Is Edison International Attractive After a 28% Slide and DCF Upside Signals?

- If you are wondering whether Edison International at around $57.55 is a bargain or a value trap, you are in the right place. We are going to unpack what the market might be missing.

- The stock has slipped 2.6% over the last week but is still up 3.3% over the past month, while longer term it is down roughly 28% year to date and over the last year. That kind of move often signals a shift in how investors see either its growth prospects or its risks.

- Those moves are happening against a backdrop of ongoing regulatory developments in California, evolving wildfire liability frameworks, and continued investment in grid hardening and clean energy infrastructure. All of these factors directly affect how investors price Edison International's future cash flows. In addition, broader market rotation between defensive utilities and higher growth sectors has periodically pushed the share price around, even when company specific news is limited.

- Despite that volatility, Edison International currently scores 5/6 on our valuation checks, suggesting it screens as undervalued on most of the metrics we track. Next we will walk through what different valuation approaches are saying about the stock today, then circle back at the end to a more holistic way of thinking about what it is really worth.

Find out why Edison International's -28.3% return over the last year is lagging behind its peers.

Approach 1: Edison International Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting its future cash flows and discounting them back into present dollar terms. For Edison International, the model uses a two stage Free Cash Flow to Equity framework. It starts from last twelve month free cash flow of about $0.63 Billion in $ and then transitions into a period of steady growth.

Analysts only provide detailed forecasts for the next few years, including an estimate that free cash flow could reach roughly $0.28 Billion by 2027 in $. Beyond that, Simply Wall St extrapolates the trend out to 2035, where free cash flow is projected to be around $3.27 Billion. When all of these annual cash flows are discounted back, the model produces an intrinsic value of about $100.70 per share.

Against a current share price around $57.55, the DCF suggests the stock trades at roughly a 42.8% discount to its estimated fair value, indicating meaningful upside if these projections prove directionally correct.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Edison International is undervalued by 42.8%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Edison International Price vs Earnings

For a profitable utility like Edison International, the price to earnings, or PE, ratio is a useful yardstick because it links what investors are paying directly to the company’s current earnings power. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or elevated risks, such as regulatory or wildfire exposure, argue for a lower multiple.

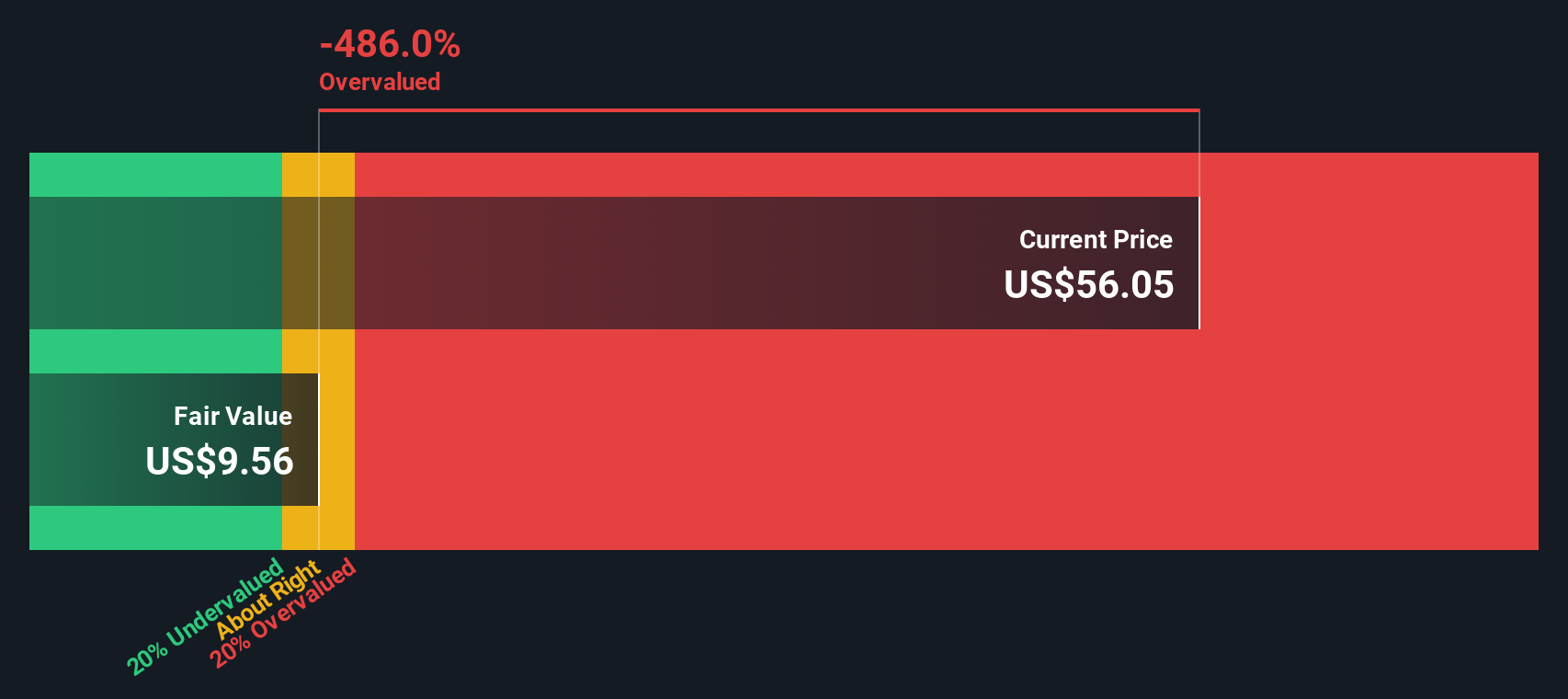

Edison International currently trades at about 7.5x earnings, which is well below both the Electric Utilities industry average of around 20.0x and the broader peer group average of roughly 20.4x. Simply Wall St’s proprietary Fair Ratio model, which estimates what the PE should be after accounting for Edison’s earnings growth outlook, margins, risk profile, industry, and market cap, arrives at a Fair Ratio of about 21.9x.

Because the Fair Ratio embeds company specific factors rather than relying only on broad peer or industry comparisons, it provides a more tailored view of what investors might reasonably pay for Edison’s earnings. Comparing that to the current 7.5x PE suggests the market is applying a steep discount to what the fundamentals would imply.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Edison International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Edison International’s story with a structured forecast of its future revenue, earnings and margins, and then translate that into a fair value estimate you can compare directly to today’s share price. On Simply Wall St’s Community page, millions of investors use Narratives to spell out their assumptions, see the implied fair value, and quickly decide whether the current price suggests they should consider buying, holding, or selling. Because Narratives update dynamically as new information arrives, such as wildfire legislation, rate case decisions or fresh earnings guidance, your fair value view stays aligned with the latest developments without you having to rebuild a model from scratch. For example, one Edison International Narrative might assume the optimistic $86 price target, stronger long term earnings growth and supportive regulation, while another leans toward the cautious $52.5 view with tighter margins and higher wildfire risk, and the platform helps you see exactly how those differing stories lead to different fair values and decisions.

Do you think there's more to the story for Edison International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal