Johnson Controls (JCI): Reassessing Valuation After a Strong Multi‑Year Share Price Rally

Johnson Controls International (JCI) has quietly rewarded patient investors, with the stock up around 45% year to date and nearly 40% over the past year, outpacing many industrial peers.

See our latest analysis for Johnson Controls International.

That move has been driven more by a steady re rating of the business than short term excitement. The latest $114.2 share price reflects solid 30 day and 90 day share price returns on top of an impressive multi year total shareholder return.

If JCI’s run has you thinking about what else is working in industrials, it could be a good time to explore aerospace and defense stocks as another pocket of opportunity.

With earnings and cash flows climbing alongside the share price, the real question now is whether JCI still offers upside from here or if the market has already priced in the bulk of its future growth.

Most Popular Narrative: 13.3% Undervalued

At a last close of $114.20 versus a narrative fair value near $131.78, the story leans toward upside and leans heavily on execution in core platforms.

The analysts have a consensus price target of $112.85 for Johnson Controls International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $132.0, and the most bearish reporting a price target of just $79.0.

Want to see what kind of earnings power and margin lift could underpin that higher fair value, and what multiple the narrative quietly bakes in? The numbers may surprise you.

Result: Fair Value of $131.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering execution risks around restructuring and Lean initiatives, along with intensifying data center competition, could quickly undermine today’s upbeat earnings and margin narrative.

Find out about the key risks to this Johnson Controls International narrative.

Another Angle on Valuation

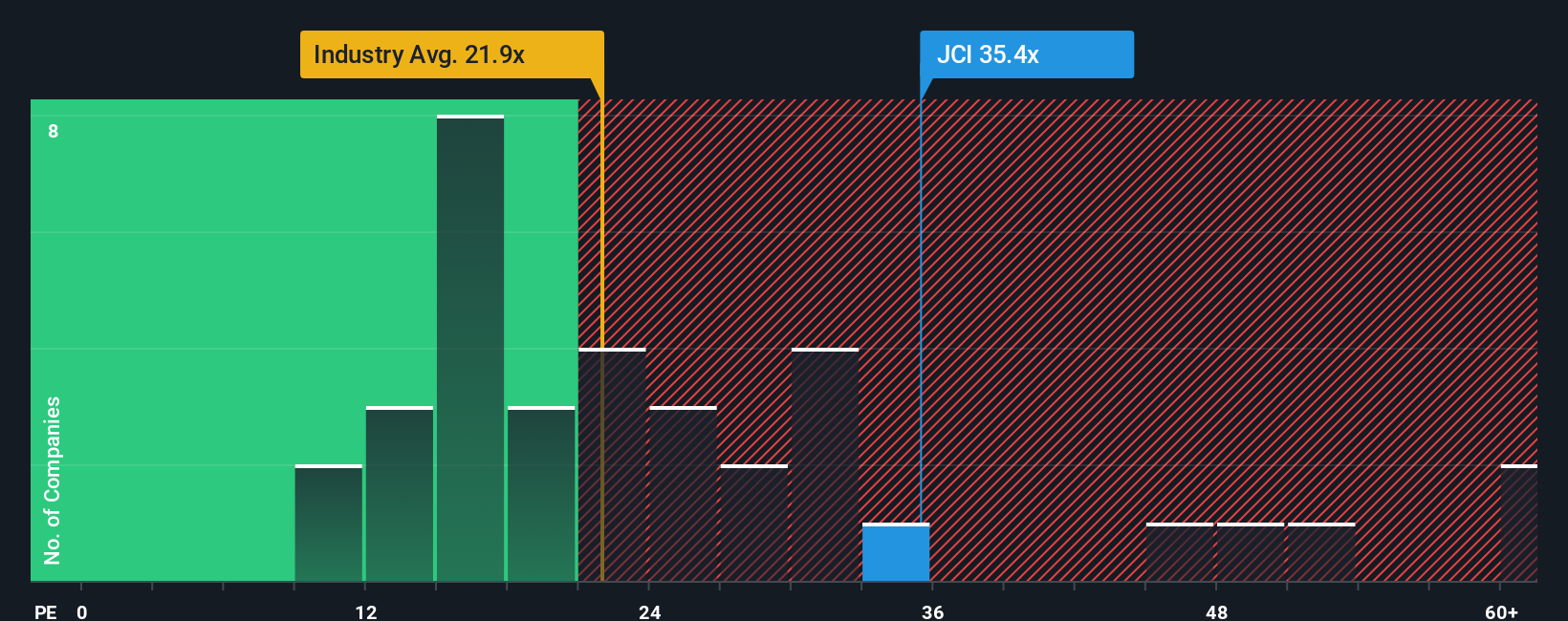

On earnings, the story looks far less forgiving. JCI trades at about 40.6 times earnings versus 19.4 times for the US Building industry and 25.6 times for peers, with a fair ratio nearer 36.9 times. That premium narrows the margin for error if growth expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Johnson Controls International Narrative

If you see the story differently or want to stress test these assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your advantage by using the Simply Wall St Screener to uncover fresh, data backed opportunities beyond Johnson Controls International.

- Capture potential mispricings by scanning these 913 undervalued stocks based on cash flows that combine attractive valuations with strong underlying fundamentals.

- Ride structural growth trends by targeting these 30 healthcare AI stocks harnessing intelligent solutions to support improvements in patient outcomes and hospital efficiency.

- Enhance your search for yield by focusing on these 15 dividend stocks with yields > 3% that may offer more reliable income than sitting in cash.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal