Did New Buyback, CEO and Mandarin Oriental Deal Just Shift Jardine Matheson’s (SGX:J36) Investment Narrative?

- Jardine Matheson Holdings Limited recently reaffirmed its profit guidance for 2025, as it ends the year with stronger underlying earnings, a new US$250 million share buyback, and the completed takeover of luxury hotel group Mandarin Oriental.

- Alongside these moves, the appointment of a private‑equity veteran as CEO marks a shift toward an engaged long‑term investor model focused on capital allocation and returns.

- We’ll now explore how the new US$250 million share buyback may reshape Jardine Matheson’s investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Jardine Matheson Holdings Investment Narrative Recap

To own Jardine Matheson, you need to believe the group can keep improving underlying earnings while recycling capital out of lower return assets and into higher return opportunities, without amplifying its existing conglomerate discount. The reaffirmed 2025 profit guidance supports the near term earnings recovery story, but does little to reduce the biggest risk right now, which remains prolonged weakness and uncertainty in Greater China property through Hongkong Land.

The new US$250 million share buyback sits at the heart of the refreshed capital allocation focus, especially alongside the completed Mandarin Oriental takeover and ongoing portfolio simplification. For me, this buyback is most relevant because it directly links the near term earnings outlook to how much value management can create for continuing shareholders through disciplined balance sheet use and potential offset to any drag from structurally challenged businesses within the wider group.

Yet even with these supportive signals, investors should be aware of how extended softness in Greater China property could still...

Read the full narrative on Jardine Matheson Holdings (it's free!)

Jardine Matheson Holdings' narrative projects $37.4 billion revenue and $2.7 billion earnings by 2028. This requires 1.7% yearly revenue growth and a $2.6 billion earnings increase from $100.0 million today.

Uncover how Jardine Matheson Holdings' forecasts yield a $72.10 fair value, a 7% upside to its current price.

Exploring Other Perspectives

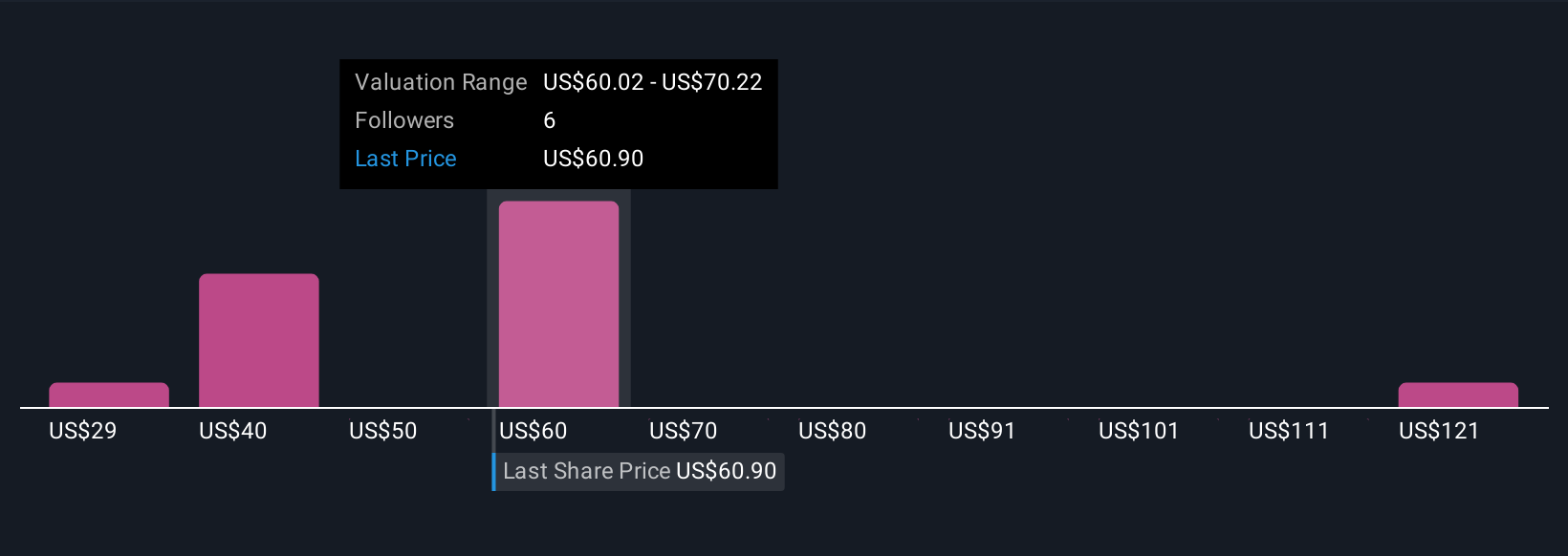

Five fair value estimates from the Simply Wall St Community span roughly US$29 to US$131 per share, so opinions differ sharply on Jardine Matheson. Against that backdrop, the reaffirmed 2025 profit guidance and new US$250 million buyback give you concrete numbers to weigh against concerns about a prolonged slump in Greater China property.

Explore 5 other fair value estimates on Jardine Matheson Holdings - why the stock might be worth as much as 96% more than the current price!

Build Your Own Jardine Matheson Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jardine Matheson Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Jardine Matheson Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jardine Matheson Holdings' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal