Is Simon Property Group Still Attractive After a 165% Multi Year Share Price Surge?

- Wondering whether Simon Property Group is still worth buying after its big multi year run, or if most of the easy gains are already behind it? You are not alone, and that is exactly what we will unpack here.

- The stock now trades around $183.32, up a hefty 165.3% over five years and 81.8% over three years, even though shorter term returns have cooled, with the share price roughly flat over 30 days and up about 5.8% over the past year.

- Recent headlines have focused on Simon doubling down on high traffic, top tier malls and outlet centers, as well as selectively investing in distressed retail brands to keep its properties vibrant and occupied. At the same time, investors are watching how shifting consumer spending and e commerce trends could reshape demand for premium retail space and influence how the market prices Simon's portfolio.

- Against this backdrop, Simon earns a valuation score of 4/6, suggesting it screens as undervalued on most of our checks. We will walk through what that means across different valuation approaches, before finishing with a more powerful way to think about what Simon is really worth.

Approach 1: Simon Property Group Discounted Cash Flow (DCF) Analysis

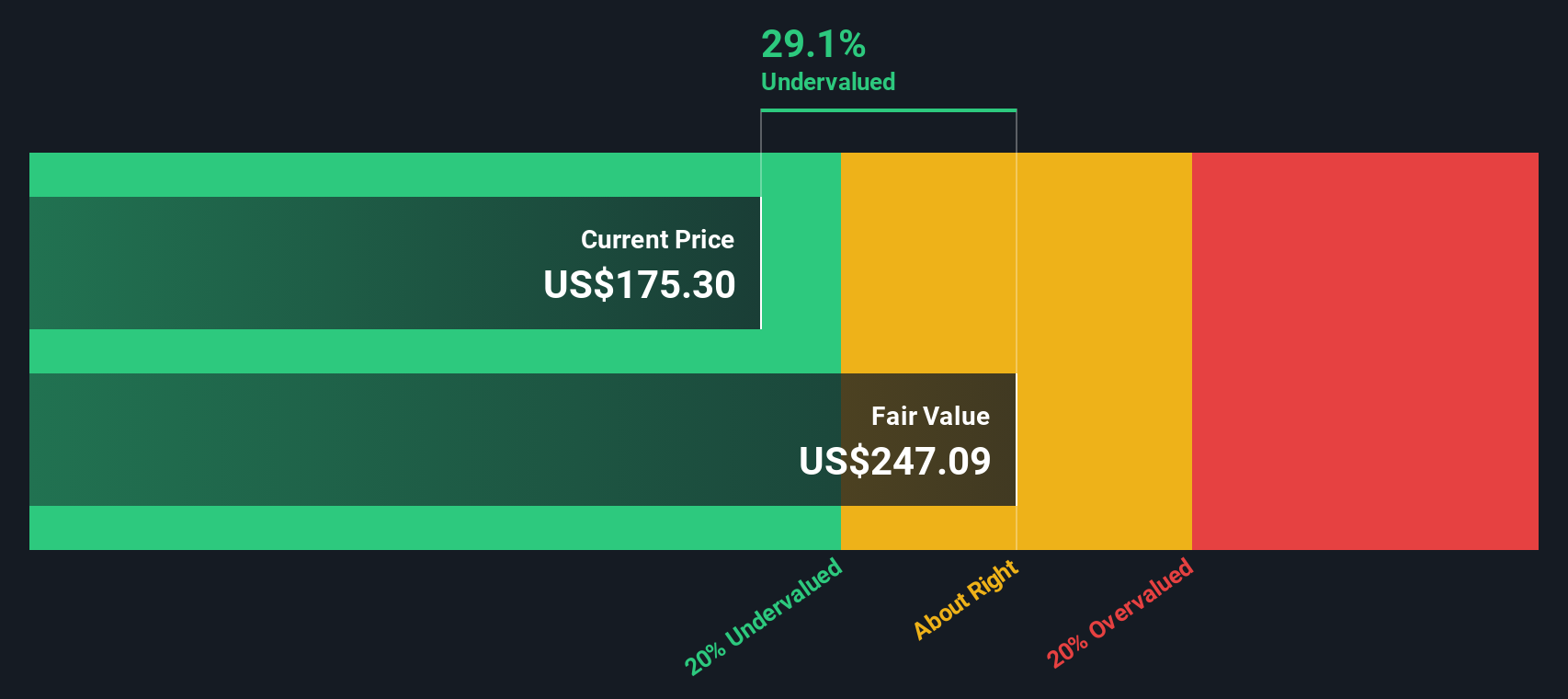

The Discounted Cash Flow model estimates what Simon Property Group is worth by projecting its adjusted funds from operations into the future and discounting those cash flows back to today in dollar terms.

Simon generated about $4.36 billion in free cash flow over the last year. Analysts expect this to gradually grow as its premium malls and outlets continue to attract tenants and shoppers. On Simply Wall St’s 2 stage Free Cash Flow to Equity model, analyst forecasts run out after several years. Later years are extrapolated, pointing to free cash flow of roughly $5.86 billion by 2035.

When these future cash flows are discounted back, the model arrives at an intrinsic value of about $258.29 per share, compared with a recent price around $183.32. That implies the stock trades at roughly a 29.0% discount to its estimated fair value. This suggests investors are not fully pricing in Simon’s cash generation power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Simon Property Group is undervalued by 29.0%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

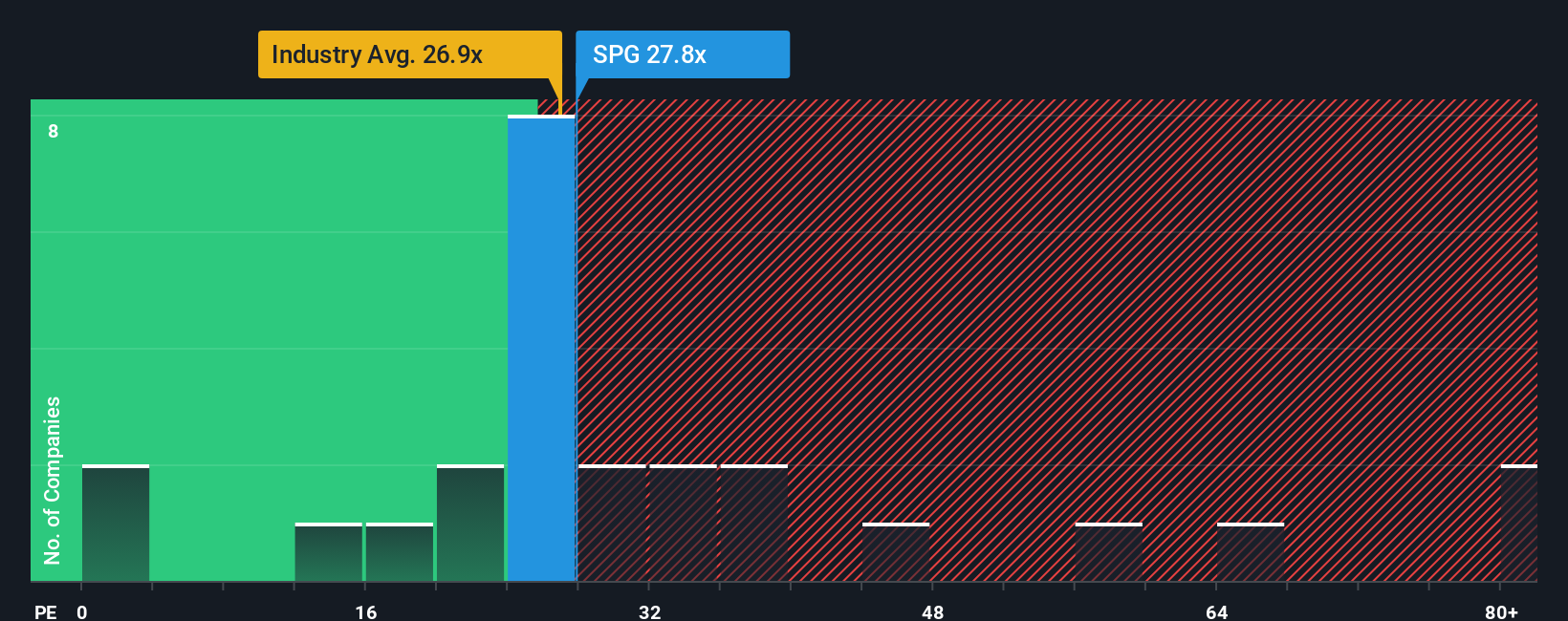

Approach 2: Simon Property Group Price vs Earnings

For a consistently profitable business like Simon Property Group, the price to earnings ratio is a useful way to see how much investors are willing to pay for each dollar of current earnings. In general, faster growing and lower risk companies deserve higher PE multiples, while slower growth or higher uncertainty usually calls for a lower, more conservative PE.

Simon currently trades on a PE of about 26.7x. That is slightly above the Retail REITs industry average of roughly 26.4x, but below the broader peer group average of around 34.2x. To go a step further, Simply Wall St calculates a Fair Ratio of 31.2x for Simon. This is the PE you might expect given its earnings growth outlook, industry positioning, profit margins, size and risk profile.

This Fair Ratio is more informative than a simple comparison with peers or the sector, because it bakes in company specific factors rather than assuming all REITs deserve the same multiple. With the current PE of 26.7x sitting below the Fair Ratio of 31.2x, the multiple based view aligns with the DCF work and points to Simon trading at an attractive valuation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

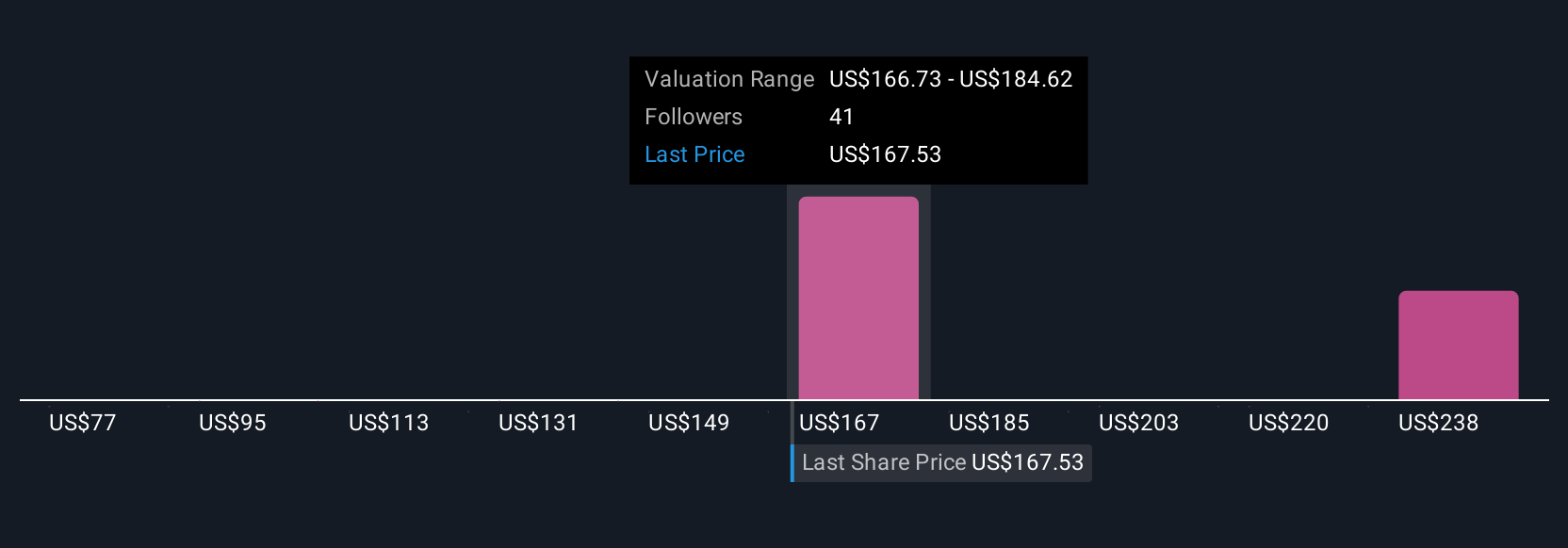

Upgrade Your Decision Making: Choose your Simon Property Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple, story driven views of a company that connect your perspective on its future (revenue, earnings and margins) to a financial forecast, then to a fair value you can compare with today’s price. On Simply Wall St’s Community page, investors use Narratives as an easy, accessible tool to spell out why they think a business like Simon Property Group will thrive or struggle, and the platform translates those assumptions into a dynamic fair value that automatically updates when new information arrives, from earnings to major news. For Simon, one investor Narrative might lean bullish, assuming premium malls stay full, redevelopment projects like mixed use destinations lift margins, and justifying a higher fair value closer to recent bullish targets around $225. Another more cautious Narrative might focus on retail bankruptcies, higher interest costs and slow revenue growth, landing nearer the low end around $169. By comparing those fair values to the current share price, each investor can decide whether Simon looks like a buy, a hold, or a sell.

Do you think there's more to the story for Simon Property Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal