Assessing Marvell Technology (MRVL) Valuation After Record Q3 Results and Expanded Microsoft Azure Cloud Security Partnership

Marvell Technology (MRVL) just delivered a record third quarter and quietly tightened its grip on cloud security, pairing strong earnings with a deeper Microsoft Azure partnership across newly certified European markets.

See our latest analysis for Marvell Technology.

Those blockbuster earnings, the Celestial AI deal and the Azure expansion have all fed into a sharp re-rating, with a 90 day share price return of 55.05% contrasting with a 3 year total shareholder return of 139.44%. This suggests that momentum is rebuilding after a tougher year.

If this kind of AI infrastructure story has your attention, it is a good moment to scan other potential winners using high growth tech and AI stocks.

But after a record quarter, a multibillion dollar Celestial AI deal and a rapid rerating, is Marvell still trading below its true AI infrastructure potential, or are investors already paying up for tomorrow’s growth?

Most Popular Narrative: 7% Overvalued

Compared to the narrative fair value of $91.73, Marvell’s last close at $98.19 implies investors are already pricing in a rich AI inflection.

The analysts have a consensus price target of $86.098 for Marvell Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $122.0, and the most bearish reporting a price target of just $58.2.

Want to see what kind of revenue climb, margin shift and future earnings multiple have to come together to justify that outcome? The narrative’s playbook is surprisingly bold.

Result: Fair Value of $91.73 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing reliance on a few hyperscale data center customers and tight supply chains could quickly derail those upbeat AI-driven assumptions.

Find out about the key risks to this Marvell Technology narrative.

Another Angle on Valuation

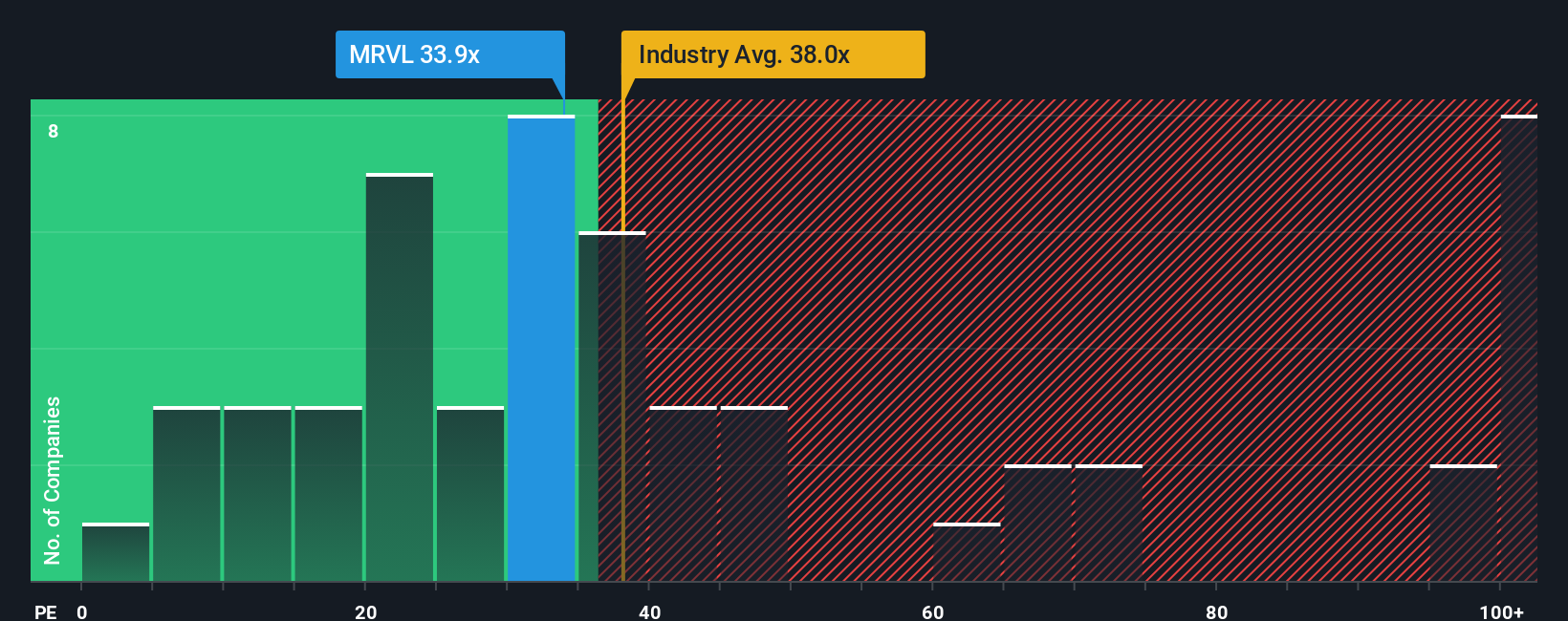

On earnings based multiples, the picture looks slightly different. Marvell trades on a price to earnings ratio of 33.7 times, below the US Semiconductor average of 37.5 times and under its own fair ratio of 36.3 times, hinting at a modest valuation cushion if growth unfolds as expected. Could this gap narrow as AI revenues build, or is it there for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marvell Technology Narrative

If you see the numbers differently or want to interrogate the assumptions yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Marvell Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next watchlist upgrade with fresh, data led stock ideas from the Simply Wall St Screener so opportunities do not slip past you.

- Target income stability by reviewing these 15 dividend stocks with yields > 3% that can help support your portfolio with reliable cash returns even when markets turn choppy.

- Catch tomorrow’s AI leaders early by scanning these 26 AI penny stocks positioned at the heart of accelerating demand for intelligent infrastructure and automation.

- Position for asymmetric upside by focusing on these 912 undervalued stocks based on cash flows where market pessimism may have overshot business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal