Aeva Technologies (AEVA) Is Up 50.8% After Winning Exclusive Level 3 LiDAR Platform Deal

- Earlier this week, Aeva Technologies announced it has been selected as the exclusive LiDAR supplier for a top European passenger automaker’s global vehicle platform outside China, supporting Level 3 automated driving across internal combustion, hybrid, and electric models in a multi-year program extending into the mid-2030s.

- This move positions Aeva’s Atlas 4D LiDAR as a core sensing and perception layer for a major mainstream platform, underscoring the shift by large automakers away from conventional 3D LiDAR toward more advanced 4D solutions.

- Next, we’ll examine how securing this exclusive Level 3 LiDAR platform win reshapes Aeva’s investment narrative and long-term commercialization profile.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Aeva Technologies' Investment Narrative?

To own Aeva, you have to believe its 4D LiDAR can become a standard layer of automated driving and smart sensing across both autos and infrastructure, despite years of expected losses. The new exclusive Level 3 passenger-car platform win materially shifts that equation: it adds long-term visibility to potential automotive program revenue and reinforces Aeva’s positioning alongside Daimler Truck, but it does little for near-term numbers, with production not targeted until 2028. In the short term, the key catalysts remain progress on OEM milestones, commercialization of Atlas and Eve 1V, and how the company deploys its new US$100.0M in convertible funding. At the same time, the recent share price spike, high price to book and ongoing cash burn keep valuation and dilution risk very much in focus.

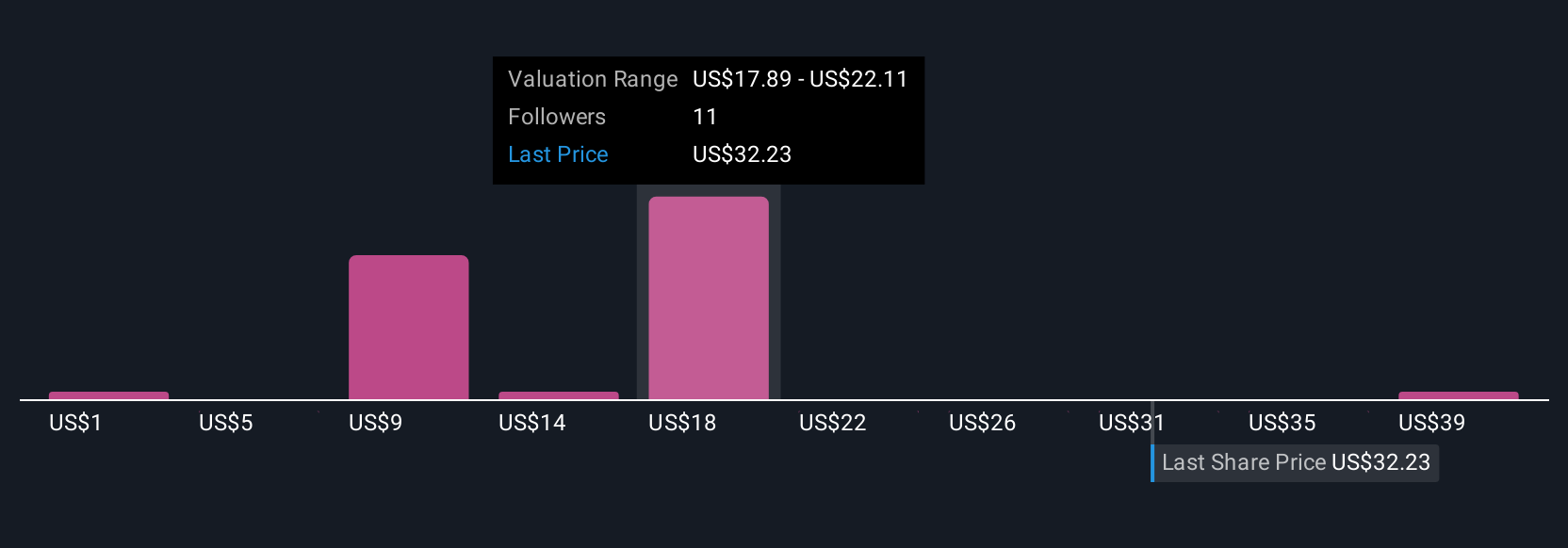

However, one risk in particular is easy to miss and could matter a lot. Insights from our recent valuation report point to the potential overvaluation of Aeva Technologies shares in the market.Exploring Other Perspectives

Explore 10 other fair value estimates on Aeva Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own Aeva Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeva Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Aeva Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeva Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal