiness and differentiate its life sciences offering across the product lifecycle.

- We’ll now explore how broad access to this AI assistant, aimed at boosting workflow efficiency, may influence Clarivate’s overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Clarivate Investment Narrative Recap

To own Clarivate, you generally need to believe its data and analytics platforms can convert high customer retention into improving profitability and cash flow, despite recent revenue declines and ongoing losses. The new Cortellis Regulatory Intelligence AI Assistant strengthens the AI-driven workflow story but does not materially change the near term catalyst around broader AI adoption or the key risks from competition, execution on portfolio reshaping, and a still-leveraged balance sheet.

Among recent developments, Clarivate’s decision to launch a new US$500,000,000 share repurchase program in December 2024 stands out alongside this AI rollout. For some investors, that mix of returning capital while investing in AI-enabled products is part of the appeal, but it also heightens focus on whether Clarivate can improve earnings enough to comfortably support buybacks, service its debt load, and maintain investment in innovation.

However, investors should be aware that rising AI competition could still compress pricing and margins over time if Clarivate’s products fail to...

Read the full narrative on Clarivate (it's free!)

Clarivate's narrative projects $2.5 billion revenue and $3.4 million earnings by 2028. This assumes a 0.1% yearly revenue decline and an earnings increase of about $436.7 million from -$433.3 million today.

Uncover how Clarivate's forecasts yield a $4.93 fair value, a 31% upside to its current price.

Exploring Other Perspectives

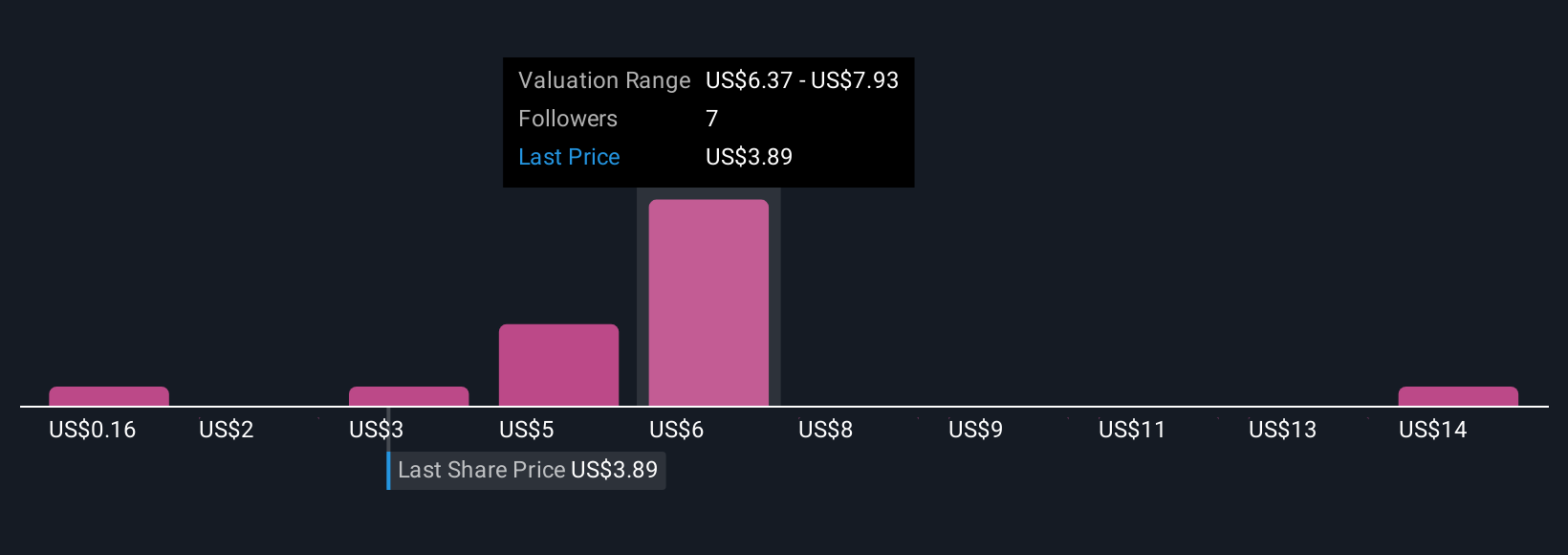

The Simply Wall St Community’s five fair value estimates for Clarivate range widely, from US$0.16 to US$15.69 per share, underscoring how far apart views can be. You can weigh those against the thesis that Clarivate’s AI driven product expansion may help differentiate its research and analytics platforms in a market where free and low cost data alternatives are putting pressure on traditional subscription models.

Explore 5 other fair value estimates on Clarivate - why the stock might be worth over 4x more than the current price!

Build Your Own Clarivate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clarivate research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Clarivate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clarivate's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal