How Viasat’s (VSAT) NexusWave Maritime Upgrade Has Changed Its Investment Story

- In the past few days, Inmarsat Maritime announced the next phase of its NexusWave bonded connectivity service, leveraging Viasat’s ViaSat-3 Flight 2 launch and the anticipated Flight 3 satellite to boost maritime bandwidth and coverage ahead of expected 2026 service entry.

- A key development is the new VS60 maritime terminal, which delivered download speeds above 250 Mbps in sea trials, signaling a step-change in “office-like” and “home-like” connectivity for ships that could reshape Viasat’s maritime offering.

- We’ll now examine how NexusWave’s ViaSat-3-powered bandwidth expansion and high-speed VS60 terminal could influence Viasat’s broader investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Viasat Investment Narrative Recap

To own Viasat, you have to believe its heavy investment in the ViaSat 3 constellation and multi orbit services will translate into durable demand across aviation, maritime and government. The NexusWave upgrade and VS60 terminal support that thesis but do not change the near term picture that the key catalyst remains successful, timely ViaSat 3 service entry in 2026, while high capital intensity and leverage remain the central risk.

In this context, the recent GSMA Intelligence report commissioned by Viasat on direct to device satellite demand feels particularly relevant, as it reinforces the broader case for satellite enabled connectivity and hybrid networks that underpin the ViaSat 3 and NexusWave expansion. It speaks to the same theme as the maritime news: if multi orbit, always on connectivity gains traction with airlines, shipping companies and mobile operators, Viasat’s existing capacity bets and product roadmap could become more valuable.

Yet, behind the promise of higher bandwidth and new services, investors should be aware of the pressure that roughly US$1,200,000,000 in annual ViaSat 3 and Inmarsat capital spending is placing on...

Read the full narrative on Viasat (it's free!)

Viasat's narrative projects $5.0 billion revenue and $534.2 million earnings by 2028.

Uncover how Viasat's forecasts yield a $36.25 fair value, a 3% upside to its current price.

Exploring Other Perspectives

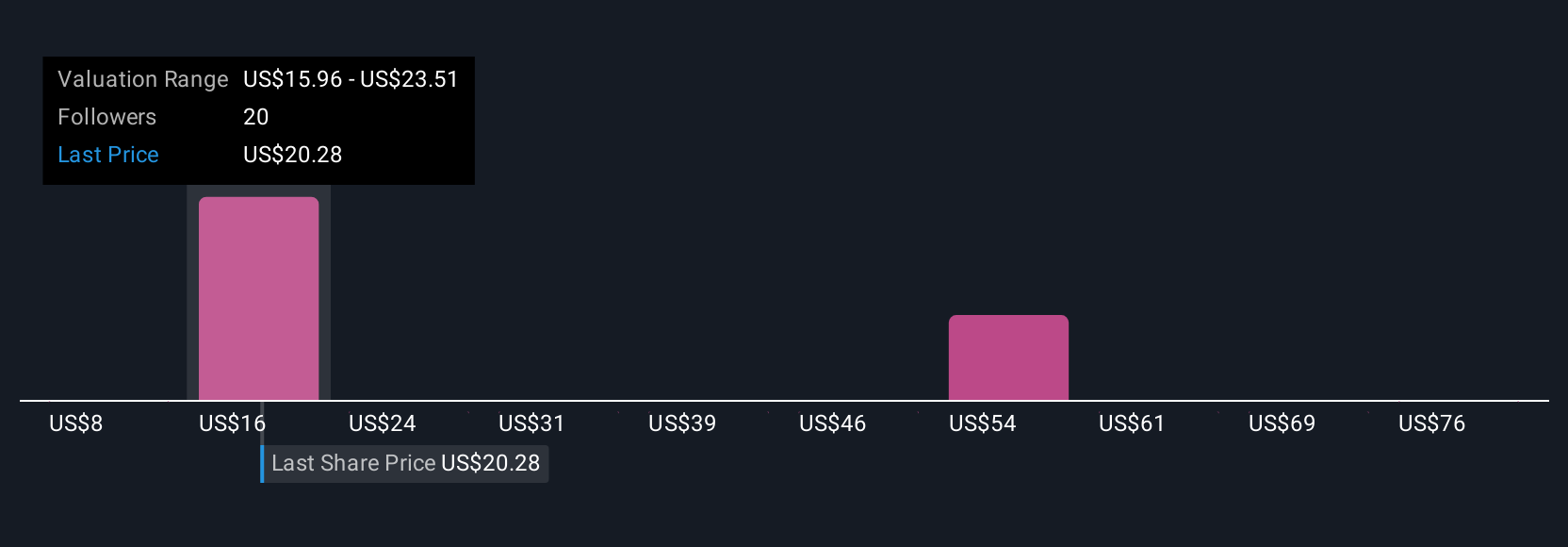

Eight Simply Wall St Community fair value estimates for Viasat span roughly US$10 to about US$101 per share, reflecting very different views on upside. Against that wide range, the heavy ongoing ViaSat 3 capital spend and related execution risk give you a concrete issue to weigh as you compare these perspectives and think about the company’s longer term performance.

Explore 8 other fair value estimates on Viasat - why the stock might be worth less than half the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Viasat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viasat's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal