Three Stocks That Could Be Undervalued By Market Estimates In December 2025

As we enter December 2025, the U.S. stock market presents a mixed picture with major indices like the Dow and S&P 500 hovering near all-time highs while investors closely monitor upcoming inflation data that could influence Federal Reserve decisions on interest rates. In this environment, identifying undervalued stocks requires careful consideration of market dynamics and economic indicators, as these factors can reveal opportunities where current valuations may not fully reflect a company's potential or resilience.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WEBTOON Entertainment (WBTN) | $14.34 | $28.20 | 49.1% |

| Super Group (SGHC) (SGHC) | $11.14 | $21.52 | 48.2% |

| Signet Jewelers (SIG) | $85.02 | $167.01 | 49.1% |

| Schrödinger (SDGR) | $18.42 | $35.34 | 47.9% |

| Perfect (PERF) | $1.77 | $3.43 | 48.5% |

| Pattern Group (PTRN) | $13.35 | $25.43 | 47.5% |

| Lyft (LYFT) | $22.52 | $43.57 | 48.3% |

| Investar Holding (ISTR) | $26.13 | $50.75 | 48.5% |

| DexCom (DXCM) | $65.25 | $126.43 | 48.4% |

| BioLife Solutions (BLFS) | $25.83 | $49.93 | 48.3% |

Let's dive into some prime choices out of the screener.

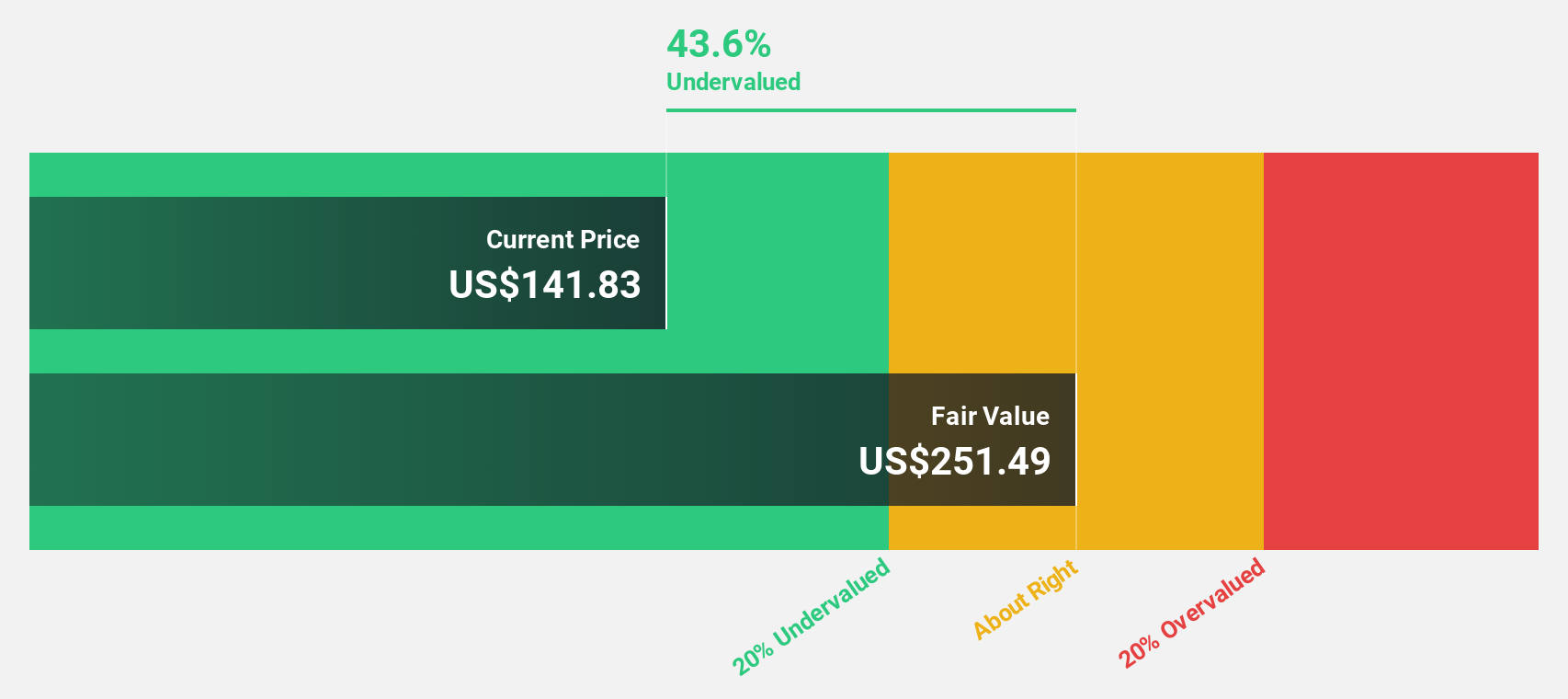

Neurocrine Biosciences (NBIX)

Overview: Neurocrine Biosciences, Inc. is engaged in the discovery, development, and marketing of pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders globally, with a market cap of approximately $15.38 billion.

Operations: The company's revenue primarily comes from research and development, commercialization, and sale of pharmaceuticals, totaling $2.68 billion.

Estimated Discount To Fair Value: 38.5%

Neurocrine Biosciences is trading at US$154.22, significantly below its estimated fair value of US$250.66, suggesting it may be undervalued based on cash flows. The company's earnings are expected to grow at 22.4% annually, outpacing the broader market's growth rate of 16.1%. Despite a recent Phase 2 study setback for NBI-1070770 in major depressive disorder, Neurocrine maintains a robust pipeline and strategic collaborations to bolster future prospects.

- Our expertly prepared growth report on Neurocrine Biosciences implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Neurocrine Biosciences.

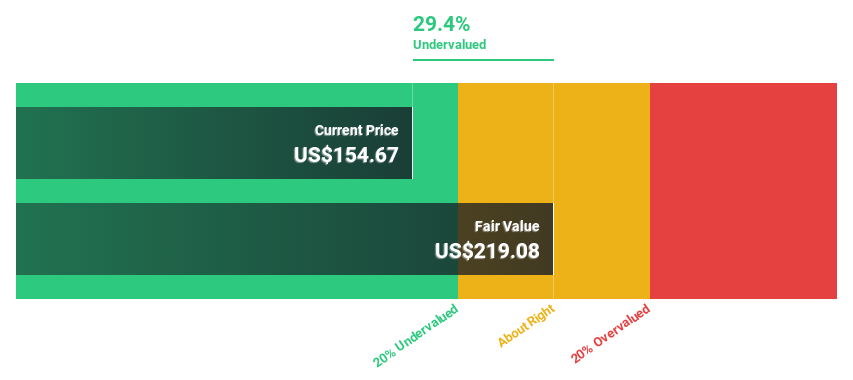

Capital One Financial (COF)

Overview: Capital One Financial Corporation is a financial services holding company offering a range of financial products and services in the United States, Canada, and the United Kingdom, with a market cap of approximately $144.46 billion.

Operations: Capital One's revenue is primarily derived from its Credit Card segment at $17.46 billion, followed by Consumer Banking at $8.43 billion and Commercial Banking at $3.52 billion.

Estimated Discount To Fair Value: 22.2%

Capital One Financial is trading at US$229.71, below its estimated fair value of US$295.42, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow 52.45% annually, surpassing the broader market's growth rate of 16.1%. Despite a lower profit margin this year and shareholder dilution, Capital One has announced a share buyback program worth up to US$16 billion and increased dividends, reflecting confidence in future cash flow generation.

- Insights from our recent growth report point to a promising forecast for Capital One Financial's business outlook.

- Unlock comprehensive insights into our analysis of Capital One Financial stock in this financial health report.

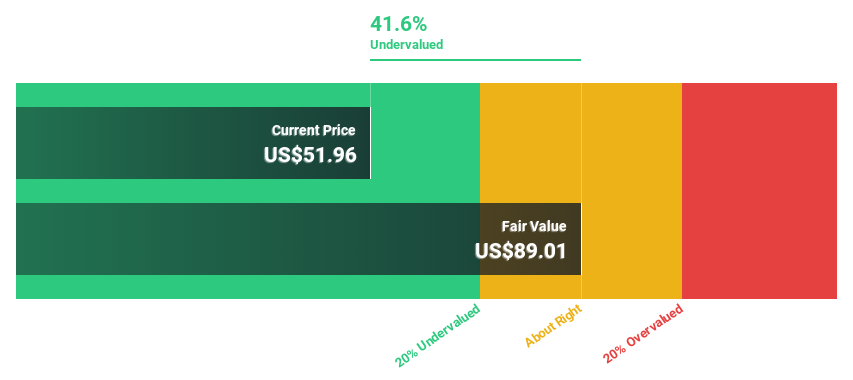

Hims & Hers Health (HIMS)

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers with licensed healthcare professionals in the U.S., the U.K., and internationally, with a market cap of $8.44 billion.

Operations: The company's revenue segment includes $2.21 billion from online retailers.

Estimated Discount To Fair Value: 31%

Hims & Hers Health trades at US$40.02, significantly below its fair value of US$58, suggesting it is undervalued based on cash flows. Despite high debt and recent share price volatility, the company anticipates robust earnings growth of 26.63% annually, outpacing the US market's 16.1%. Recent Canadian expansion and a new share repurchase program worth up to US$250 million underscore strategic moves to enhance long-term financial performance and shareholder value.

- Our comprehensive growth report raises the possibility that Hims & Hers Health is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Hims & Hers Health.

Summing It All Up

- Embark on your investment journey to our 208 Undervalued US Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal