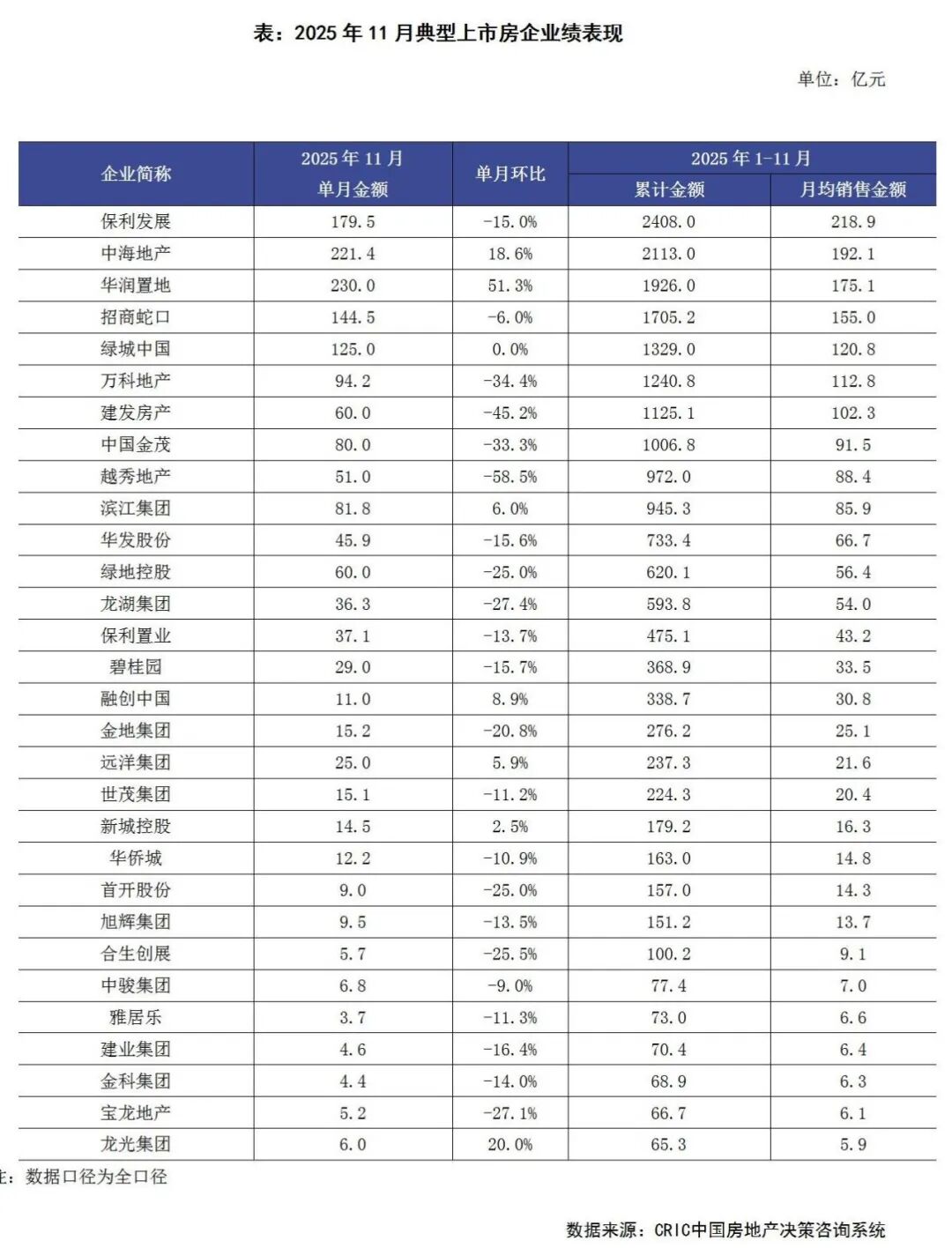

Kerui: In November, 30 key listed real estate companies achieved full-caliber sales of 162.36 billion yuan

The Zhitong Finance App learned that the monthly report published by Kerry Real Estate Research shows that in November 2025, 30 key listed real estate companies achieved a total sales amount of 162.36 billion yuan. Judging from the cumulative results, 30 key listed real estate companies achieved full-caliber sales of 1981.13 billion yuan. Judging from the performance of individual companies, 7 of the 30 key listed real estate companies increased month-on-month in November 2025, including China Resources Land, Longguang Group, Zhonghai Real Estate, Sunac China, Binjiang Group, Ocean Group, and Xincheng Holdings. Among them, China Resources Land had the biggest month-on-month increase in monthly performance. Overall, China's Jinmao and Greenland Holdings achieved an increase in the cumulative sales volume of the 30 key listed housing companies in the first 11 months.

Enterprise land acquisition: leading central and state-owned enterprise core cities replenish positions, and overall investment remains cautious

1. Monthly housing companies' investments are still cautious. On the one hand, sales have continued to bottom out since the fourth quarter. After actively acquiring land in the first half of the year, companies all adopted a contraction strategy to seek higher quality land next year; on the other hand, the total supply and frequency of high-quality land sold in the fourth quarter also declined significantly compared to the second and third quarters. Therefore, as can be seen from the data side, the monthly investment amount (full caliber) of the 30 housing enterprises monitored is about 23.4 billion yuan, and the land acquisition area is 1.31 million square meters.

2. Thirteen companies added land storage accounts in a single month. Among them, enterprises that have acquired more than 3 billion yuan (full caliber) of land in a single month include central state-owned enterprises such as Zhonghai Real Estate, Greentown China, and China's Jinmao. Overall, typical enterprises are very cautious in their attitude and intention to acquire land, and their investment layout concentrates on first-tier and second-tier high-quality plots.

Housing companies' investment at the end of the year remained rational. Instead of blindly expanding, they turned their focus to sprint to full year results. On the one hand, enterprises have reduced their acquisition of new land and are instead paying more attention to the development and sale of existing projects to achieve a rapid return of capital before the end of the year. On the other hand, even if there is a demand for land acquisition, companies are more inclined to choose high-quality plots located in Tier 1 and 2 cities with high development value and market potential to ensure the stability and sustainability of return on investment. Overall, the investment behavior of housing enterprises at the end of the year showed a “dormant” trend, saving strength for next year's market layout.

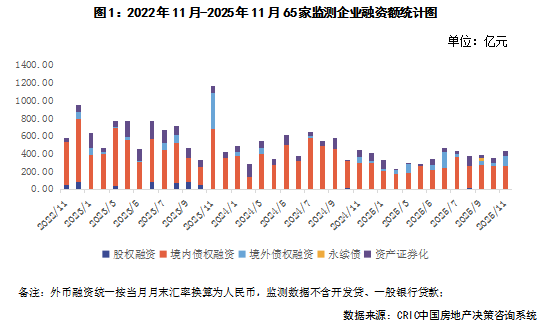

Corporate financing: monthly total volume rebounded month-on-month, and costs continued to fall

1. Total financing volume: In November 2025, the total financing volume of 65 typical housing enterprises was 43.279 billion yuan, an increase of 24% over the previous month. Judging from the cumulative data for the whole year, the total financing volume of 65 typical housing enterprises from January to November was 390.236 billion yuan. In terms of financing structure, domestic debt financing by housing enterprises this month was 26.126 billion yuan, a decrease of 1.2%; overseas debt financing was 11.174 billion yuan, an increase of 292.1% over the previous month; and asset securitization financing was 5.979 billion yuan, an increase of 6.6% over the previous month.

2. Financing costs: From January to November 2025, the cost of additional bond financing for 65 typical housing enterprises was 2.87%, down 0.06 percentage points from 2024. Among them, overseas bond financing costs were 6.21%, up 2.03 percentage points from the full year of 2024, and domestic bond financing costs were 2.52%, down 0.39 percentage points from the full year of 2024. Looking at a single month, since China Resources Land issued two overseas bonds this month, overall overseas financing costs have been reduced. Since domestic companies that issue bonds are basically central state-owned enterprises such as China Merchants Shekou, Poly Development, and China Resources Land, domestic bond financing costs have been reduced by 0.08 percentage points to 2.3% month-on-month, and continue to remain low.

Organizational News: Longhu Huafa and other real estate companies are streamlining hierarchies and improving efficiency

Since this year, large-scale organizational restructuring and defense changes for housing enterprises have become the norm. According to the 65 companies monitored by CRIC, this trend has continued since November. Not only have there been intensive changes in the senior management of housing enterprises, but many enterprises have also simultaneously initiated organizational structure optimization to adapt to the new situation in the industry.

In terms of organizational structure adjustments, many housing enterprises have improved their efficiency through regional mergers and hierarchical streamlining. Longhu Group initiated organizational adjustments in November. The core content includes merging the relevant regional businesses in Wuhan and Changsha, and finalizing the business layout of the top ten regional companies to further focus on the core market. This adjustment continues the trend of regional integration in the industry and aims to improve synergy and decision-making efficiency by optimizing regional layout.

Huafa Co., Ltd. also recently announced the merger of the Zhuhai region and the South China region into the new South China region to form a new “mixed fleet”. The new region has four major regions: Guangshen, Southwest China, Central China, and Zhuhai to maintain three-level control of the group-region-region. Xiang Yu, the executive vice president of the South China region, is the chairman of the board. The team members have absorbed talents from various systems such as Vanke and CNOOC.

Xincheng Holdings has also made organizational adjustments. The core is “construction and management fission and real estate integration.” Its asset-light business “Xincheng Construction Management” is divided into two companies with the intention of seizing the contract construction market through internal competition and turning it into a new growth engine. The Real Estate Development Division integrated the original regions into four major regional companies in North China, East China, Southeast China, and South China, with the aim of reducing costs and improving efficiency, and focusing on “guaranteed delivery”. At the same time, the company bucked the trend and launched a “three year thousand people” school recruitment to achieve the enterprise's strategy of “steady development and strong management” and strengthen its ability to cross the cycle.

Xuhui Group's adjustments were more thorough. In early November, in order to achieve organizational streamlining and efficiency, five divisions and subsidiary city companies, including Beijing, Suwan, and Southeast China, were abolished, and three new regional divisions were established. Among them, the East China Division covered six provinces and cities, including Shanghai, Zhejiang, and the Jiangsu Division, while the South China Division covered five provinces and regions including Guangdong, Xiang, and E. After the adjustment, Xuhui formed a business layout for the four major regions of East China, South China, Beijing, and West China and the Shandong platform. The regional division set up “four divisions and three groups” of core departments to achieve direct management of the headquarters, highlighting the intention of strategic contraction and focus on the core region.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal