Northern Star Resources (ASX:NST): Reassessing Valuation After 25-Year Renewable Power Deal With Zenith Energy

Northern Star Resources (ASX:NST) is back in focus after locking in a 25 year renewable power purchase agreement with Zenith Energy for its Kalgoorlie Consolidated Gold Mines, reshaping its long term energy and cost profile.

See our latest analysis for Northern Star Resources.

The new renewable power deal rounds out a big year for Northern Star Resources, with the share price at A$26.33 and a 32.05% 3 month share price return reflecting building momentum on top of robust 1 year and multi year total shareholder returns.

If you are reassessing your exposure to gold and growth stories, this could also be a good moment to explore fast growing stocks with high insider ownership for other fast moving ideas.

With the share price near record highs, analysts only seeing modest upside, and a transformational growth pipeline ahead, investors now face a key question: Is Northern Star still undervalued, or is the market already pricing in its future expansion?

Most Popular Narrative: 19.7% Overvalued

According to Robbo's narrative, Northern Star's fair value of A$22 sits below the last close at A$26.33, setting up a tension between momentum and valuation.

At a current share price of just over $25, Northern Star is not cheap by historical standards. The stock trades on a price-to-earnings ratio of around 21.6 times, suggesting that much of the expected growth may already be priced in.

Curious why a high growth outlook still leads to a valuation below today’s price? The narrative leans on robust reserves, rising margins and ambitious earnings projections. If you want to see which assumptions push the model to that fair value line, and how future profit multiples fit in, the full story reveals the numbers behind the call.

Result: Fair Value of $22.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including gold price volatility and potential project delays or cost overruns that could quickly compress margins and challenge today’s valuation.

Find out about the key risks to this Northern Star Resources narrative.

Another Angle on Value

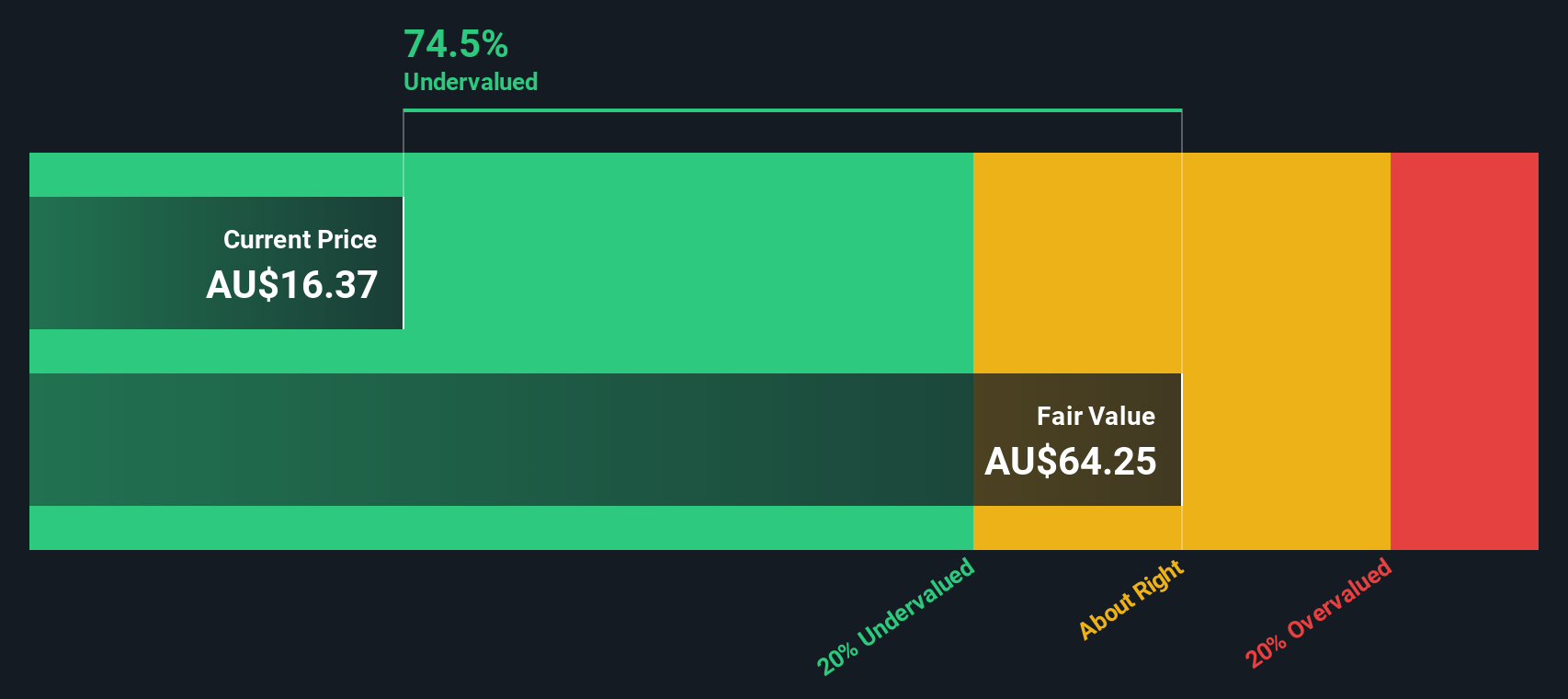

Our SWS DCF model tells a very different story, pointing to a fair value of about A$57.58 versus today’s A$26.33. This implies Northern Star could be deeply undervalued. If the cash flows play out, is the market underestimating the growth runway, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Northern Star Resources Narrative

If you see the numbers differently or want to test your own assumptions against the data, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Northern Star Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Northern Star, you could miss other powerful setups. Put Simply Wall St’s screener to work and line up your next opportunity today.

- Capitalize on mispriced potential by targeting these 912 undervalued stocks based on cash flows that strong cash flow forecasts suggest the market has not fully recognized yet.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks positioned at the heart of transformative, real world AI adoption.

- Explore reliable cash flow candidates through these 15 dividend stocks with yields > 3% that can help boost your portfolio’s income while rates and markets shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal