Exploring US High Growth Tech Stocks For Potential Portfolio Enhancement

As the U.S. stock market experiences a mixed performance with major indices like the Nasdaq Composite and S&P 500 inching closer to record highs, investors are keenly observing economic indicators such as inflation data that could influence Federal Reserve decisions on interest rates. In this environment, identifying high-growth tech stocks can be crucial for portfolio enhancement, as these companies often demonstrate resilience and innovation in times of economic uncertainty.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Workday | 11.18% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| Cellebrite DI | 15.29% | 20.24% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.83% | 45.89% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Zscaler (ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $38.57 billion.

Operations: The company generates revenue primarily through the sales of subscription services to its cloud platform and related support services, amounting to $2.83 billion.

Zscaler, a trailblazer in cloud-native cybersecurity, continues to expand its influence through strategic partnerships with companies like Peraton and Orca Security, enhancing its offerings in secure and efficient infrastructure solutions. With a recent 25.5% increase in quarterly sales to $788 million and a slight reduction in net loss to $11.62 million from the previous year, Zscaler is demonstrating robust financial health. The company's commitment to innovation is evident as it anticipates revenue between $797 million and $799 million for Q2 2026, underpinning its strategy with substantial R&D investments that align with its forward-looking security technologies. These collaborations and financial milestones not only bolster Zscaler's market position but also reflect its pivotal role in shaping future cybersecurity landscapes by integrating advanced AI capabilities within its platforms.

- Click to explore a detailed breakdown of our findings in Zscaler's health report.

Gain insights into Zscaler's historical performance by reviewing our past performance report.

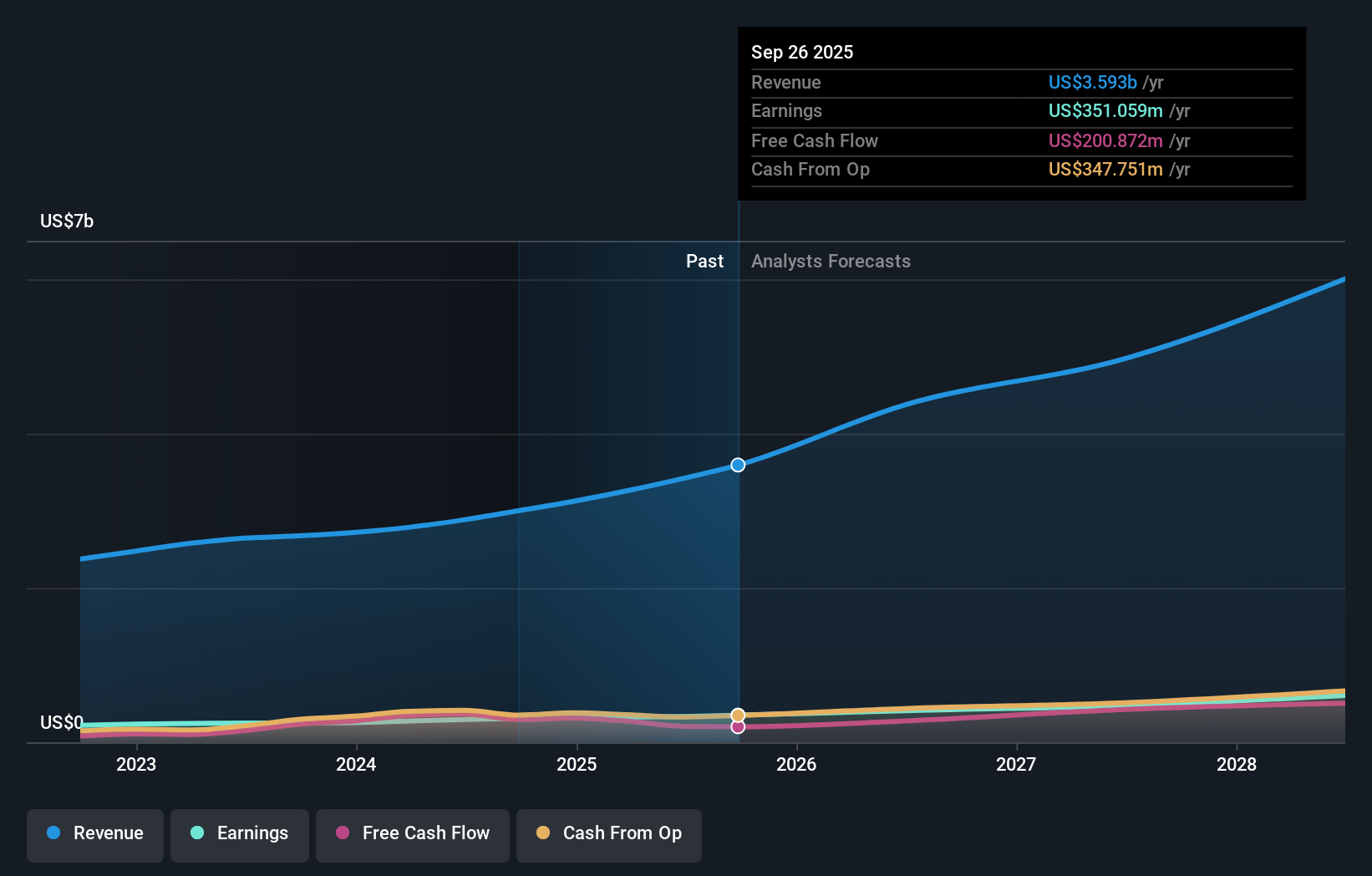

Fabrinet (FN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fabrinet offers optical packaging and precision optical, electro-mechanical, and electronic manufacturing services across North America, the Asia-Pacific, and Europe with a market cap of $16.03 billion.

Operations: The company generates revenue primarily from its Optical Networking Equipment segment, which accounts for $3.59 billion. Its business operations span North America, the Asia-Pacific, and Europe, focusing on precision optical and electro-mechanical manufacturing services.

Fabrinet demonstrates a robust trajectory in the tech sector, with a notable 17.2% annual revenue growth and an 18.7% increase in earnings per year, outpacing the US market's average. Recent strategic leadership transitions aim to sustain this momentum, highlighted by the appointment of Seamus Grady as chairman, ensuring continuity in their innovative approach towards manufacturing optical communications and advanced technology components. The company's commitment to R&D is evident from their substantial investments which bolster its competitive edge in a rapidly evolving industry. Moreover, Fabrinet's recent guidance anticipates Q2 revenues between $1.05 billion and $1.10 billion with earnings per share up to $3.06, reflecting confidence in continued financial health and operational excellence.

- Delve into the full analysis health report here for a deeper understanding of Fabrinet.

Review our historical performance report to gain insights into Fabrinet's's past performance.

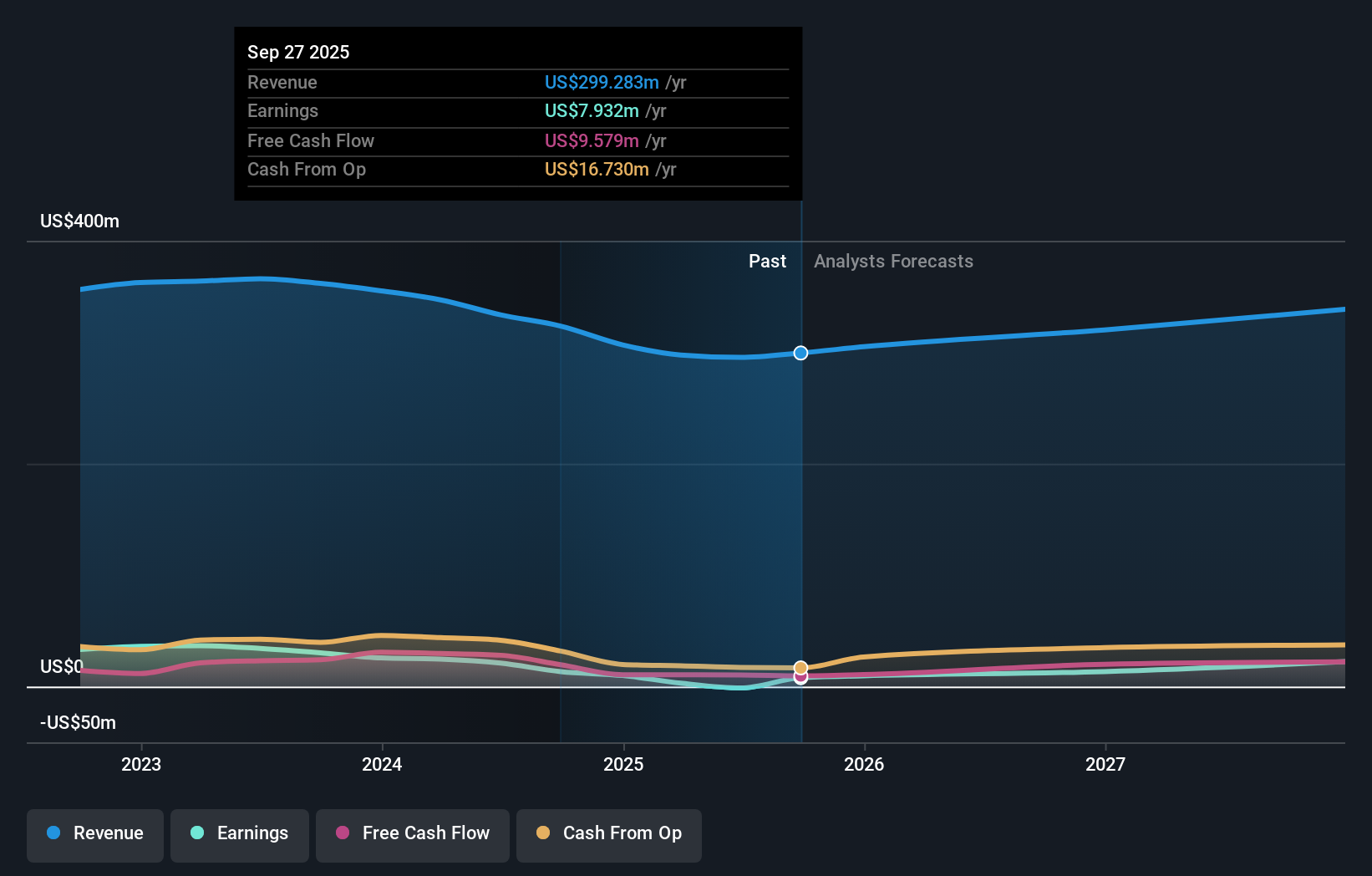

Vishay Precision Group (VPG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vishay Precision Group, Inc. operates in the precision measurement and sensing technologies sector across the United States, Europe, Israel, Asia, and Canada with a market capitalization of approximately $495.58 million.

Operations: VPG focuses on precision measurement and sensing technologies, generating revenue primarily from three segments: Sensors ($112.64 million), Weighing Solutions ($109.66 million), and Measurement Systems ($79.14 million).

Vishay Precision Group (VPG) exhibits a mixed performance in the tech sector, with a modest annual revenue growth of 5.3%, underperforming the broader US market's average of 10.6%. However, its projected earnings growth is robust at 43.9% annually, surpassing the market forecast of 16.1%. Recent strategic executive appointments and operational enhancements signal VPG's commitment to refining its product and business strategies, which could catalyze future performance despite current earnings being impacted by significant one-off items totaling $4.4 million. The company's focus on integrating operations across its manufacturing sites suggests a streamlined approach that may support sustained improvements in efficiency and profitability moving forward.

- Take a closer look at Vishay Precision Group's potential here in our health report.

Evaluate Vishay Precision Group's historical performance by accessing our past performance report.

Key Takeaways

- Delve into our full catalog of 74 US High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal