Record Backlog Expansion And Capital Returns Could Be A Game Changer For Comfort Systems USA (FIX)

- In the past week, Comfort Systems USA reported strong operational momentum, including a 65% year-over-year backlog increase, five acquisitions in 2025, higher dividends, share repurchases, and recent insider share sales by its Chief Financial Officer following a robust third-quarter result.

- These developments highlight how Comfort Systems USA is using acquisitions and large-scale technology and industrial projects to build a multi-year pipeline while returning more capital to shareholders.

- Now, we’ll explore how the record backlog expansion and capital returns influence Comfort Systems USA’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Comfort Systems USA Investment Narrative Recap

To own Comfort Systems USA, you need to believe its record backlog and exposure to technology and industrial projects can be converted into profitable execution without overextending on complex work. The latest backlog surge and strong third quarter reinforce that near term execution on these large projects remains the key catalyst, while the cluster of insider sales and the share price run up sharpen the risk that expectations are already elevated and more sensitive to any slowdown in tech related demand.

Among the recent updates, the 65% year over year backlog expansion tied to data centers, chip manufacturing and other complex industrial work is most relevant. It underpins the multi year project pipeline that supports current optimism, but also concentrates Comfort Systems USA’s fortunes in sectors where a pause in building activity or project deferrals could quickly change how sustainable today’s growth profile looks.

Yet alongside all this apparent strength, one emerging risk that investors should be aware of is the heavy reliance on technology driven construction demand...

Read the full narrative on Comfort Systems USA (it's free!)

Comfort Systems USA's narrative projects $10.5 billion revenue and $1.3 billion earnings by 2028. This requires 10.9% yearly revenue growth and an earnings increase of about $0.6 billion from $692.2 million today.

Uncover how Comfort Systems USA's forecasts yield a $1133 fair value, a 13% upside to its current price.

Exploring Other Perspectives

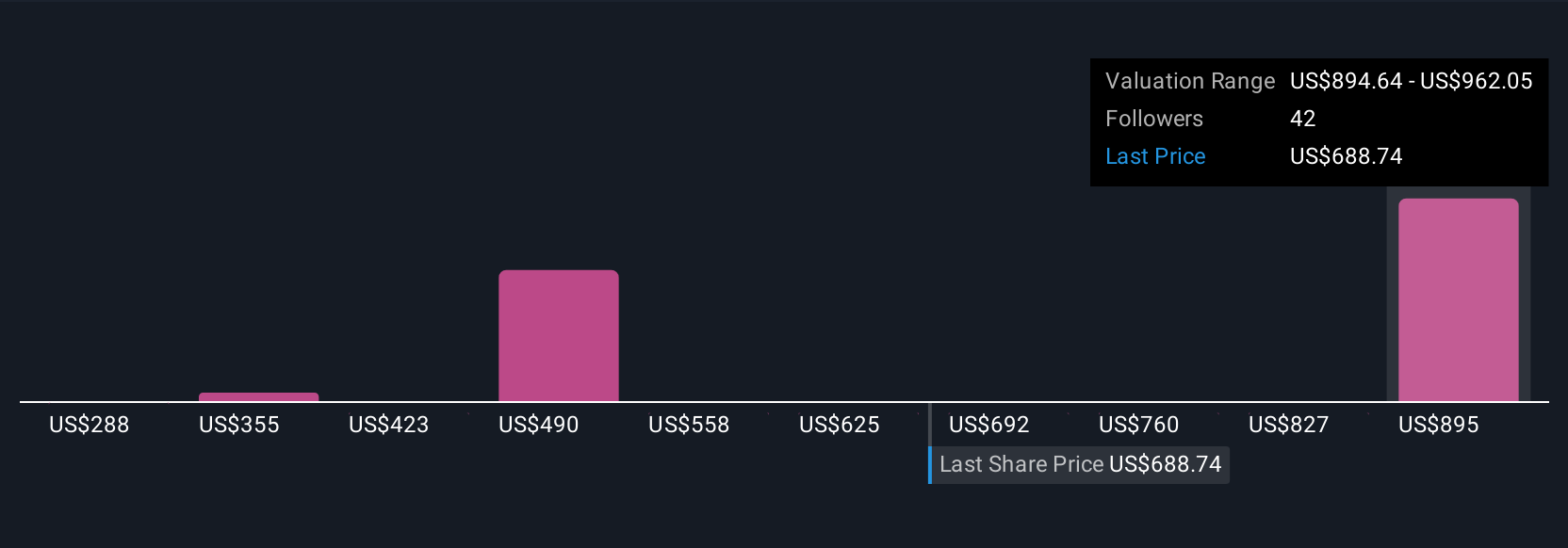

The 11 fair value estimates from the Simply Wall St Community span roughly US$288 to US$1,472, showing how far apart individual views can be on Comfort Systems USA. As you compare those opinions with the company’s rapidly expanding backlog in technology and industrial projects, it is worth weighing how concentrated that pipeline is in a single growth theme and what that could mean if conditions change.

Explore 11 other fair value estimates on Comfort Systems USA - why the stock might be worth less than half the current price!

Build Your Own Comfort Systems USA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comfort Systems USA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comfort Systems USA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comfort Systems USA's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal