nVent Electric (NVT) Valuation After Raised 2025 Guidance and Growing AI Infrastructure Exposure

nVent Electric (NYSE:NVT) heads into its Goldman Sachs Industrials and Materials Conference appearance with momentum, after lifting 2025 guidance on stronger data center and utility demand and a rising role in AI infrastructure hardware.

See our latest analysis for nVent Electric.

The guidance hike comes after a powerful run, with a roughly 58% year to date share price return and a 3 year total shareholder return near 186%. This suggests momentum is still building as investors lean into the AI infrastructure story.

If nVent’s move has you rethinking where growth could come from next, this is a good moment to explore high growth tech and AI stocks and see which other names are quietly lining up behind the data center and AI buildout.

With shares already up sharply and trading only modestly below analyst targets, is nVent still flying under the radar on its AI and grid exposure, or are investors now fully pricing in the next leg of growth?

Most Popular Narrative: 10.9% Undervalued

With nVent Electric last closing at $108.27, the most widely followed narrative sees room for upside, anchored in aggressive data center and electrification growth assumptions.

The rapid acceleration in global electrification, digitalization, and the surge in AI-driven data center and power utility infrastructure is leading to record new orders and a backlog more than four times higher than a year ago, with visibility into 2026 and beyond. This sets the stage for sustained revenue growth and increases the likelihood of multi-year topline outperformance.

Curious how stronger margins, faster growth, and a rich future earnings multiple can still point to upside from here? The full narrative reveals the exact growth runway, profitability shift, and valuation reset that underpin this fair value call.

Result: Fair Value of $121.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained upside still hinges on AI data center capex staying elevated and recent acquisitions integrating smoothly without eroding margins or free cash flow.

Find out about the key risks to this nVent Electric narrative.

Another Angle on Valuation

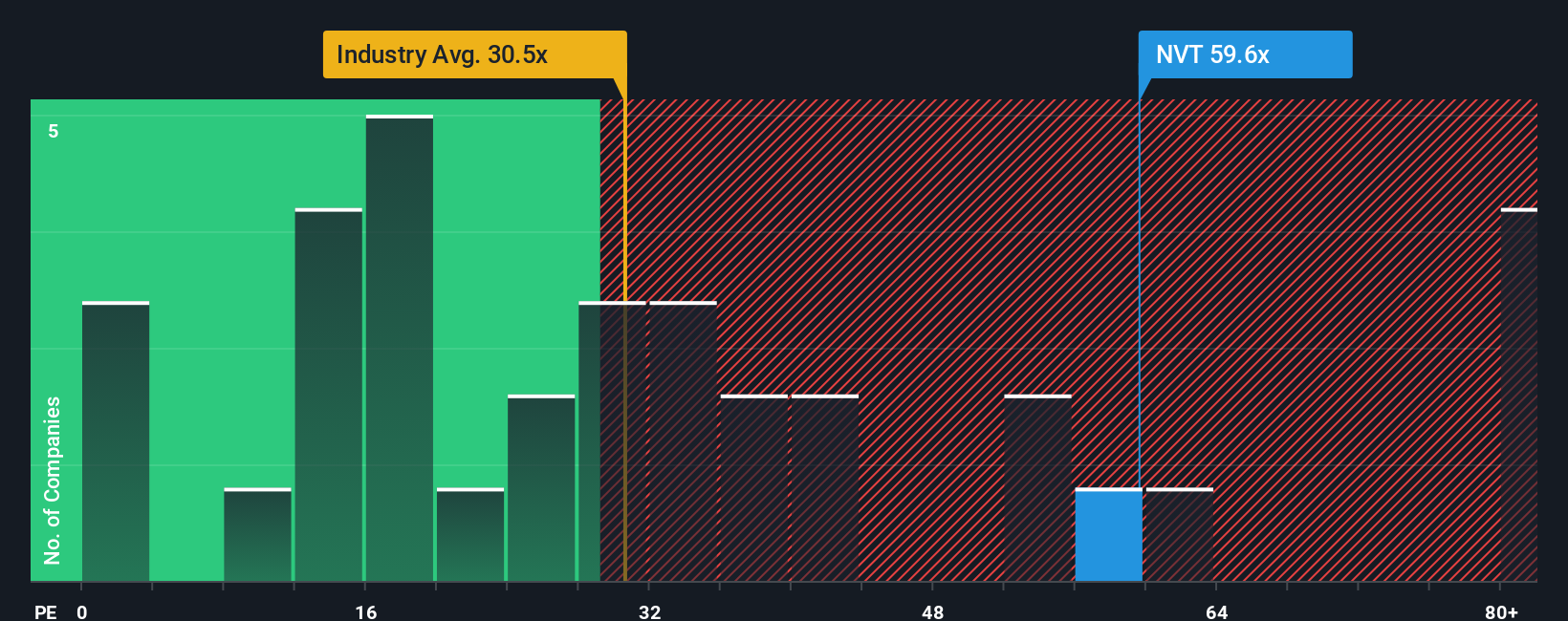

While the narrative pegs fair value around $121.54, a simple earnings lens tells a tougher story. At roughly 59 times earnings, nVent trades far above US Electrical peers at 31.2 times and a fair ratio of 33.8 times. This implies the stock could be priced for perfection rather than mispriced opportunity.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nVent Electric Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes with Do it your way.

A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to quickly uncover fresh ideas and stay ahead of investors waiting on yesterday’s stories.

- Capitalize on beaten down names with cash flow potential by scanning these 912 undervalued stocks based on cash flows that the market may be overlooking right now.

- Ride powerful secular trends in automation and machine learning by targeting these 26 AI penny stocks positioned to benefit from accelerating digital transformation.

- Lock in potential income streams by zeroing in on these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal