Dominion Energy (D): Valuation Check as Offshore Wind and Data Center Strategy Gain Key Regulatory Momentum

Dominion Energy (D) just hit a key milestone with its Coastal Virginia Offshore Wind project reaching 66% completion, alongside fresh regulatory approvals that reshape how it serves power hungry data centers.

See our latest analysis for Dominion Energy.

Despite a choppy week that saw a 7 day share price return of negative 4.32 percent, Dominion’s year to date share price return of 10 percent and 1 year total shareholder return of 10.16 percent suggest momentum is steadily rebuilding as investors warm to its data center and renewables pivot.

If Dominion’s energy build out has you thinking about what else could benefit from rising infrastructure and innovation demand, it might be worth exploring aerospace and defense stocks as another hunting ground for resilient, long duration growth stories.

But with Dominion trading only modestly below analyst targets, with steady earnings growth and major capex already well telegraphed, is the market underestimating this regulated data center winner, or has the next leg of growth been fully priced in?

Most Popular Narrative: 6.5% Undervalued

With Dominion closing at $59.84 versus a narrative fair value of $64.00, the most widely followed view sees upside grounded in regulated growth visibility.

Large scale investments in regulated renewables, especially the Coastal Virginia Offshore Wind (CVOW) project, position Dominion to benefit from the accelerating energy transition, earning stable regulated returns and expanding rate base, with a positive impact on long term earnings.

Want to see the math behind that upside call, from revenue climb to margin lift and future earnings power, and the multiple it all depends on? Read on.

Result: Fair Value of $64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on CVOW staying on budget and regulators remaining supportive on cost recovery and allowed returns.

Find out about the key risks to this Dominion Energy narrative.

Another Angle on Value

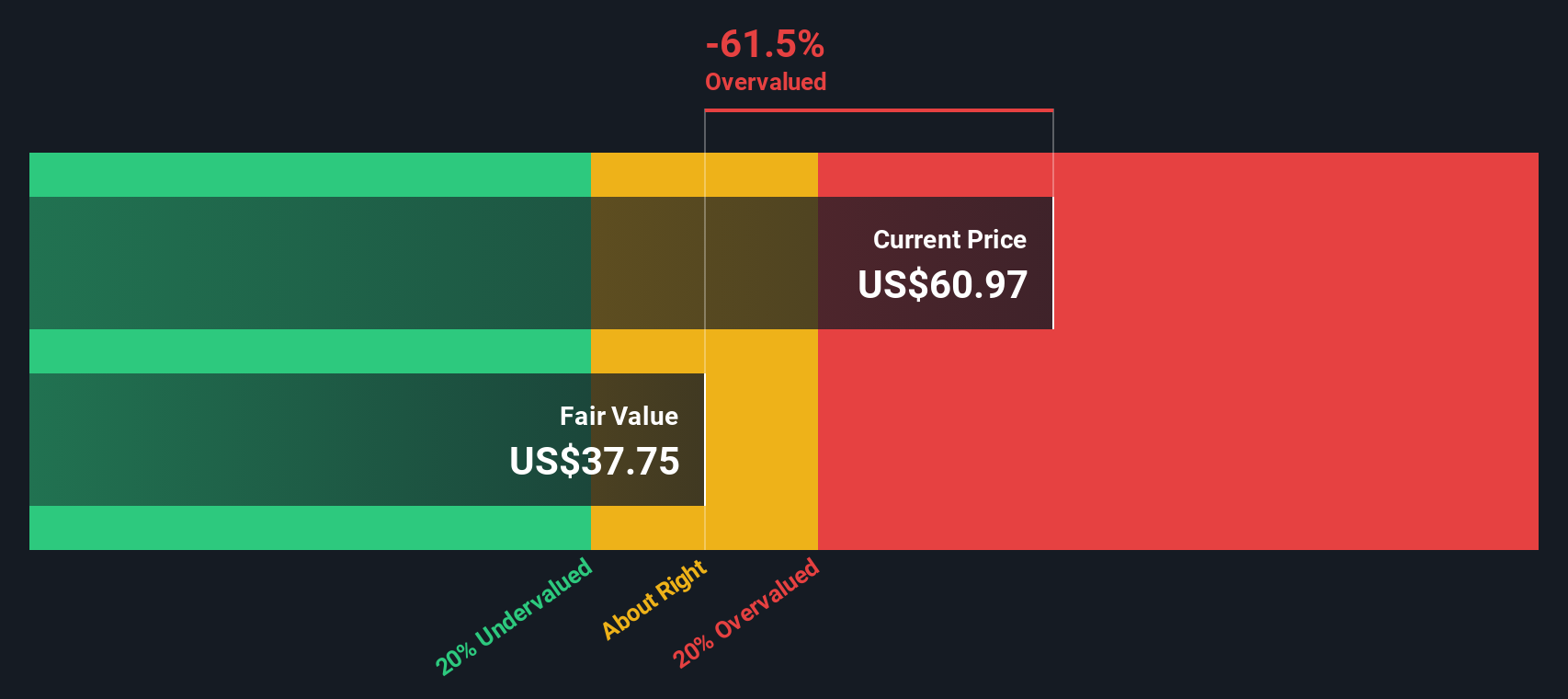

Our SWS DCF model paints a harsher picture, putting Dominion’s fair value around $36.73, which is well below the current $59.84 share price and implies the stock is overvalued on cash flow terms. If the cash flows fall short, could today’s narrative premium unwind?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dominion Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dominion Energy Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a personalized view in just minutes using Do it your way.

A great starting point for your Dominion Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next smart move?

Do not stop at one opportunity. Use the Simply Wall Street Screener now to target fresh ideas before other investors notice where the real momentum is building.

- Capture early upside in nimble businesses by reviewing these 3572 penny stocks with strong financials that already show strong financial foundations and room to scale.

- Position yourself at the front of the AI wave with these 26 AI penny stocks that combine powerful technology trends with compelling growth potential.

- Explore stronger income potential by screening these 15 dividend stocks with yields > 3% that may boost portfolio yield while still offering long term resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal