Sunrun (RUN) Is Down 9.4% After ESOP Shelf Filing Amid Solar Tax Credit Uncertainty

- Earlier this week, Sunrun Inc. filed a US$693.55 million shelf registration for 38,854,154 common shares tied to its employee stock ownership plan, while investors digested the impending expiry of key U.S. residential solar tax credits and a peer company’s bankruptcy after those incentives were reduced.

- The combination of tax-credit uncertainty, insider share sales, and rising solar component costs has sharpened questions about how resilient Sunrun’s residential solar demand and profitability could be without current policy support.

- We’ll now examine how the looming expiration of residential solar tax credits may reshape Sunrun’s investment narrative and long-term outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sunrun Investment Narrative Recap

To own Sunrun, you have to believe residential solar and storage can remain attractive even as U.S. tax incentives change and financing stays capital intensive. The looming 25D credit expiry and questions around policy support look like the key short term catalyst and the biggest risk, while the new US$693.55 million shelf registration tied to employee shares does not itself materially change that near term risk reward balance.

Among recent announcements, Sunrun’s July 2025 securitization of US$331 million of Class A 1 notes stands out as closely linked to today’s concerns, because it highlights how dependent the business model is on continued access to debt and securitization markets. As investors weigh policy uncertainty and higher solar component costs, Sunrun’s ability to keep raising attractively priced capital remains central to how the story around growth, cash generation, and scale plays out.

Yet the possibility that residential solar demand could shrink sharply after the 25D tax credit expires is something investors should be aware of as...

Read the full narrative on Sunrun (it's free!)

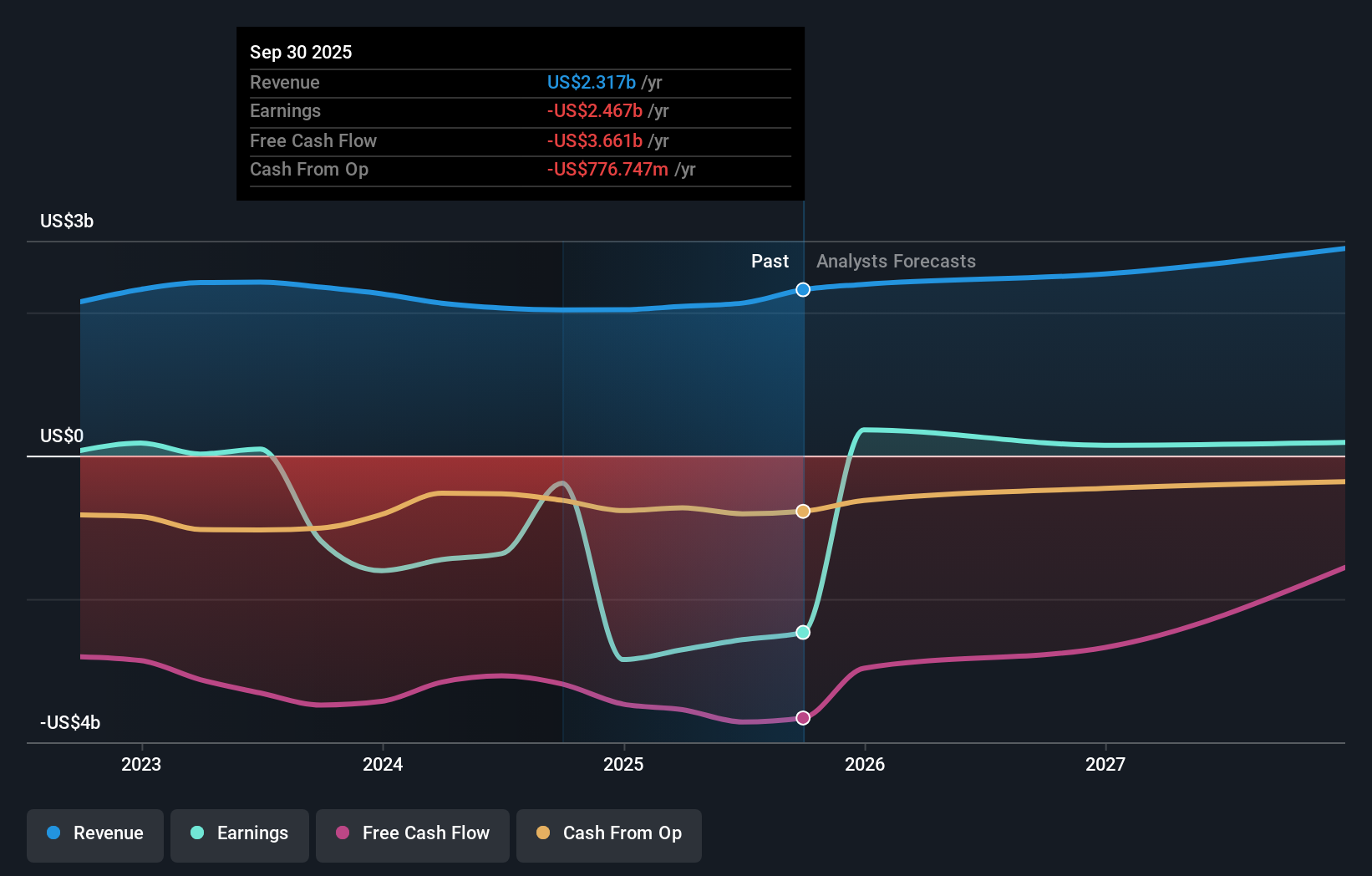

Sunrun's narrative projects $2.9 billion revenue and $465.4 million earnings by 2028. This requires 10.4% yearly revenue growth and an earnings increase of about $3.1 billion from -$2.6 billion today.

Uncover how Sunrun's forecasts yield a $22.74 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$13.14 to US$23.58, showing how far apart individual views can be. You may want to compare those opinions with the risk that Sunrun’s addressable market could contract when current residential tax credits expire, before deciding how you think this business might perform over time.

Explore 5 other fair value estimates on Sunrun - why the stock might be worth 28% less than the current price!

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal