Prologis (PLD): Evaluating Valuation After Recent Pullback and Strong Multi‑Year Shareholder Returns

Prologis (PLD) has quietly outpaced many peers this year, and that climb is starting to make investors ask a simple question: is the current price still reasonable given its fundamentals?

See our latest analysis for Prologis.

The recent pullback, with a 1 day share price return of negative 0.78 percent from 128.18 dollars, comes after a strong 90 day share price return of 12.78 percent and a solid 5 year total shareholder return of 51.44 percent. This suggests momentum is still broadly intact even as expectations reset around valuation.

If Prologis has you thinking about where else real estate style momentum might show up, it could be worth scanning the market for fast growing stocks with high insider ownership.

Yet with the shares trading just below analyst targets and a model implied premium to intrinsic value, investors now face a pivotal question: is Prologis still undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 1.6% Undervalued

With Prologis last closing at 128.18 dollars versus a narrative fair value of about 130.30 dollars, the story points to only a modest upside grounded in detailed earnings assumptions.

The continued expansion in value-added services (like renewable/distributed energy solutions and data centers) further diversifies revenue streams and leverages long-term trends toward automation and electrification in warehouse operations, which is likely to provide incremental NOI and margin expansion opportunities.

Curious how steady top line growth, powerful margins, and a richer future earnings multiple combine to justify this near full valuation? The narrative leans on carefully calibrated revenue expansion, modest margin compression, and a punchy profit multiple that looks more like a growth stock than a traditional REIT. Want to see exactly which forecasts hold this price target together?

Result: Fair Value of $130.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat case could be challenged if leasing activity stays sluggish, or if elevated vacancy and bad debt continue to pressure rents and margins.

Find out about the key risks to this Prologis narrative.

Another Angle on Valuation

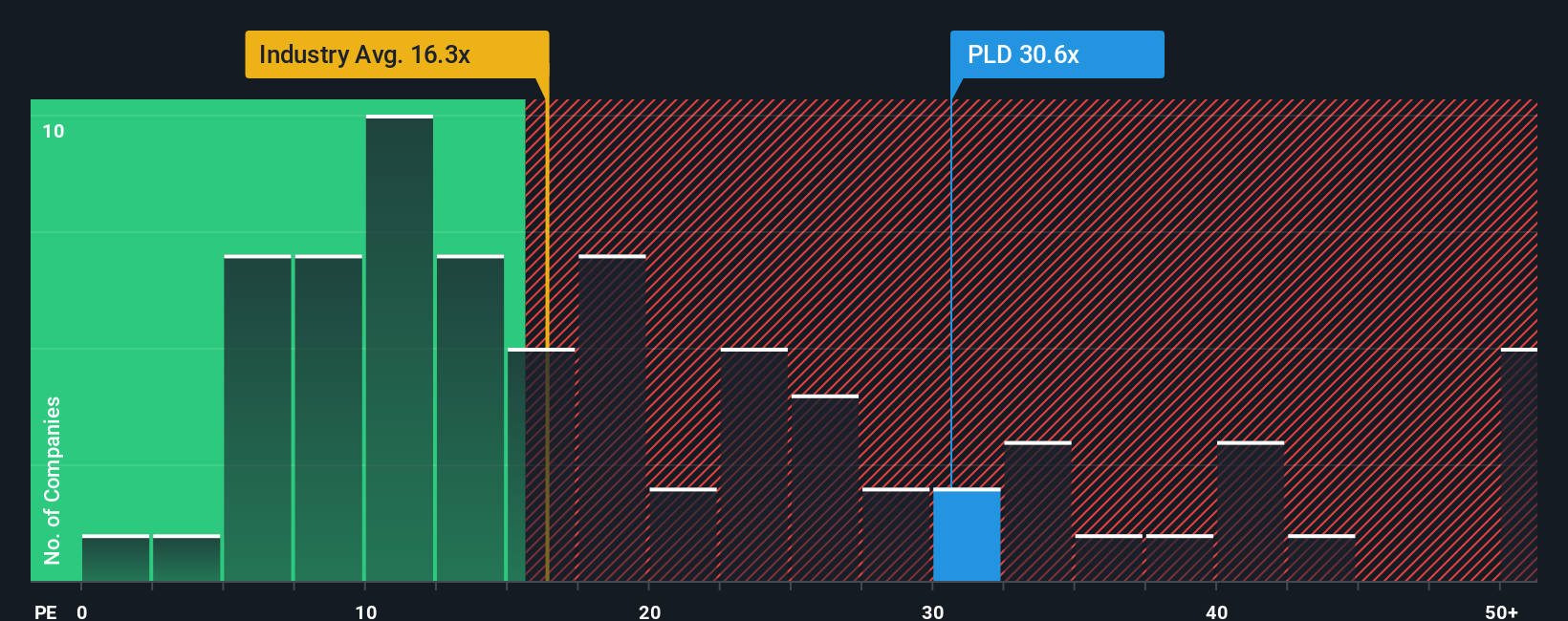

Our numbers tell a less forgiving story. On a simple price to earnings snapshot, Prologis trades at 37.2 times earnings versus a 32.4 times peer average and a 15.9 times industry mark, while its fair ratio sits nearer 32.5 times. That premium narrows the margin for error if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prologis Narrative

If you prefer to challenge these assumptions or dig into the numbers yourself, you can build a tailored view in just a few minutes. Do it your way.

A great starting point for your Prologis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

While Prologis might earn a spot on your watchlist, you will miss real opportunities if you stop here instead of comparing it with other focused strategies.

- Capitalize on mispriced quality by targeting companies that screen as attractively valued through these 914 undervalued stocks based on cash flows based on robust cash flow metrics.

- Ride structural growth trends by zeroing in on innovators powering the AI wave with these 26 AI penny stocks and their accelerating demand tailwinds.

- Strengthen your income stream by focusing on steady cash generators via these 15 dividend stocks with yields > 3% and lock in yields that can cushion market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal